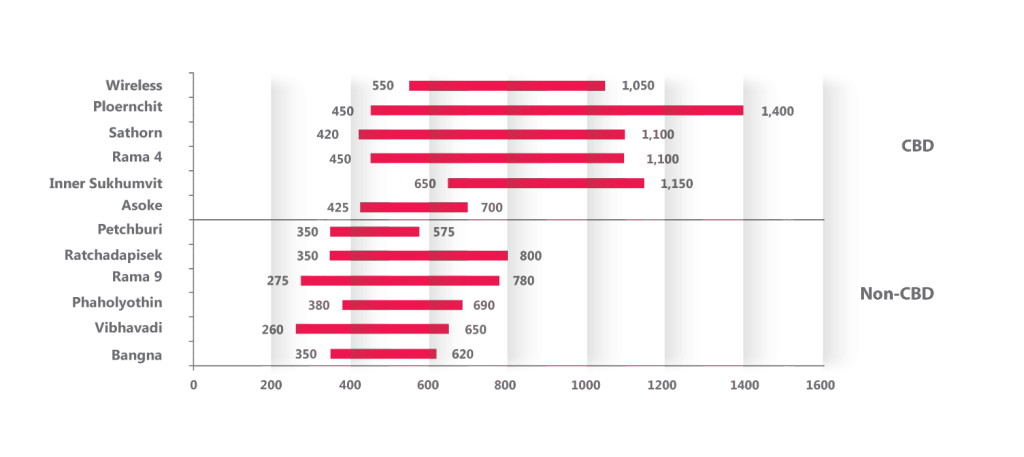

Finding office space in Bangkok’s CBD areas continues to become more difficult according to Knight Frank Thailand. Research from the consultancy noted that the scarcity of office space in these locations became even more prominent during the fourth quarter of 2015. Among the factors at play are a limited supply, growing demand and an office occupancy rate that continues to slowly rise.

The office market in Bangkok is expected to witness a shortage sometime during the next two years and this is likely to result in a continuing rise in the rental rate, Knight Frank Thailand reported. The company also believes that this will likely trigger an expansion or a relocation of businesses into Non-CBD areas. Supply in the CBD is expected to remain stagnant while prices for available space increase.

“Tenants are facing a soft economy in a climate where office rents are likely to continue to rise, and they need to look at cost control strategies that could be employed in their workplace,” Marcus Burtenshaw, executive director and head of Commercial Agency Department, Knight Frank Thailand, stated. “Flexible working arrangements, standardized (and reduced) desk allocations, split operations or even moving to secondary locations might all be considered.”

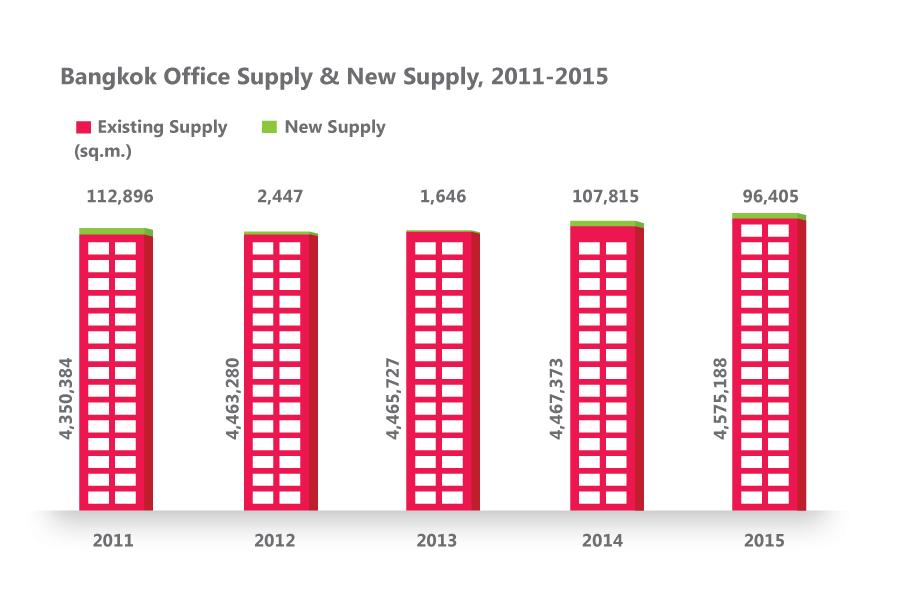

Research from Knight Frank Thailand showed that office supply increased 2.11 percent in 2015 as a number of larger projects came online. The completion of AIA Sathorn Tower, Major Tower and Bhiraj Tower at EmQuartier accounted for this increase. Both Major Tower and Bhiraj Tower at EmQuartier are situated in the Inner Sukhumvit area while AIA Sathorn is located in the Sathorn District. Of the new office supply that became available last year, 53 percent of it was located outside CBD areas while 47 percent was in the CBD.

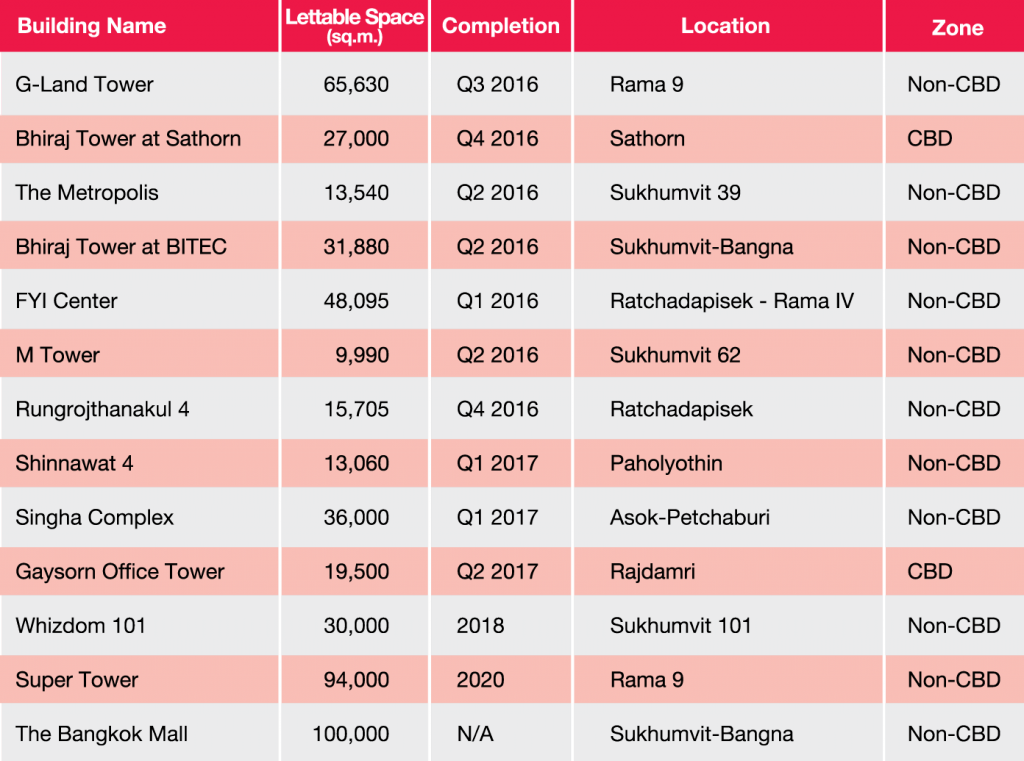

A majority of the supply of new office space scheduled to come onto the market in 2016 will be situated in non-CBD areas. Knight Frank Thailand revealed that approximately 87 percent of this space will be outside of the CBD. Most of the new office supply coming online after 2017 is predicted to be in non-CBD areas such as Bangna, Outer Sukhumvit and Ratchadapisek.