More international brands are expanding into numerous locations in Asia-Pacific in order to grow growth, according to a report by real estate firm JLL.

With economic challenges remaining in many developed markets, international retailers are increasingly looking to emerging markets, such as Asia-Pacific, for growth.

One of the key drivers is the absolute market size, in terms of population numbers and economic power. Asia- Pacific now accounts for 54 percent of the world’s population and 36 percent of the world’s economy. This is set to rise by 40 percent by 2020, at a growth rate of approximately twice as fast as the rest of the world

Asia-Pacific also accounts for one third of the world’s middle class, and this is projected to increase by 46 percent by 2020. For retailers, this is an exciting prospect as many customers can now afford to purchase fashion or luxury items for the first time.

Strong growth in tourism is another key driver for international retailers, as it helps to raise consumer aspirations and increase brand awareness, while supporting changing trends in fashion and technology. According to the United Nations World Tourism Organisation, in 2013 Asia-Pacific saw 248 million international tourists, six percent more than the year before, and nearly a quarter of the world’s total.

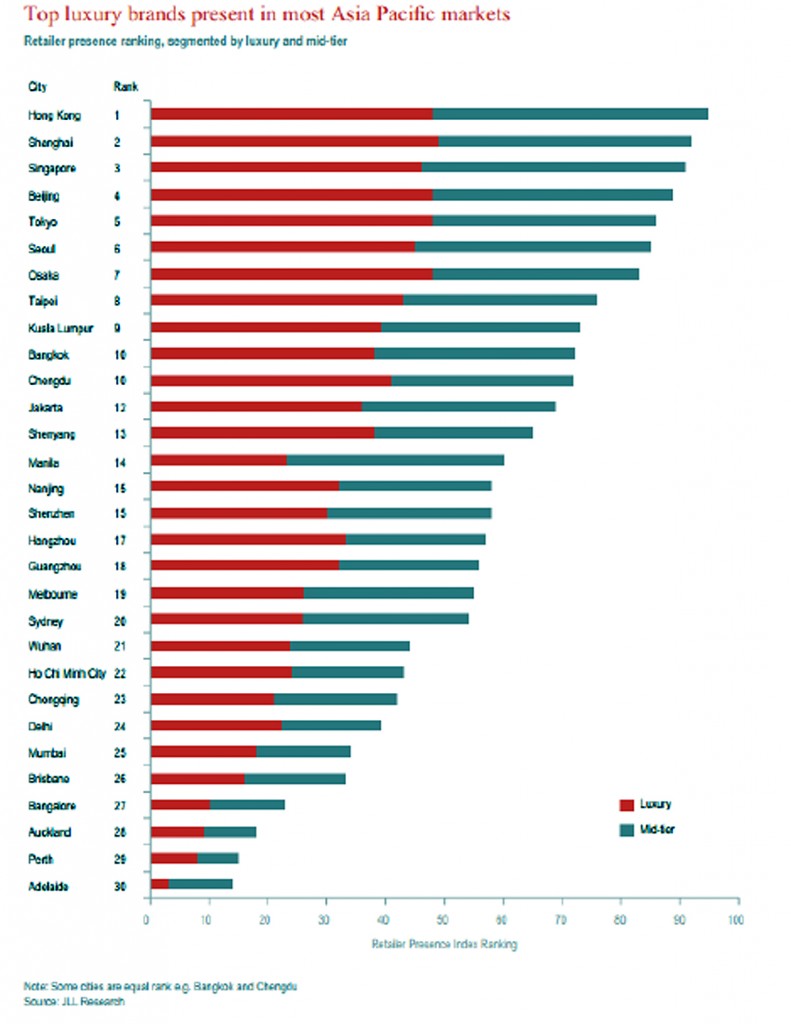

JLL’s report ranked Singapore third in terms of international retailer presence, after Hong Kong and Shanghai. As the most modern and affluent city in Southeast Asia, Singapore is a highly sought after location for retailers. Bangkok was ranked in 10th place in the region.

Tom Hamilton, Director of Retail, JLL Singapore, said: “For existing in country brands, due to falling tourist arrivals, increasing e-commerce growth and continued difficulties with foreign worker policy, we expect a continued slow-down in take up of weaker locations with many existing retailers reigning in expansion strategies along with potential consolidation of store numbers.

“In 2015, we foresee retailers placing further energies on their multi-channel platforms and from a bricks and mortar perspective, focusing resources and manpower on the best performing stores within their portfolios – what we call ‘a fight to prime’.”

The JLL report examined the presence and expansion patterns of 100 top international retailers, both luxury and mid-tier, in 30 major cities in Asia-Pacific. It identified major trends in key markets across the region, taking into account factors such as retail sales, market size and rental rates.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg