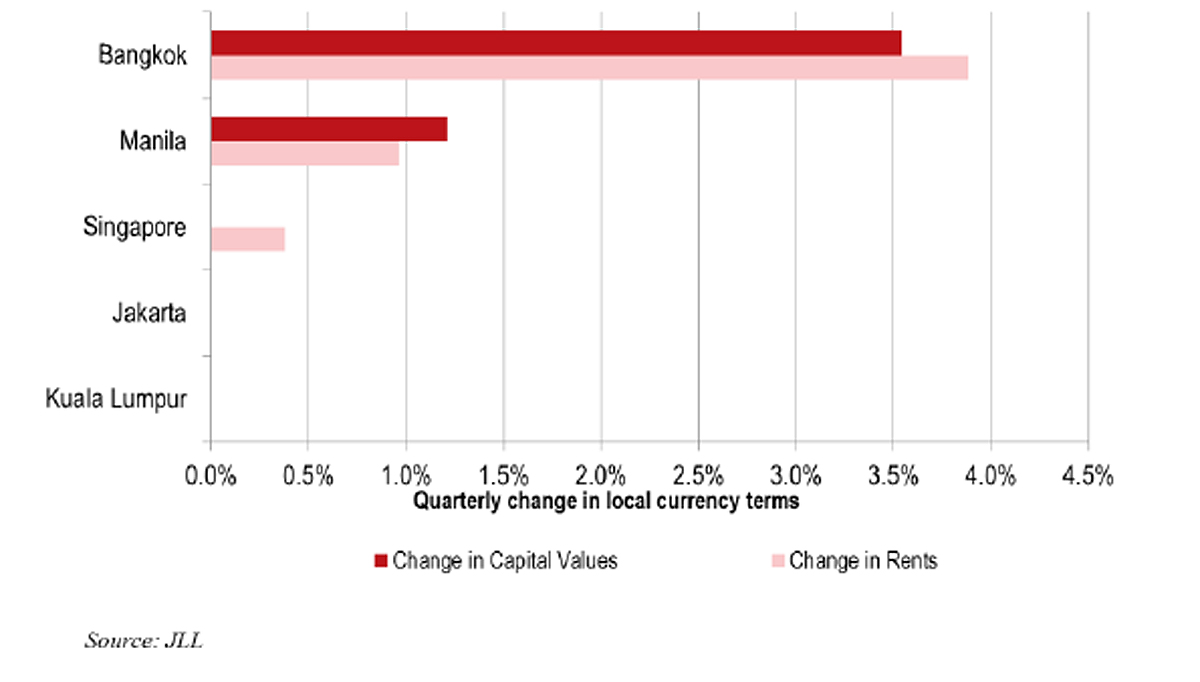

Despite the political tension in Thailand, retailers remained confident of the domestic consumption market, resulting in landlords being able to raise previously lowered rents by more than 3.5 percent as the military coup ended the political fallout.

Similar to the office sector, retail markets across Southeast Asia expanded or remained stable. Top gainers were Bangkok, Manila and Singapore, according to real estate firm JLL in its latest research report.

In Manila, the prevailing strong economic climate and an underlying young consumer market drove retail rents up by almost 1 percent. New-to-market international apparel brands, such as Givenchy and Under Armour, and home furnishing stores like Crate & Barrel and Pottery Barn, have opened in Manila. Existing retailers that are expanding include American Eagle Outfitters, Dorothy Perkins, Topshop, Old Navy and Cold Stone Creamery.

With the strong underlying occupier demand, capital values expanded at over 1 percent and allowing yields to remain stable. In Singapore retail rents expanded moderately at slightly under 0.5 percent. This was due to the growth in international retailers such as Etro and Givenchy. Capital values remained stable, allowing for marginal yield expansion.

Despite the uncertainty leading up to the presidential election, F&B and apparel retailers in Jakarta remained upbeat and generated the most demand. These include H&M, Aunty Anne, Tiffany & Co, and Galleries Lafayette. This has kept rents stable despite the stiff competition among landlords, which is unlikely to let up anytime soon.

Looking ahead, JLL remains positive on the office markets in Singapore and Manila. In the Philippines, continual support from the outsourcing and offshoring, financial and logistics sector should support rent. The limited physical completion with general recovery demand should bode well for the Singapore office.

On the retail front, Manila remains the hot favourite in Southeast Asia.

Dr Chua said: “As income levels in the Philippines rise, the strong underlying demographic and sustained economic growth over the past few years should support domestic consumption.”

He added that overall retail rents in Manila are still ranked last according to JLL Retail Index, making it highly affordable compared to other cities in Asia and this would bode well for new to market retailers as well as existing ones that are on a growth trajectory.

With the military junta taking control, this has ended street demonstrations, which bodes well for Bangkok retailers. As such, Dr Chua recommends keeping a close watch on the Bangkok retail market going forward, he noted.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email: andrew@propertyguru.com.sg

Last weeks’s most-read stories on DDproperty.com:

Thai confidence at 11-month high

Office deals see strong growth

Bangkok prime property prices start to plateau

More than 70% sold at IconSiam

If you have a news story or comment for publication about Thailand property or real estate email: andrew@propertyguru.com.sg