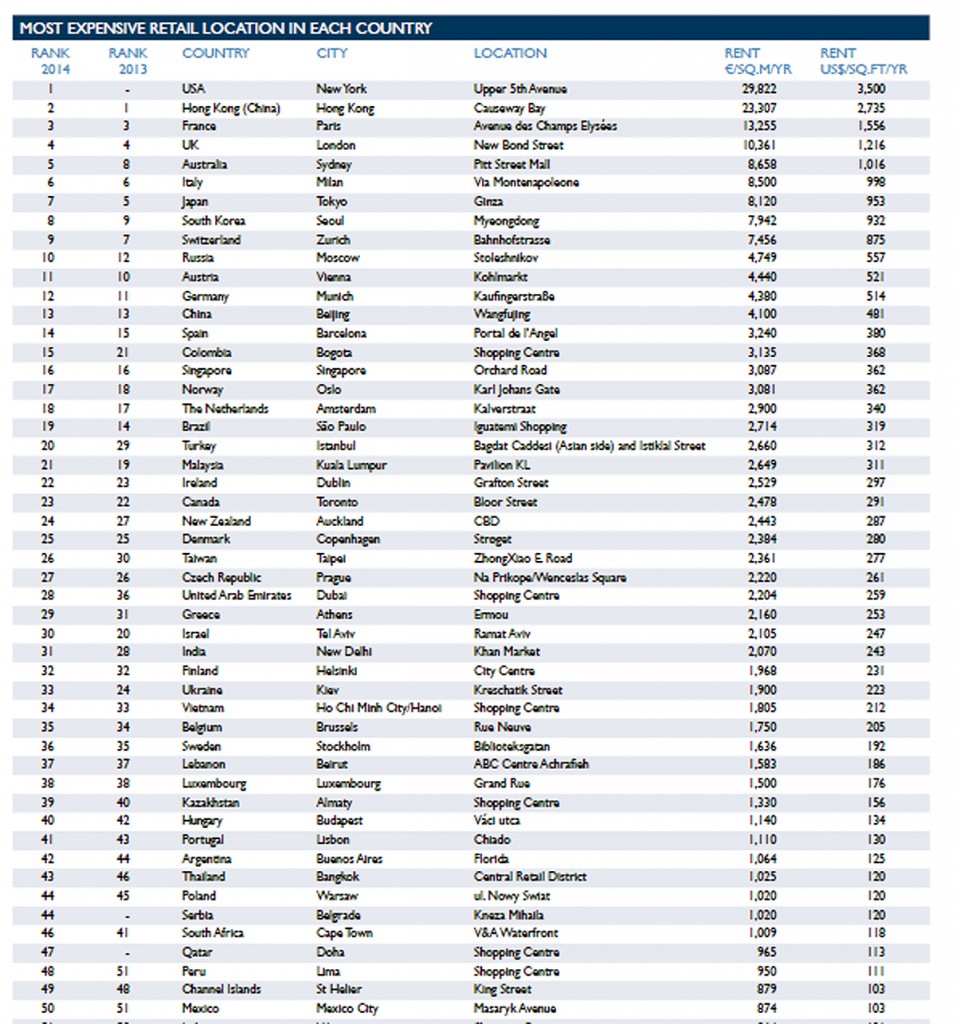

While New York’s Upper Fifth Avenue has overtaken Hong Kong’s Causeway Bay as the world’s most expensive shopping destination, Bangkok has risen three places but still costs a mere fraction of its global and regional competitors.

According to global real estate adviser Cushman & Wakefield’s flagship retail research report Main Streets Across the World, Bangkok is ranked as the 43rd most expensive place for retail space with rental prices of US$120 per sqft per year.

New York’s US$3,500 per sq ft per annum is the most expensive in the world, while regionally Singapore is ranked 16th at US$352 per sq ft per annum – some three times more costly than Bangkok. New York is some 20 times more costly than Bangkok.

The report is widely recognised as the barometer for the global retail market and ranks the most expensive locations in the top 330 shopping destinations across 65 countries.

Prime retail rents across the globe rose by an average of 2.4 percent in the 12 months to the end of September 2014, with recovery being sustained but at an overall slower rate. Volatile and somewhat subdued economic activity affected some markets, while structural changes impacting on others. However, despite a more constrained rental growth rate, 277 of the 330 locations surveyed were either static or increased over the year.

Cushman & Wakefield’s Global Head of Retail, John Strachan, said: “New York is once again the most expensive shopping destination in the world and for the first time since 2011 – Upper Fifth Avenue also set a new record for the highest retail rents ever recorded. Global gateway markets continue to surge ahead as major brands battle for premier addresses in the top cities.”

Despite seeing no change to rental values after a 40 percent rise last year, Champs-Élysées in Paris retained its third place, which was followed by London’s New Bond Street in fourth where rents rose by 4.2 percent.

Pitt Street Mall in Sydney completed the top five, with the location surging up three places as it recorded an increase of 25 percent on the back of a several international retailers taking up large units in the last six months.

A slower expansion was also evident in Asia-Pacific (3.6 percent) where the traditionally buoyant Hong Kong market was adversely affected by a decline in retail spending and lower tourism growth.

James Hawkey, Head of Retail in Asia-Pacific at Cushman & Wakefield, said: “Although New York took first place this year, Hong Kong’s Causeway Bay remains the second most expensive retail location on earth.

“In 2014, retailers showed caution expanding in Hong Kong in the face of moderating sales performance and less exuberant consumption from mainland visitors. Luxury brands were conservative, while watch and jewellery retailers notably cut back on new stores, with this sector seeing negative growth. Several leading local retailers recorded lower holiday sales.

“The beginning of the ‘Occupy Central’ protest in Hong Kong since the end of September has further weakened the retail sentiment in major core retail areas, especially in Causeway Bay and Mong Kok where students are still blocking some major roads.”

Despite headwinds faced by local retail industry Singapore sees prime rents remain stable due to lack of supply and continued entry of international retailers

Jocelyn Hao, Director Retail, Cushman & Wakefield Singapore, added: “Singapore’s retail market faces challenges this year due to government’s tightening of labour market, fewer visitor arrivals following the disappearance of flight MH370, continued impact of China’s tourism law enacted in October 2013, that clamps down on “zero-dollar-tours”, and a strong Singapore dollar.

“The major decline of China and Indonesia tourists, who are the two largest drivers of luxury spending, contributed significantly to the lower tourist shopping expenditure in Q2, which saw a decline of 19 percent. On the back of declining sales, lower shopper traffic and shortage in labour, many retailers are undergoing consolidation.

“Despite the headwinds faced by the local retail industry, prime Orchard Road rents remains stable with a marginal increase of 1.3 percent contributed by limited new supply of prime spaces and continued entry of international retailers who can’t ignore Singapore’s significance as the fashion capital in Southeast Asia.”

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.