Bangkok’s condominium sector slowed during Q1 2015 as a result of financial institutions tightening credit for both developers and buyers according to the latest research report published by Colliers International.

In its research report, the real estate firm noted that bank rejection rates continuously increased to 30 percent, especially in the mid- to low-level group, which directly affected the transfer rates of completed condominiums.

There were approximately 10,450 units newly launched in the first quarter of 2015, dramatically less than in Q4 2014. Although many developers are still confident in the market and launched new condominium projects in Q1 2015, most new projects in Q1 were launched in March.

Colliers reported that many developers are concerned about low purchasing power, and the high bank rejection rates that are largely due to high household debt.

Many developers postponed the launch of new projects during Q1 and are reported to be monitoring the market carefully, especially on the demand side.

The high-end to luxury units took more of a market share in Q1 2015 than in the past few quarters. This was due to many developers focusing more on this target group, replacing the mid- to low-level market group, particularly in the Bangkok Inner City area close to BTS stations.

Mid- to low-level condominium prices will remain stable during 2015, according to Colliers, whereas high-level to luxury prices continue to increase.

A huge number of available units in the mid- to low-level market are the major factors forcing a freeze in the prices of mid- to low-level units, or an increase of only a few percentage points.

The increase in land prices in the past few years is the major factor contributing to increasing condominium prices.

The New Residence Buyer’s Confidence Index, compiled from a survey in January – March 2015 by the University of the Thai Chamber of Commerce, continued to decrease from January to only 71.5 in March, the lowest in the past many months. This was due to Thailand’s economic situation still not recovering after export performance showed negative signs in Q1 2015, which directly affected confidence.

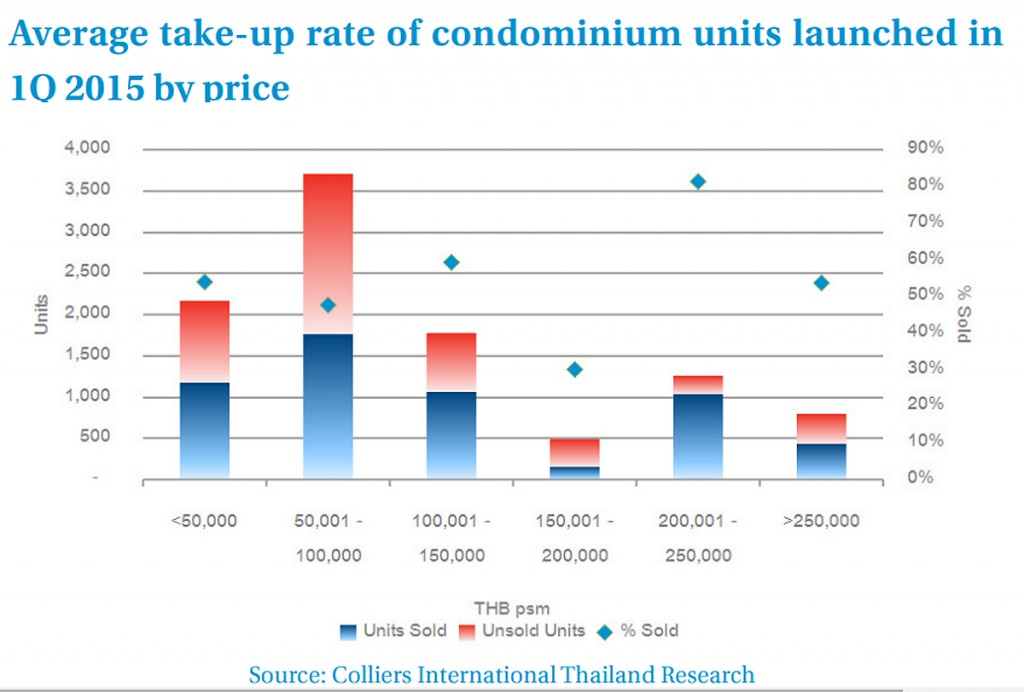

The average take-up rate of all condominium units launched in Q1 2015 was approximately 54 percent, lower than in the past few quarters.

Approximately 56 percent of newly launched units in Q1 2015 are selling at less than THB100,000 per sqm. The average take-up rate of condominium units with a price of between THB100,000 and THB200,000 per sqm is around 53 percent,higher than units that are for sale at lessvthan THB100,000 per sqm, Colliers reported.

New condominium units launched during Q1 2015 with an average price of more than THB200,000 per sqm are more than 66 percent sold, while some projects were almost 100 percent sold within a few days after their official launches.

High-end and luxury condominium projects that were launched in Q1 had a significantly higher take-up rate compared to mid- to low-level projects due to the high purchasing power group still confident in the condominium market. In addition, condominiums are becoming more interesting an investment than putting the money in the bank, and are more stable than the stock market.

The decline in overall take-up rates was due to many factors that influenced Thai confidence, such as rising household debt and the economic slowdown in Thailand and in other countries that are export destinations.

Colliers said demand in the condominium market in the remaining three quarters of 2015 depends on the overall economic situation and government spending on infrastructure projects, as well as export performance, all factors that will directly affect Thai confidence. These may increase spending for the rest of this year, if Thailand’s economic performance improves.

New condominium projects in the areas close to BTS stations are already more expensive than THB250,000 per sqm and continue to increase every quarter. The average selling price of condominium projects launched during the past few years increased by around 5 percent to 10 percent per year, and will continue to increase during 2015, according to Colliers.

The major factor directly affecting new condominiums in Bangkok is the many second-hand units that are still available in the market with lower prices, so new and second-hand units in the same location will compete for sales. Land prices also became a major factor affecting condominium prices.

In its forecast, Colliers said the new mass transit lines are a positive factor for the condominium market as many developers are looking for new locations for condominium development projects. Some development lines are under construction and some new lines are expected to open for bidding in 2015.

After the first quarter passed and demand in the condominium market slowed down, developers are revising their plans and focusing more on housing projects. In addition, most developers are launching their new projects in locations where their prior projects were successful.

The number of newly launched condominium units in Bangkok in 2015 may be similar to 2014 or less than 50,000 units, the real estate firm predicted.

The high-end and luxury markets are becoming the most interesting for most developers in 2015, but this depends on the location and the reputation of the developer, it concluded.

To read the full Colliers report visit: http://www.colliers.co.th/images/agency/idYpqevGBangkok%20Condominium%20Q1%202015-en.pdf

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg