Consumer confidence in Thailand continued to decline during the first three months of 2015, according to the latest Bangkok Property Times research report from DTZ, after the government cut its target for economic growth for this year.

In February, consumer confidence decreased again to 79.1, after falling to 80.4 in January 2015. This prompted the Thai government to reduce the policy rate from 2.0 percent to 1.75 percent in March.

Retail stock continued to expand in midtown locations, downtown remained stable

Focusing on the retail property sector, stock continued to expand in midtown locations with a number of developments completing in Q1 2015. These brought an additional 22,180 sqm of new retail space to midtown. The most notable was the 12,000 sqm Yodpiman River Walk, located at Chakphet Road along the riverside.

The total stock in midtown areas increased to 705,636 sqm in Q1 2015, whilst the total stock in downtown locations remained unchanged at 1,272,493 sqm, as no new supply entered the market.

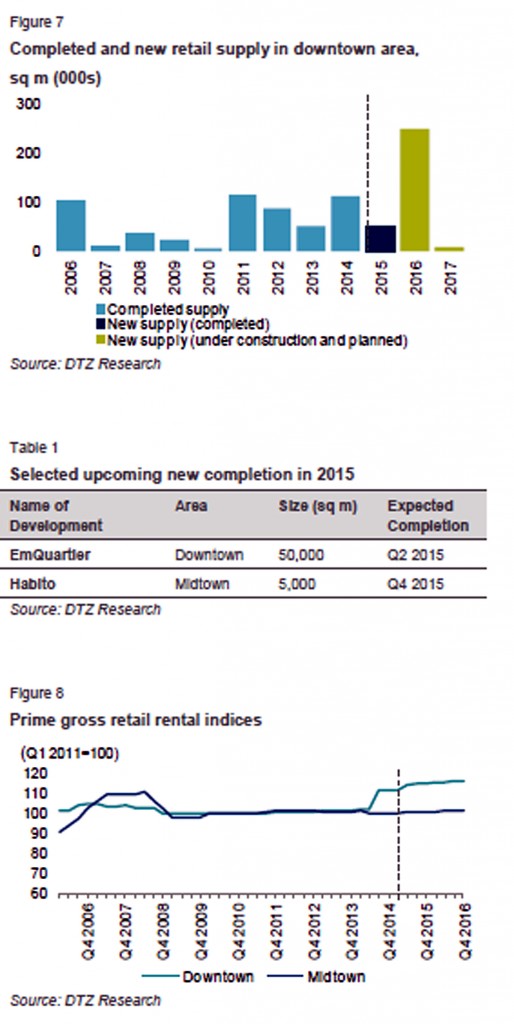

Approximately 50,000 sqm of downtown retail space is expected to be completed in Q2 2015, thereafter, DTZ does not expect any further developments to complete in the downtown area for the rest of 2015 (see figure 7 below).

Relatively stable occupancy for retail in downtown and midtown areas

There was some movement in the downtown market, bringing the average occupancy rate in Q1 2015 to 91.4 percent, from 91.5 percent in Q4 2014. The highlight in the downtown areas in Q2 2015 is the recent opening of EmQuartier located at Phrom Phong BTS station. A luxury shopping mall with around 1,000 foreign and local brands, EmQuartier will be the main driver in the downtown market in 2015, offering an additional stock of 50,000 sqm.

The building was expected to be fully-occupied on completion earlier this month (see table 1). It is anticipated that downtown occupancy levels will increase amidst strong demand for retail space, in line with limited new supply completing in 2015.

The retail market in the midtown area is highly competitive between new malls and existing malls, as seen once again in this quarter. The vacancy rate stayed at 6.9 percent, unchanged from Q4 2014. It is anticipated that the retail market in the midtown area will remain competitive throughout 2015.

Approximately 128,140 sqm of new retail space is scheduled to come into the market between Q2 and Q4 2015.

Retail rental levels was unchanged in Q1

Average rental levels in downtown areas remained unchanged in Q1 2015, at THB2,550 per sqm per month (see figure 8 below). Similarly, average rental levels in the midtown area remained stable at THB1,560 per sqm per month, despite the completion of more stock.

DTZ said it expects retail rents to increase gradually during 2015 with the completion of a prominent mall in the prime downtown area, as well as new shopping malls and community malls in the midtown area.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg