Thailand was one of the world’s largest beneficiaries of commercial real estate stock held by global investors last year, according to new research from real estate firm DTZ.

Asia-Pacific invested property stock hits new US$5.1tn record last year, according to DTZ, as the value of stock in the region held by investors rose 10 percent in 2014, double the global growth of 5 percent.

DTZ cautioned some markets are in danger of overheating and risks from a reversal of capital flows, with leading gateway cities less exposed.

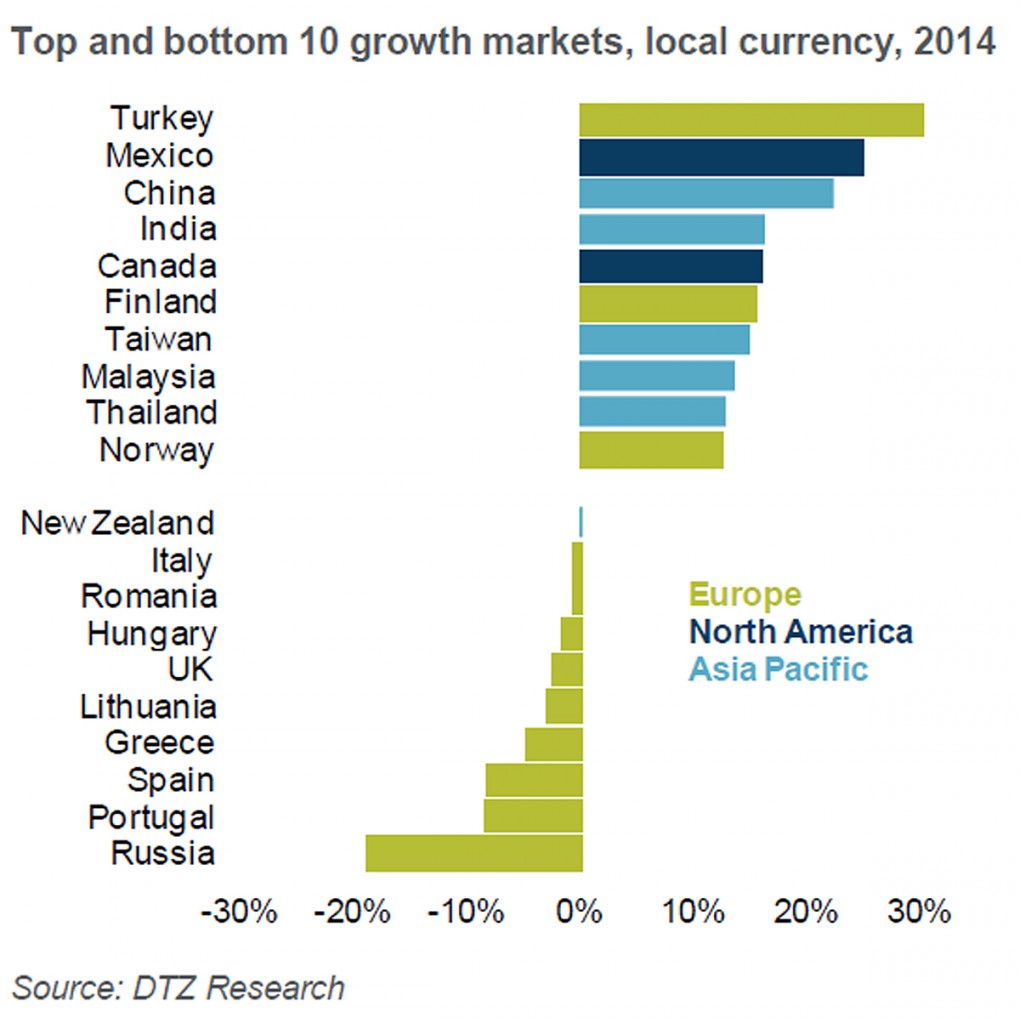

Asia-Pacific benefitted from the strongest annual growth led by China, which rose 21 percent (in dollar terms). The growth of stock in China was so significant that, when excluded, Asia-Pacific rose by just 1 percent.

India and the Southeast Asian markets of Malaysia and Thailand also posted strong growth in dollar terms of 13 percent, 10 percent and 8 percent respectively, with the latter two coming off a low base.

Dr. Nigel Almond, Head of Capital Markets Research at DTZ, said: “The equity component of stock rose by 8 percent during 2014, driven by private equity, whereas debt was more muted and was up by just 2 percent.

“As the market continues to de-lever, those markets with relatively lower leverage levels have benefitted from stronger growth, particularly Asia-Pacific markets such as Australia, Hong Kong and Taiwan.

“Growth in the more leveraged western markets of the U.S. and U.K. has been held back in comparison,” he concluded.

Dominic Brown, Head of Asia Pacific Research at DTZ, added: “Investment volume in Asia-Pacific reached a record high in 2014 of US$107bn, but we note that the first quarter of 2015 was particularly quiet as investors struggled to source product.

“We expect this to be temporary and for 2015 annual volume to remain at the recent peak, with investors identifying Japan, Australia and China as their key markets in Asia-Pacific.”

“On a city level, the strength of investment in Asia-Pacific was reflected in the region accounting for five of the top 15 markets.

Almond added: “The weight of capital is driving a disconnect between pricing and fundamentals. Markets are at risk of an increase in interest rates which will see the relative attractiveness of real estate diminish. In turn, this could stall new investment and reverse the flow of funds as investors

seek to redeem their investment with consequent impact on pricing.

‘Investors need to focus on fundamentals, and in our view good quality assets in gateway markets are less exposed to these risks.”

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg