Bangkok’s resilient office market has grown despite last year’s political turmoil.

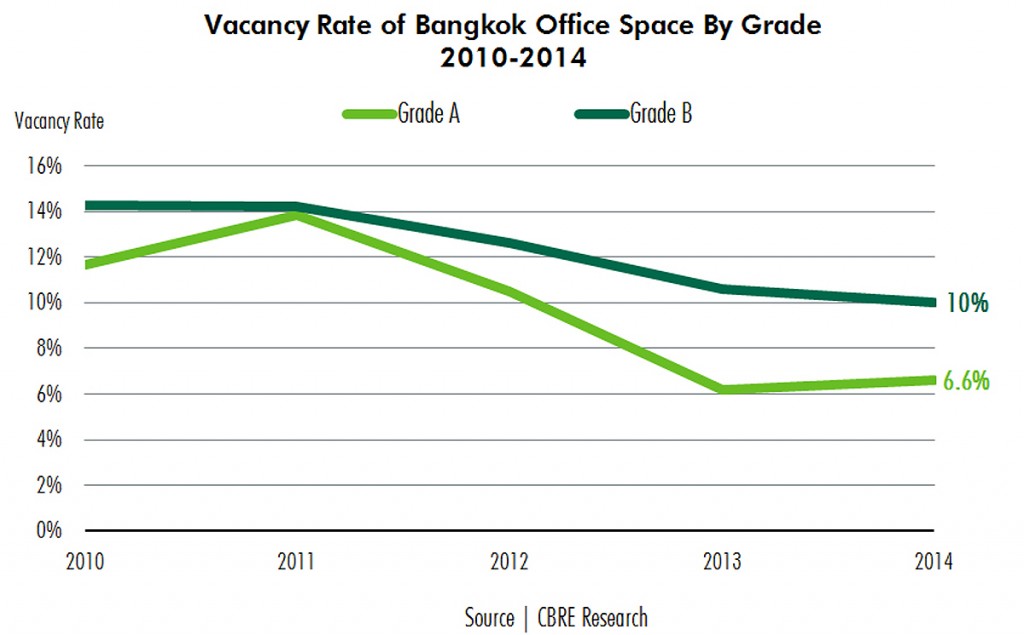

Occupancy and rents continued to rise throughout 2014, and looking forward CBRE anticipates the trend of falling vacancy rates and rising rents to continue.

That said, the real estate firm expects a temporary increase in vacancies is as a result of the completion of new supply.

The office vacancy rate in 2014 was below 10 percent and CBRE expects that figure to hold steady in 2015. An estimated 200,000 sqm of office space will come to the market and, according to CBRE’s forecast, net take-up will match that amount.

Although the first half of 2014 was slow, there was an uptick in activity in the latter half.

As the political situation improves, demand will continue to grow,” said Nithipat Tongpun, Executive Director, Head of Office Services, CBRE.

For example, take-up at the AIA Capital Center was above 60 percent within just a few months of completion, despite many companies deciding to put their expansion plans on hold in the earlier part of the year.

In 2015, Bhiraj Tower at EmQuartier and AIA Sathorn Tower will also be completed. Both are Grade ‘A’ central business district offices which will attract interest from local and foreign tenants, and consequently CBRE expects to see rents rise – but they will be slow, steady increases rather than any dramatic jump.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg