Industrial land sales in Thailand dropped to 2,276 rai during 2014, the lowest in the past few years due to the political unrest.

However, factory occupancy rates stood firm at 77.6 percent in H2 2014, a reduction of 0.1 percent year-on-year. The highest factory rent rate growth was seen in the Eastern Seaboard, with an increase of 5.6 percent, however rental rates in Pathumthani – Ayutthaya, and Suvarnabhumi – Bangpakong remained stable.

This data comes from Knight Frank it its latest report about Thailand’s Manufacturing Outlook report, published yesterday.

According to Knight Frank the total supply of Serviced Industrial Land Plot (SILP) at the end of 2014 was at 140,841 rai, an increase of 3.1 percent from the previous year. On average, the SILP supply has increased by a steady 2 percent to 5 percent each year.

Thailand produces more cars than any other ASEAN nation. It is amongst the 10 largest car producers in the world, thanks to policies that nurture and support the local automotive industry.

Currently, Thailand commands up to 55 percent of ASEAN’s total car production. As one of the country’s most important economic drivers, the automotive industry is currently occupying up to 15.7 percent of the total industrial estate land.

Throughout the Kingdom more than 140,000 rai of industrial land is under development, and most of the future supply is in the Eastern Seaboard zone, which benefits from its proximity to Laem Chabang port and its flood-free location. Within the year, nearly 4,000 rai is expected to be ready.

During 2014, industrial land sales were 2,276 rai, the lowest level in the past few years. There were only 937 rai in H1 2014 and 1,339 in H2 2014. This was due to delays in Board of Investment (BOI) approvals and the absence of the relevant committee since late 2013 to mid-2014. After mid-2014, land sales volumes were expected to recovery; however, foreign investment sentiment was still not evident.

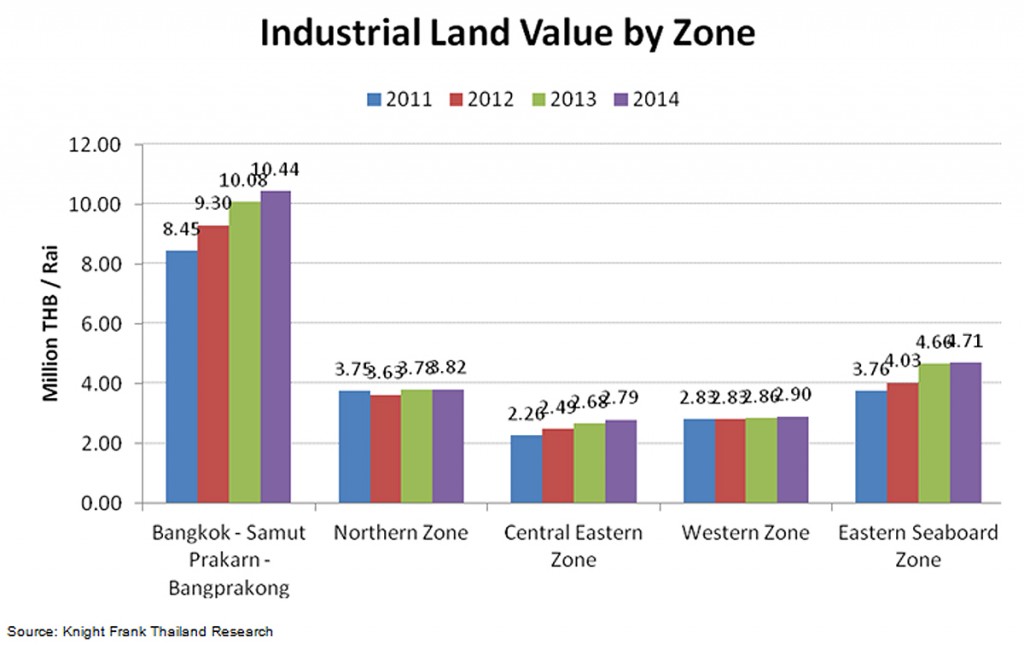

In 2014, the overall SILP asking price increased by 0.9 percent from 2013 to 4.3 percent. Industrial land in the every zone enjoyed pricing growth. SILP prices on the Central Eastern Zone recorded the highest growth, which saw average prices increase by 4.3 percent.

Pricing growth in 2014 was not as much as the growth seen in 2013 due to the political unrest that affected industrial land demand, as indicated in the drop of the industrial land sales volume.

Location, proximity to the port, logistics facilities and infrastructure, labour sources and flood risk are the key factors that affect industrial land prices.

The total supply of rental factory space at the end of 2014 was 2,553,046 sqm, increasing from last year’s supply by 88,577 sqm and representing growth of 3.6 percent. A significant increase in supply happened right after the major floods of 2011, where factories were developed to accommodate new demand in areas unaffected by flooding.

The rental factory supply did not increase aggressively in terms of warehouse supply due to the limitation of land use regulations requiring a license for factory operations.

Chonburi province has the largest share of the total rental factory supply at 30 percent, with a total rental factory space of 775,636 sqm. Samutprakarn has the second largest share at 20 percent with 517,452 sqm. The third and the fourth largest shares belong to Rayong at 19 percent and Ayutthaya at 17 percent.

The Eastern Seaboard in Chonburi and Samutprakarn provinces boast the largest supply of factory leasable space, as those areas are major locations of various industrial hubs and more particularly, they are home to Thailand’s automotive industry.

Rental rates

The average factory rental rate was THB205.4o pr sqm per month, and increase of 2.7 percent y-o-y. The Eastern Seaboard zone commanded the highest rents of THB224.80 per sqm per month. That area also saw the highest rental rate growth with an increase of 5.6 percent. Rental rates in Pathumthani – Ayutthaya, and Suvarnabhumi – Bangpakong remained stable.

Suvarnabhumi – Bangpakong generally has lower factory rental rates as most rental space is not located inside industrial estates; moreover land inside the industrial estates in this area is quite

In 2014, Thailand’s industrial property market was weakened as a result of the negative domestic circumstances. However, Thailand is still attractive to investors, with advantages of a high level of infrastructure, geographic location in the middle of Southeast Asia, special tax incentives, and a skilled labour force. Moreover, the launch of the AEC is expected to bring positive changes to Thailand.

Outlook

Knight Frank expects growth in demand from both domestic and international companies, including small, medium-sized, and large enterprises, reflecting the need for industrial property and the growth in the automotive industry from Eco Car Phase 2, which strengthens Thailand’s position as the key automotive manufacturing base in ASEAN.

It also expects to see industrial land values increase in the Eastern Seaboard and Samutprakarn as these locations have limited supply.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg