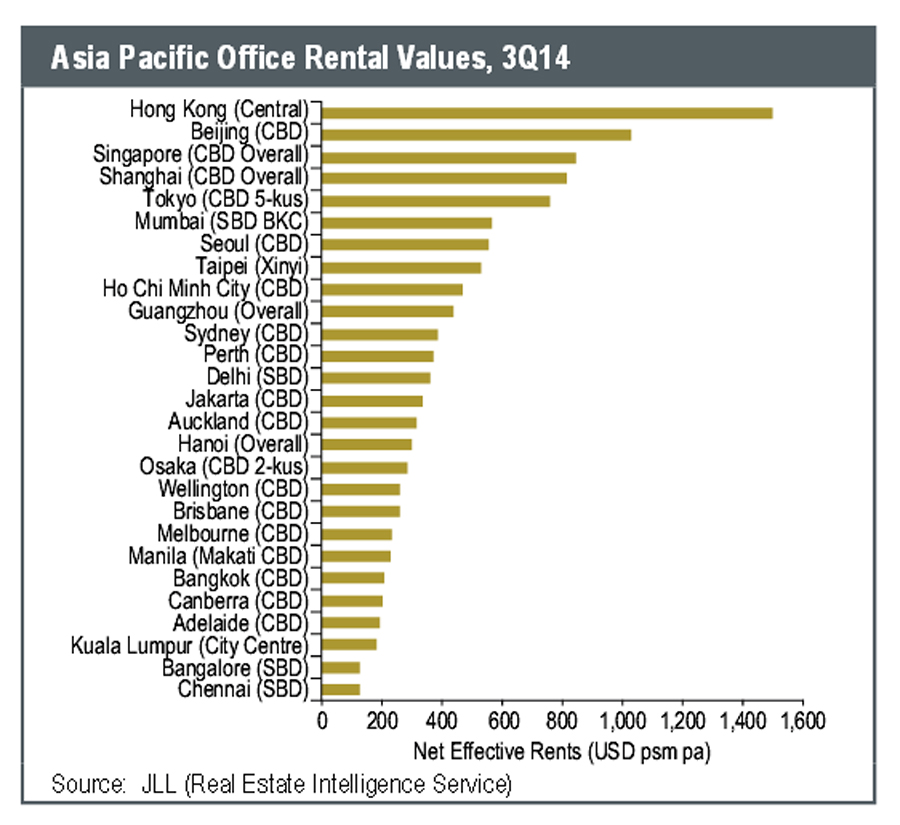

Bangkok remains one of the cheapest places for office rentals throughout Asia, according to the latest research from JLL.

Mixed occupier market conditions were seen in most markets in 3Q 14, as a result of subdued regional economic growth and multi-national companies remaining in cost-saving mode. Overall leasing activity grew year-on-yea on both a gross and net basis in 3Q, with Greater China and India accounting for between 70 percent and 80 percent of the regional total.

However, improvements remained patchy.

The healthiest uplift in new leasing was seen in India’s Tier I cities, while all other markets except China (mainly Shanghai), Sydney and Hong Kong fell ear-on-year.

Singapore and Hong Kong continued to see limited take-up, underpinned by smaller requirements. Tokyo saw slower pre-leasing activity for Grade ‘A’ space, but occupier demand remained healthy for Grade ‘B’. Demand in China largely came from domestic financial services and legal firms requiring space to accommodate new hires.

Technology firms drove stronger leasing activity in India, while Manila continued to see the strongest underlying demand in emerging Southeast Asia. Overall leasing activity has improved in Australia, with stronger enquiry/activity from technology firms (mainly in Sydney) but still limited growth from banks, legal firms and the public sector.

Singapore and New Zealand top rental growth league

During 3Q14, net effective rents grew in about half of all Asia-Pacific markets, with steady average quarterly growth of 0.9 percent (similar to 2Q). Singapore (3.5 percent quarter-on-quarter), together with Auckland and Wellington (3.8 to 4.6 percent q-o-q), experienced the strongest rental growth on the back of low vacancy levels.

Rents in Tokyo, Beijing and most emerging Southeast Asia markets grew steadily by between 1 and 2 percent q-o-q, while Hong Kong saw marginal growth (0.4 percent q-o-q) driven by the top end of the market.

On the other hand, rents in Seoul and Shanghai Puxi edged down due to soft demand or more supply.

In Australia, effective rents rose by 1.6 percent q-o-q in Melbourne but fell in other cities by up to 6 percent q-o-q (the highest in Perth) due to limited demand from traditional occupiers.

Over the twelve months to end-3Q14, average rents in aggregate grew 2.9 percent compared with 1.9 percent in the twelve months ended 2Q14 and was the strongest result in two years.

Singapore (+18.6 percent) remained the regional outperformer on an annual basis, followed by Taipei and the two New Zealand cities (between 8 percent and 10 percent).

At the opposite end of the spectrum, most Australian CBDs (down by between 8 percent and 29 percent for the year except for Sydney and Melbourne) continued to see the weakest performance.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg