Real estate firm Colliers expects the Bangkok property market during 2015 will grow lower than many government and developer expectations – at less than 10 percent versus last year.

In its latest Bangkok Condominium Q4 research, the firm noted that unsold units and second-hand units are the major concern for property developers due to economic factors and household debt.

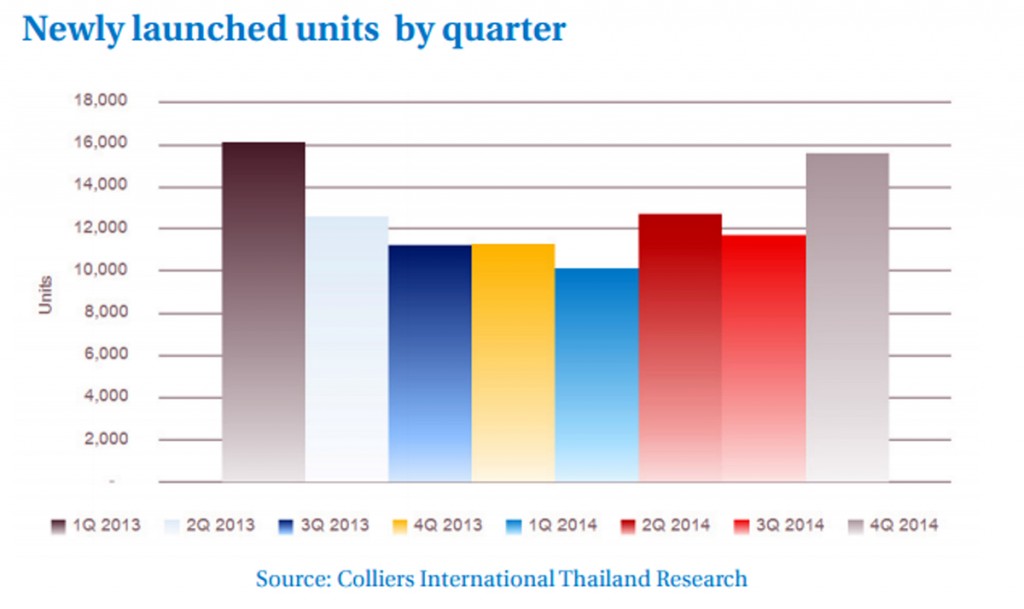

Although the Bangkok condominium market performed more poorly than expected during the first three quarters of 2014, due mainly to political issues, it recovered in terms of supply in the last quarter.

This was due to the launching of many condominium projects in Bangkok, with 15,560 units launched in the fourth quarter. This figure was the highest among all quarters in 2014. The total number of condominium units launched in 2014 was around 50,100, which was only two percent fewer than that in 2013 and higher than widely expected.

The accelerated rate of new supply in Q4 2014 was largely attributable to pent-up demand from 1H that was gradually activated as confidence returned following the end of the political problems in 2013 and in 1H 2014.

Colliers’ estimates that approximately 60,000 condominium units are still available (including all unsold units and around 15,000 units from speculators or investors), but absorption in 2014 was only 40,000 units.

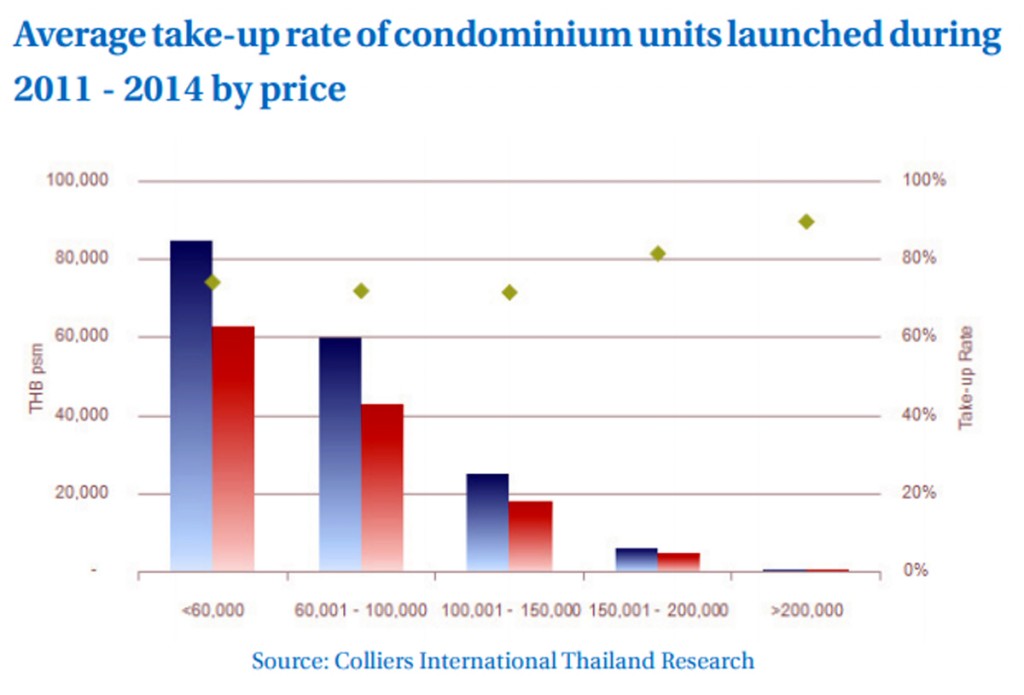

Approximately 80 percent of the 60,000 units are for sale at less than THB100,000 per sqm.

Bank rejection rate continuously increased to 30 percent, and that directly affected the transfer rate. The rejection ratio is approximately 25 – 30 percent; household debt is the main factor affecting buyers’ financial status, especially in the mid- to low-level sector.

Colliers expects that mid-to low-level condominium prices will remain stable in 2015, while high level to luxury prices may increase slightly.

It expects a huge number of available units in the mid- to low-level market will be the major factor forcing a freeze in the prices in these sectors.

Colliers’ research found that more than 38,500 units with average prices from THB60,000 to THB100,000 per sqm are still available in the market. Luxury condominium projects priced higher than THB200,000 per sqm are 90 percent sold and only around 100 units are available in the market.

The areas around some new BTS stations still have many condominium units available because many projects were launched in the past few years, especially at Wutthakat and Punnawithi stations.

Demand in the condominium market in 2015 may show a similar or slightly decreased trend compared with that in 2014, according to Colliers. Although the Confidence Index in December rose sharply from November, many factors will still affect Thai confidence in 2015, such as household debt and the economic situation.

Average selling prices of condominium projects launched during the past few years increased by between 5 percent and 10 percent per year, and will continue to increase slightly in 2015.

One major factor directly affecting new condominiums in Bangkok is the sheer number of second-hand units that are still available in the market with lower prices than new condominium units, so new condominium units will compete with all second-hand units in the same location.

Colliers’ forecast that the number of newly launched condominium units in Bangkok will be around 55,000 in 2015, or 10 percent higher than that in 2014, because most listed and well-known developers are planning to launch more new projects than last year, but this still depends on developers’ decisions.

Listed developers will remain the main players in Thailand’s condominium market, especially in Bangkok and in some tourist destinations, as well as in principal secondary cities.

Developers will focus more on the mid- to high-level bracket or condominium prices that are higher than THB100,000 per sqm in 2015 because the mid- and low-level group is directly affected by bank approvals.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg