The unprecedented uncertainty surrounding last month’s General Election in the United Kingdom saw a stifling of house price growth across London, with the rate of house price growth at less than 4 percent, compared with the 9.6 percent increase seen in 2014.

The emergence of the capital as a political scapegoat, with potential rent caps and a ‘Mansion Tax’ being discussed, contributed to the sense that London households would bear the brunt of any tax changes. However both issues have now subsided following the surprise majority win by the Conservatives, according to international real estate consultants Cluttons.

Despite this, the damage done to domestic and international buyers’ confidence was reflected in a sharp tailing off in demand during the first quarter of 2015, with both vendors withdrawing properties and buyers adopting a ‘wait and see’ approach.

Cluttons’ International Research and Business Development Manager Faisal Durrani explained: “There is no doubt that the results of the General Election have helped to re-inject confidence into the market that had receded early on this year.

“The outlook for the London housing market has stabilised, while buyers and vendors have returned to the market following a conspicuous absence of activity.

“Our outlook for the rest of the year is for increased stability in the market and a return to a more normal state of activity.”

Despite the Mortgage Market Review (MMR) contributing to a 16 percent year-on-year dip in home purchase loans in Greater London to March 2015, affordability appears to be improving slightly, with the average loan size dipping to 3.86 times annual income in the first quarter of 2015.

Risks remain on the international front, however.

Durrani continued: “International risks, such as the threat of another Scottish referendum, a disorderly Greek exit from the European Union and a potential Brexit (a British exit from the European Union) mean that the market has moved from a situation of having several unknown unknowns to being left with a handful of known unknowns.

“A Brexit remains the biggest threat as the impact on the economy is the biggest unknown at this stage.”

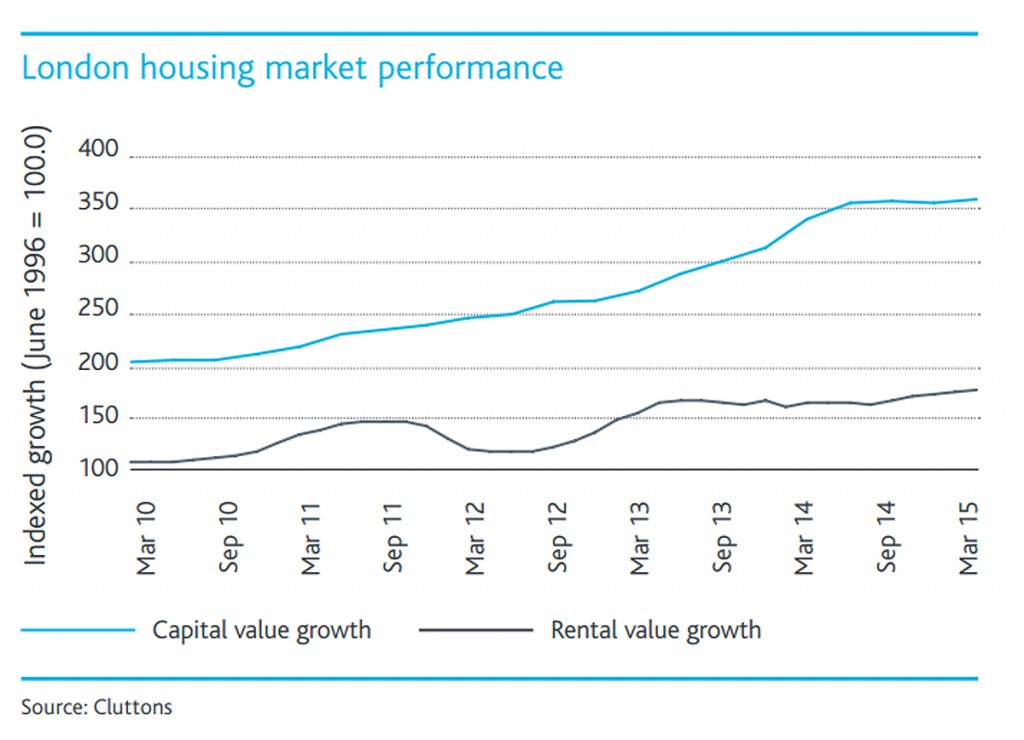

Cluttons forecasts modest Central London house price growth in 2015 of between 2 percent and 3 percent, before accelerating to nearly 5 percent in 2016 and stabilising at around 4 percent per annum between 2017 and 2019.

The real estate firm expect this level of growth to deliver cumulative capital value appreciation of almost 18 percent over the next five years.

The prospects for the prime Central London rental market are stable, it noted, with average growth of 4 percent per annum forecast for the next five years.

Cluttons explained that affordability and the desire to purchase remain key challenges for the capital’s rental market and while supply levels are rising, the strong rate of job creation in London will help in absorption rates.

Durrani added: “The more subdued growth forecast by a number of factors, but the propensity of tenants to show less geographic loyalty now means that households are not put off by the idea of moving out of the prime core in search of lower rents.

“The key driver of course for this behaviour is the desire to purchase.

“The breach of affordability thresholds now means that the rippling out of buyer activity from the prime core markets has meant that Greater London boroughs, such as Newham, Lewisham and Enfield, have all emerged as the capital’s three best performing markets over the last 12-months according to data from the Land Registry.

Quick Central London Property Facts

- Average prime Central London house price is Q1: £2.3 million

- Average weekly prime Central London rent: £1,100

- Cumulative capital value growth for prime Central London residential till 2019: 18.3%

- Cumulative rental value growth for prime Central London residential till 2019: 19.5%

Source: www.cluttons.com

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg