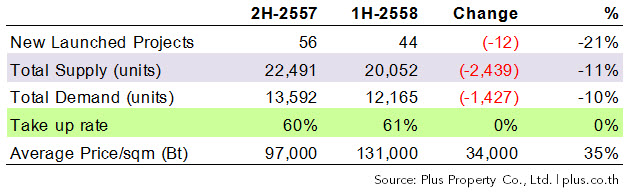

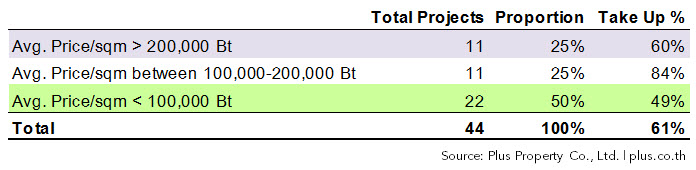

The condominium market in Bangkok suffered a 21 percent drop in new project launches during the first half of 2015. Despite that figure, average prices soared by 35 percent in the same period as developers focused on the medium- and high-price segments, according to full-service professional property and facility management agency Plus Property.

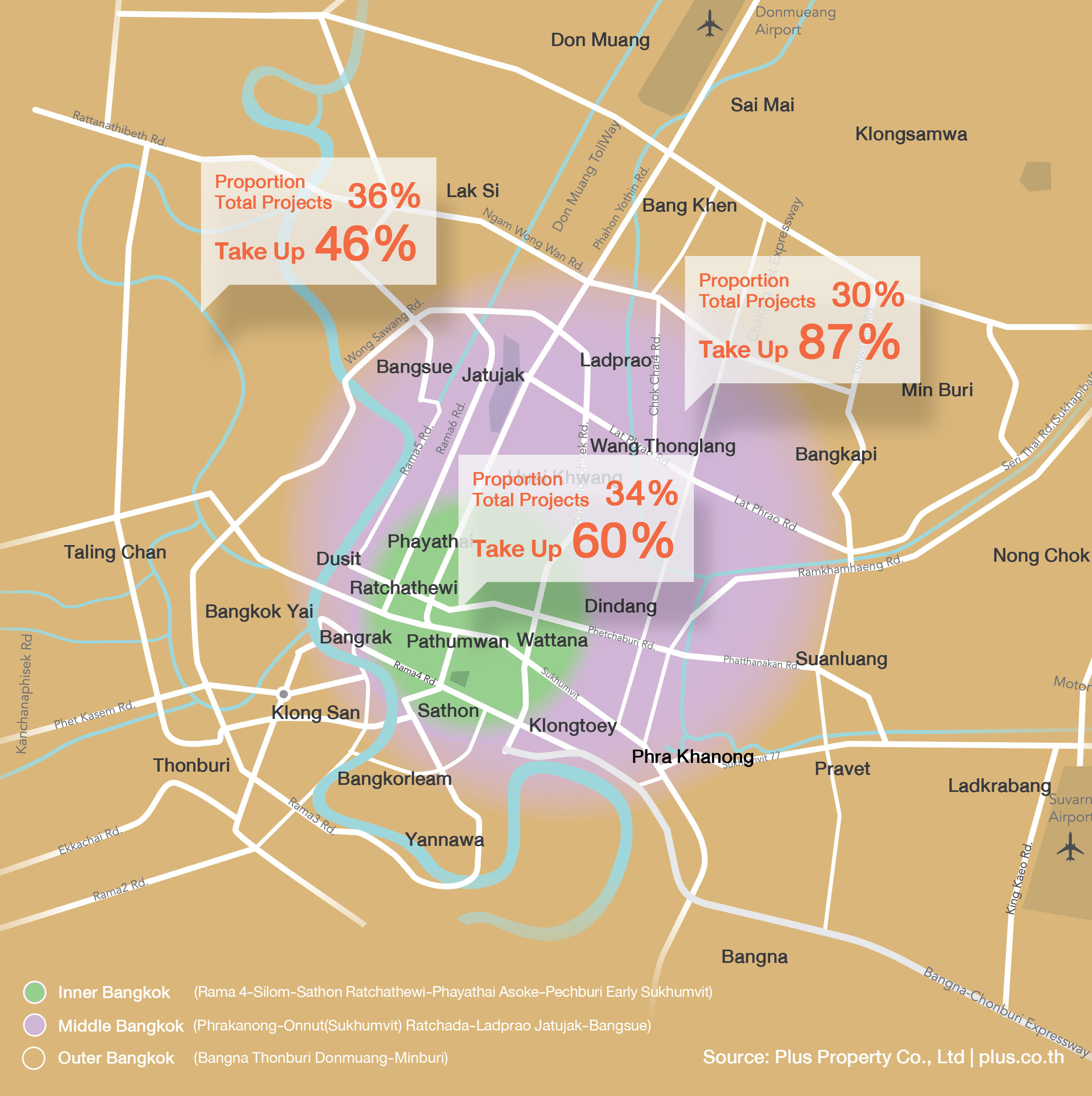

Some of the most popular areas to buy were Phra Khanong-On Nut (upper), Ratchada-Lat Phrao and Chatuchak-Bang Sue. These areas posted a sell-through rate of 87 percent. New projects overall in Bangkok recorded a sell-through rate of 61 percent in the first half, a similar total to the 60 percent that occurred in in the second half of 2014. Plus Property noted that market will remain stable to close out 2015 with the high-end segment contining to stay active as buyers have strong purchasing power which is not affected by Thailand’s economic issues.

“The first half of 2015 saw 44 new condominium project launches in Bangkok, comprising 20,052 units and representing a 21 percent decline from the second half of 2014, which had 56 new projects with 22,491 units,” said Poomipak Julmanichoti, managing director of Plus Property Company Limited. “Demand in the first six months accounted for sales of 12,165 units, representing a sell-through rate of 61 percent. Meanwhile, new-launch prices have risen by 35 percent from THB97,000 per square meter to THB131,000.”

Phra Khanong-On Nut (upper), Ratchada-Lat Phrao, and Chatuchak-Bang Sue were the most popular places to buy because of convenient Skytrain and subway transit access as well as moderate prices that are lower than inner Bangkok developments. The rental market in these neighborhoods also offers higher returns when compared to inner Bangkok and has a wider customer base covering both cash and loan buyers who have no household debt issues and high loan approval rates.

According to Plus Property, the low sell-through rate in inner Bangkok was likely caused by projects with mismatches between features and demand. Developers have been forced to conduct a thorough analysis of the situation before putting a new project on sale as consumers become savvier in regards to what they expect from a property.

“The property market in the second half of 2015, especially the condominium segment, will likely show stable but unspectacular growth due to the gradual economic improvement,” Poomipak concluded. “Regardless, high-end projects are likely to perform best as customers in the segment still have strong purchasing power.”