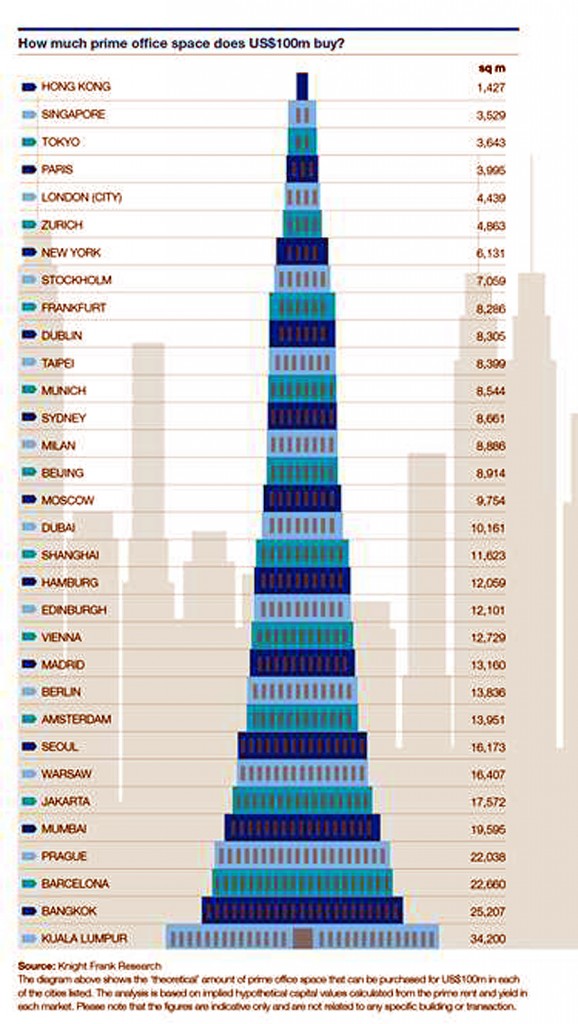

Office space in Hong Kong is more than twice expensive as prime commercial property in any other global city, while prime office space locations in Bangkok are still among the cheapest in the world.

As part of its 2015 outlook for global commercial property, Knight Frank analysed capital values for prime offices in 32 cities, which showed that prime Hong Kong office space is valued at US$70,000 per sqm. While this is significantly more than second-placed Singapore at US$28,340 per sqm, it’s substantially more than the 25,207 sqm that US$100 million will buy in central business district of Bangkok.

Despite strong recent growth in capital values and an uneven global recovery, Knight Frank is forecasting further growth in cross-border investment in 2015, as investors seek better returns and diversification outside home markets.

Knight Frank also believes that global investment volumes will rise by at least 10 percent to more than US$700 bn in 2015, given the significant weight of capital targeting real estate. Finalised data for 2014 is expected to show that global investment volumes for commercial property exceeded US$600 bn, around 15 percent up on 2013.

Key forecasts for 2015 from Knight Frank include a new wave of Chinese investment from Ultra High Net Worth Individuals & State-owned enterprises; Large-scale Japanese Pension Funds will diversify into global real estate; improving tenant demand for offices and falling availability will lead to rental growth; and specialist property will continue to attract investors and become increasingly mainstream.

Darren Yates, Head of Global Capital Markets Research at Knight Frank, said; “The availability of land and land values are the fundamental issues that are driving rents and capital values in Hong Kong and Singapore, in particular.

“These locations have a very constrained supply of land, combined with high population densities and an abundance of successful global companies with an ability to pay higher rents.”

He added: “Real estate capital markets have been increasingly buoyant and disconnected from occupational trends, which in turn have mirrored the unevenness of the global recovery.

“Investor focus thus far has been on transparency and liquidity, which has played well to the gateway cities such as London, Paris and New York. But demand is increasing for second and third tier cities where competition for stock is less intense and potential returns are higher.”

Knight Frank’s report also includes the findings from a survey of leading investment brokers from Sumitomo Mitsui Trust Bank on how the major Japanese pension funds will approach the real estate market in the coming years.

The survey suggested that more than 70 percent believe that Japanese pension funds will increase their exposure to real estate within one to two years, citing “stable income” as their key objective, followed by the opportunity to diversify.

North America will be the most popular region for Japanese Pension Funds investing abroad. Other Asian markets (18.8 percent) and European cities (12.4 percent) are expected to be far less popular initially.

Yates said: “With the top Japanese pension funds managing over US$2 trillion between them, even a small allocation to property is likely to have a significant impact on global real estate markets.

“Just a five percent allocation to international property by the 15 largest Japanese pension funds would amount to US$100 billion. This is unlikely to occur overnight but will undoubtedly have a major impact over the next two to three years.”

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg