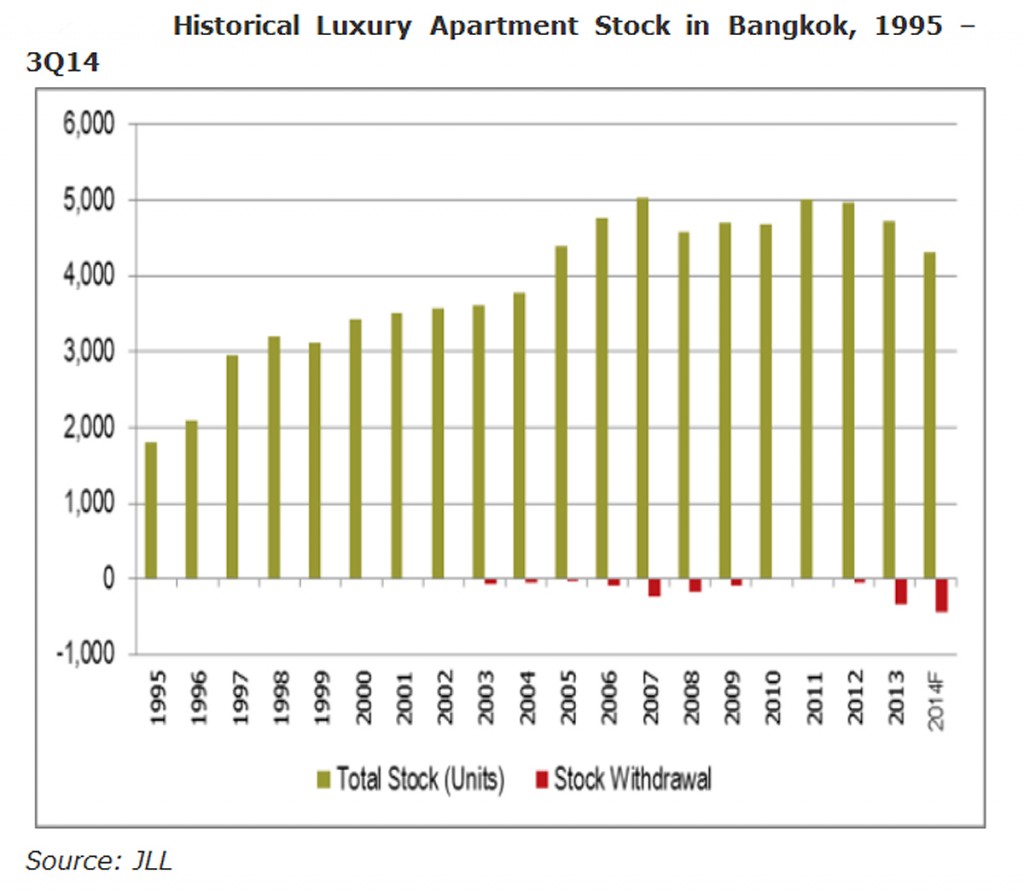

While the supply of condominiums in Bangkok has grown rapidly over the past several years, the stock of luxury apartments has been declining steadily.

With a wider variety of products, amenities and locations that the condominium market has to offer, traditional luxury apartment tenants, most of whom are expatriates or long-stay tourists, are increasingly turning away from luxury apartments.

Along with shifting occupier preferences, developers and operators are increasingly chasing higher yields by converting existing luxury apartment stock into condominiums, hotels, and serviced apartments.

Generally speaking luxury apartments are located in downtown and commercial areas, primarily in the Central Bangkok and the Central East sub-markets that include Sathorn Road, Silom Road and Sukhumvit Road.

These locations have traditionally offered tenants good accessibility and an abundance of amenities. With much of the existing luxury apartment stock built before the 1997 Asian Financial Crisis, these developments typically feature much larger living spaces than more recently built condominiums.

Equipped with the same modern amenities as modern condo projects such as swimming pools, broadband internet, and high security, as well as additional amenities such as tennis courts, squash courts, saunas and separate living quarters for maids, these existing luxury apartments are priced lower on a per square metre basis than the newer condominiums.

Since 2008 many luxury apartments have been converted to serviced apartments, which typically provide daily amenities such as cleaning and housekeeping services while also being available for short-term stay. At the same time, some luxury apartments have been refurbished and then marketed as freehold condominiums.

For example, a luxury apartment block on Sathorn Road, SC Sathorn Mansion, has been renovated and converted to a high-end condominium named The Hudson Sathorn 7. This project began pre-sales at the beginning of November 2014 with an average price of THB130,000 per sqm, roughly 10 percent lower than the average price of THB146,000 per sqm of new condominium projects in the same area.

With greenfield condominium developments and refurbished / renovated luxury apartments that have been converted to condominiums yielding returns that are more than double that of existing luxury apartments, we expect the future supply of luxury apartments in the Central Bangkok and the Central East sub-markets to be limited over the short term.

The general outlook for the luxury apartment sector is weak. Rents are likely to stagnate given the large supply of condominiums that are available for let. However our research suggests that the demand for two and three-bedroom units from large expatriate families has been increasing steadily over time.

Given Bangkok’s strategic location and the better outlook for the Thai economy with the formation of the ASEAN Economic Community by 2015, luxury apartments will remain relevant although they may not experience the same heights of the 1980s and 1990s.

Klongkwan Tangnukulkij is the Research Analyst in JLL Thailand’s Research and Consultancy group, wrote this article which is reproduced with kind permission of JLL Thailand.