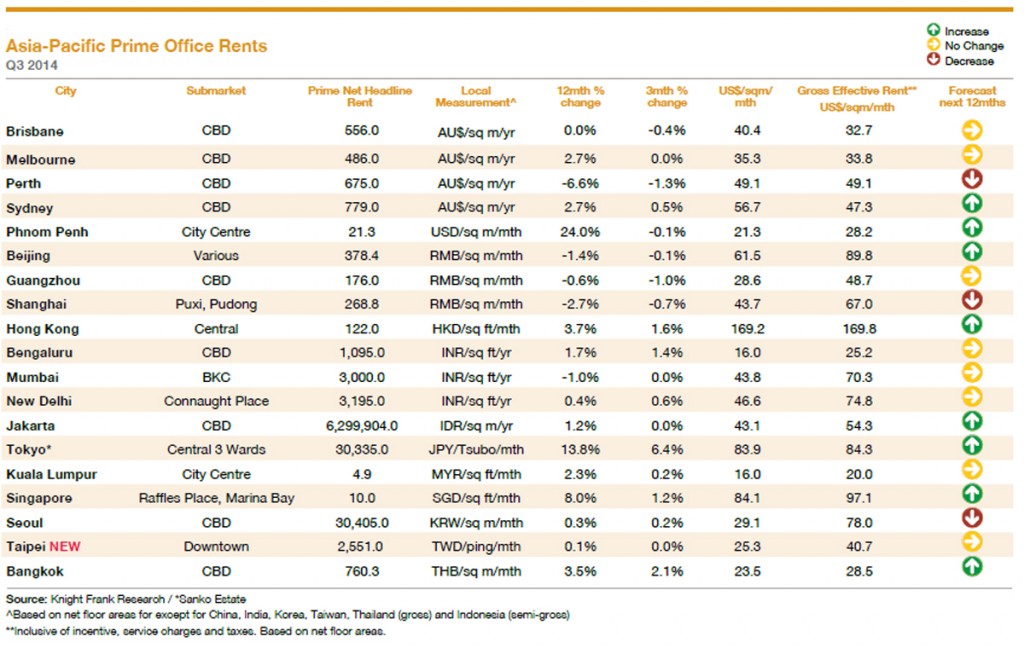

Prime office rental rates in Bangkok grew by 3.5 percent in the 12 months ending September 2014, and by 2.1 percent from Q3 2014 from the previous three-month period.

In its Asia-Pacific Prime Office Rental Index, Knight Frank noted tightening vacancy rates across the region, spurring a more widespread rental recovery

Amidst low vacancies, limited new supply, steady demand and rising rents, confidence in the Bangkok office market outlook has rarely been higher, Knight Frank reported. The recent announcement of The Super Tower, a 125-storey, 615 metre- tall mixed-use development, which upon completion will be the tallest building in ASEAN, is a testament to that.

Grade ‘A’ office space in central Tokyo, which led the region by growth, saw rents increase by 6.4 percent in Q3 2014, as vacancy rates fell to 5 percent. With the Marunouchi and Otemachi areas now virtually fully leased, the strong rental growth in Japan’s capital looks set to continue, according to the report.

In neighbouring South Korea meanwhile, a slight decrease in the prime office vacancy rate in the CBD area has led to some overall prime rental growth in Seoul.

In Southeast Asia, Singapore continued to see solid rental growth of 1.2 percent over Q3 2014 – the fifth consecutive quarter of positive growth. With quarterly net absorption at a two-year high amid positive business sentiment and significant leasing enquiries, the market is similarly expected to see continued rental growth going forward.

In Jakarta, meanwhile, the market has slowed from the stellar growth rates of previous years, with the significant pipeline of supply likely to moderate rental growth prospects going into 2015.

In Kuala Lumpur, Grade ‘A’ rental rates remain resilient while occupancy rates have improved marginally.

Prime office rents remained unchanged in Phnom Penh despite a 7.9 percentage point increase in the average vacancy rate, attributable to the Cambodian Stock Exchange vacating two floors of office accommodation in Canadia Tower.

In mainland China, an economy which is attempting to manage its economic slowdown, a decline of activity from multinational corporations (MNCs) has contributed to rental declines across all Tier-1 markets tracked.

Hong Kong, despite its recent troubles, saw prime rents increase, with the opening of the Shanghai-Hong Kong Stock Connect likely to continue to boost mainland Chinese demand.

Taipei, introduced for the first time into the rental index, saw its prime rents remain fairly flat amid solid office net absorption led by the high-tech and finance sectors.

The Indian office markets are now at the far end of a bottoming out phase as also reflected in the Knight Frank Sentiment Index. Bengaluru is the only market that has shown depressed absorption numbers during Q3 2014, but its 2014 absorption numbers are expected to comfortably eclipse the previous year’s total.

Australia’s prime office markets experienced mixed fortunes during the quarter. Perth and Brisbane saw rents continue to fall, while conversely Melbourne and Sydney continued to witness recoveries in their leasing markets.

Knight Frank concluded by saying that downside risks remain in the region, including the Chinese slowdown, deflation in the European Union and the impact of tightening monetary conditions in the U.S. and the U.K.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.