Bangkok is predicted to see record-breaking prices in the downtown area this year, but at the same time will face a ‘stress test’ in the midtown sector.

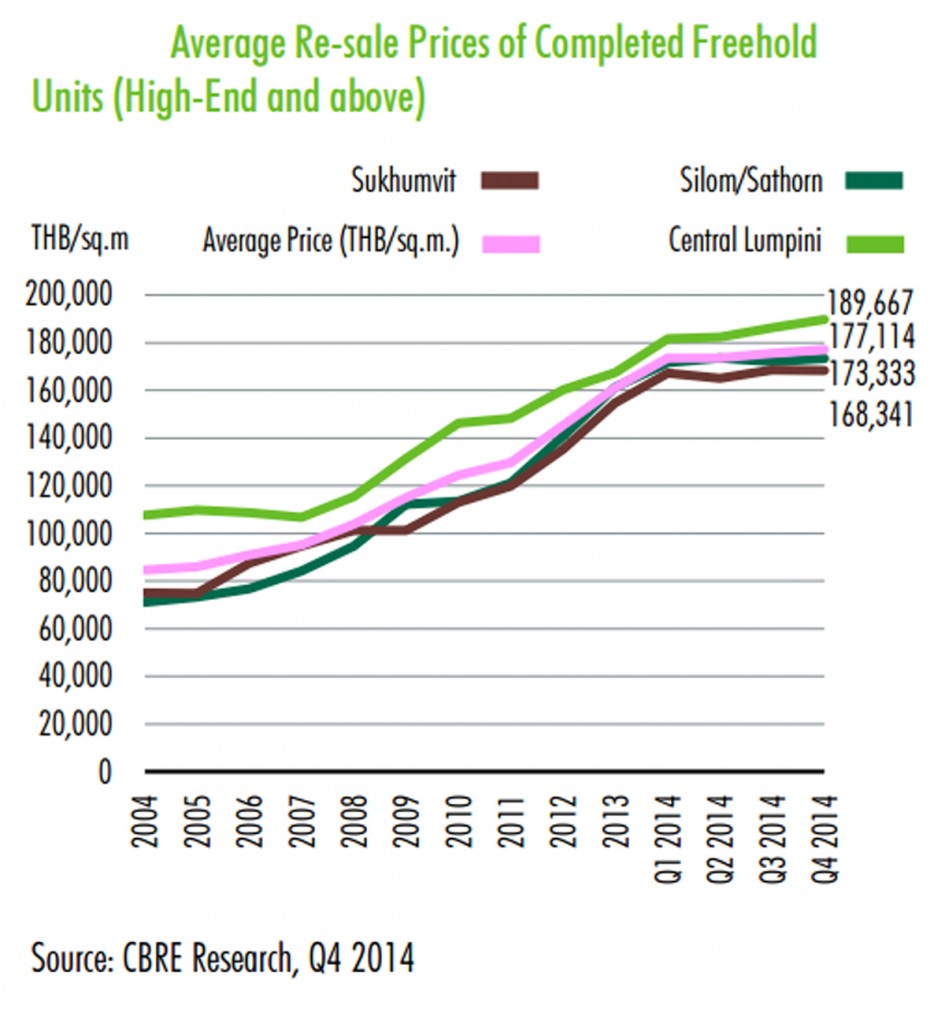

The Thai capital has already witnessed prices of more than THB300,000 per sqm in five downtown condominium projects during 2014.

In its latest market report, real estate firm CBRE noted how this reinforced its belief of the downtown condominium market being a low volume, high-value market with limited new supply.

The rush from developers to launch new condominium projects continued in Q4 2014. The number of condominium units launched increased by a staggering 281 percent quarter-on-quarter in the downtown area, and just 13 percent quarter-on-quarter in the midtown/suburban area.

Due to the political turmoil in the first half of the year, the total number of condominiums launched throughout 2014 decreased by 37 percent in the downtown market and by 29 percent in the midtown/suburban market, compared to 2013.

Overall, the downtown market is in a relatively healthy condition.

“We believe that prices for both newly launched downtown condominiums and the best existing condominium projects located in the best downtown locations will continue to rise,” CBRE noted in its research.

The increase in land prices, especially in the downtown areas along existing mass-transit lines, to more than THB1 million per square wah has forced developers to develop condominium projects that command luxury to super luxury prices of above THB 170,000 per sqm.

CBRE believes that the starting price of newly launched condominium projects in the most prime downtown locations during 2015 will be around THB200,000 to THB300,000 per sqm.

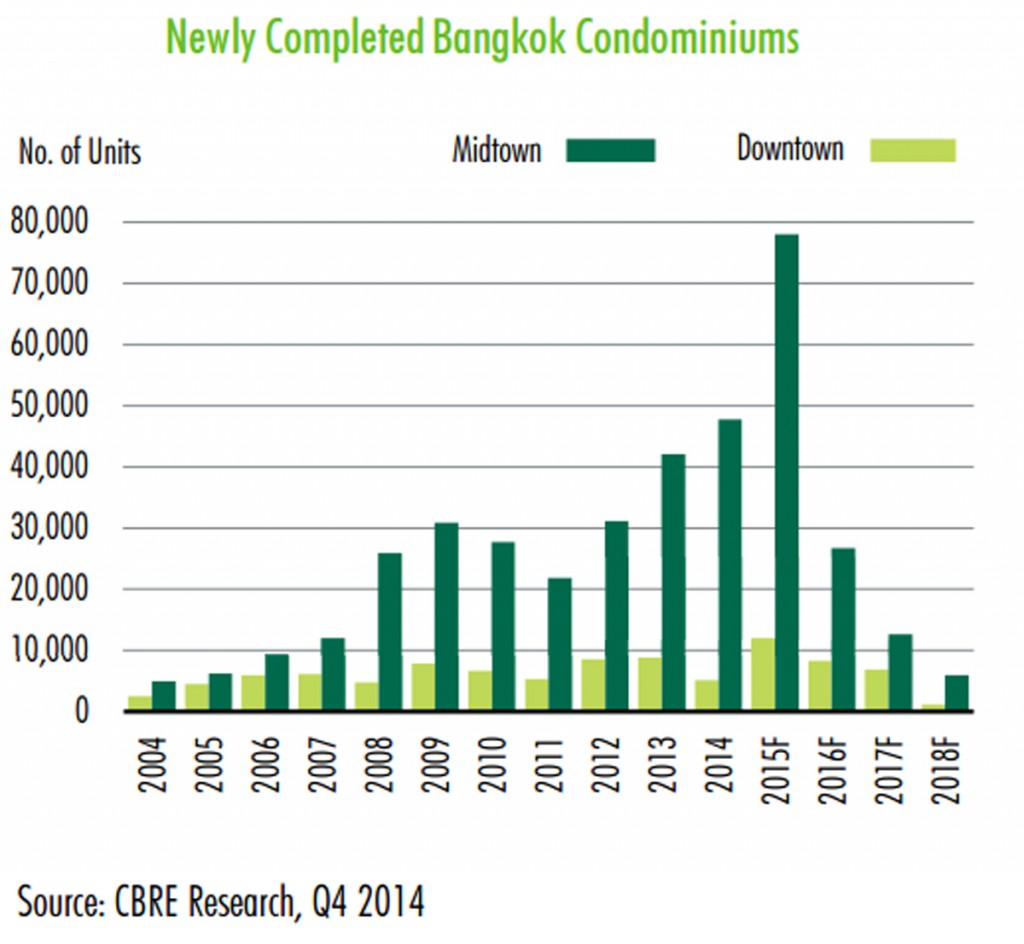

For the midtown/suburban market, around 78,000 condominium units will complete in 2015 and this number is almost equal to the combined number of units completed in 2013 and 2014.

The key issues, according to CBRE, are still how many speculative buyers of these units will default if they cannot resell before completion, and how many end-user buyers will be able to get mortgage loans.

Banks have continued to tighten their mortgage lending criteria as a result of the rising household debt to 83 percent of gross domestic product. This has made it even more difficult for end-users, especially middle- and lower-income earners, to secure loans.

Cancellations from both speculators who cannot resell their units and buyers who cannot get loans mean that developers could be left with built but unsold inventory that may have to be discounted to sell.

If sales of new midtown/suburban projects are slow, we expect to see a slower rate of new launches despite developers’ announcements of optimistic plans at the beginning of 2015.

We believe developers will be cautious in launching new projects unless they are confident about sales, since their lenders will be watching and will only provide project finance if sales targets are reached.

The hot spot for midtown/suburban condominium launches in 2014 was along the MRT’s Purple Line that will be fully operational by August 2016. Throughout the year, 14 projects comprising 7,500 units launched in this area, accounting for 58 percent of newly launched units along under construction mass transit lines. This has pushed developers to search for new locations along other under-construction mass transit lines where there is less competition.

Looking forward in 2015, CBRE said it believes that the trend of forming joint ventures to finance projects among Thai developers, such as BTS and Sansiri, and between Thai developers and foreign investors, such as AP and Mitsubishi Estate as well as Ananda and Mitsui Fudosan, will continue in the upcoming year.

In conclusion, CBRE said the Bangkok condominium market sentiment in 2015 will largely depend on the pace of economic recovery, developers’ ability to transfer completed units and the presales of newly launched projects especially in the midtown/suburban market where buyers are most affected by the rising household debt.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg