The cabinet introduced a bill to reform the land and building tax on 7th June 2016. The bill stated that from 2017 onward, all landowners, both natural and juristic person, would be subject to pay property tax.

The new land and building tax law will replace the local administration tax and building and land taxes, which will both expire when the new law officially comes into effect next year. In general, the new land and building tax law will reduce unfair speculation practices in the real estate industry, encourage undeveloped lands to be utilised, and collect revenue for the local administration. In addition to this, the total revenue collected will increase, mainly from the commercial and industrial sectors, from THB30,000 to THB60,000. When the new land and building tax law goes into effect next year, the taxation will be divided into 4 areas as follows:

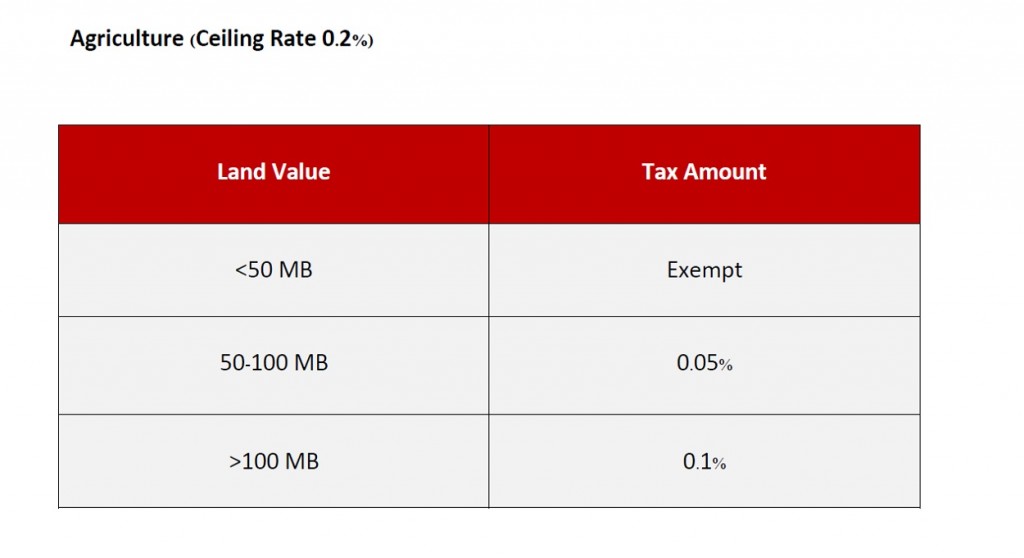

Agriculture (Ceiling Rate 0.2%)

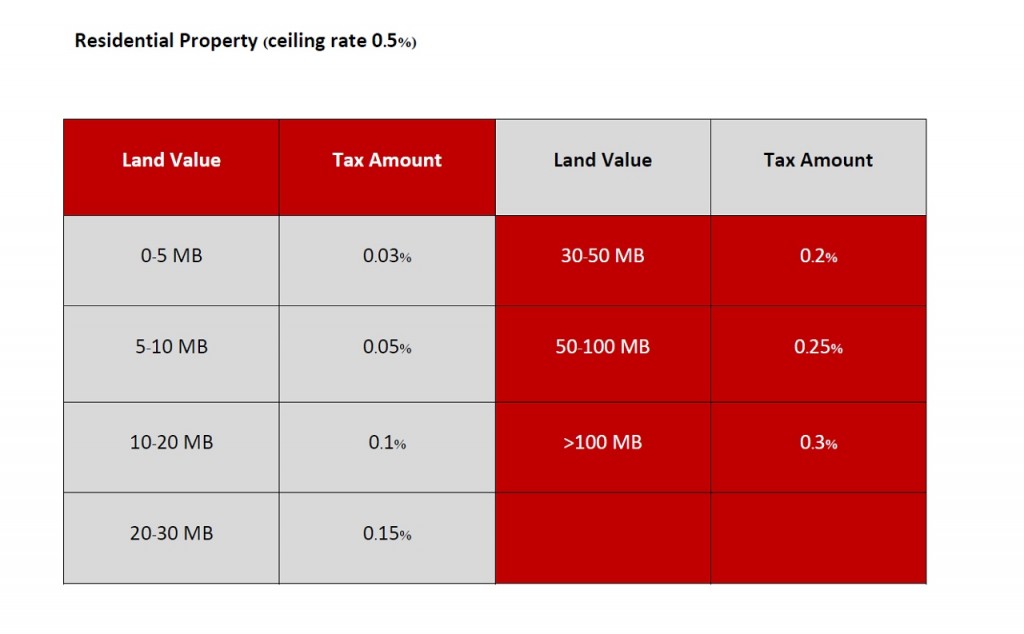

Residential Property (ceiling rate 0.5%)

A first house that has a land value under THB50 million will be exempt, while lands with an owner’s second house are subject to tax at the following rates:

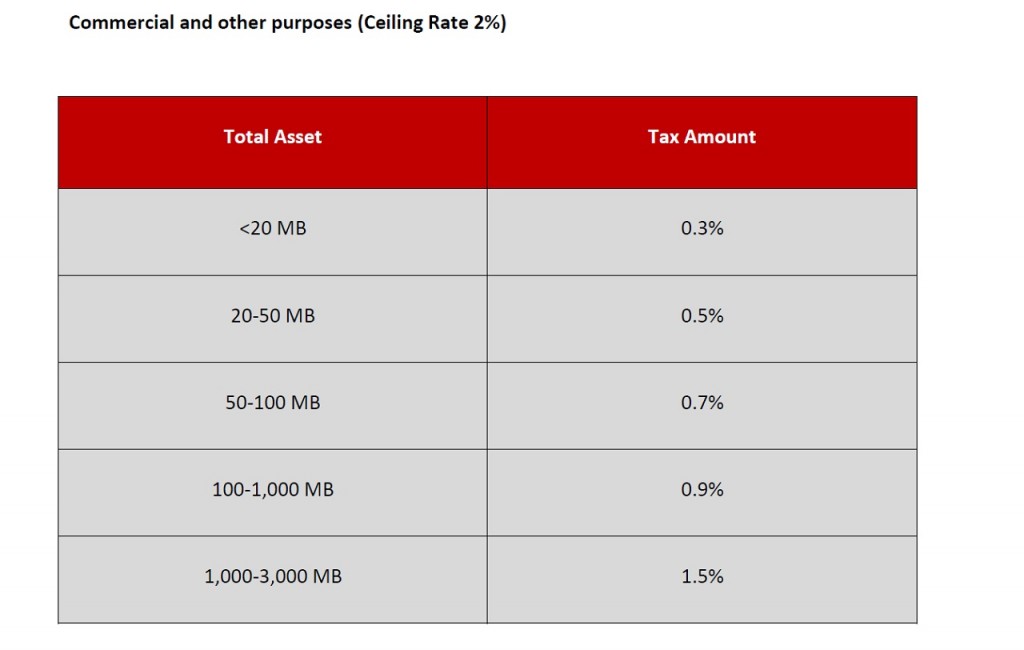

Commercial and other purposes (Ceiling Rate 2%)

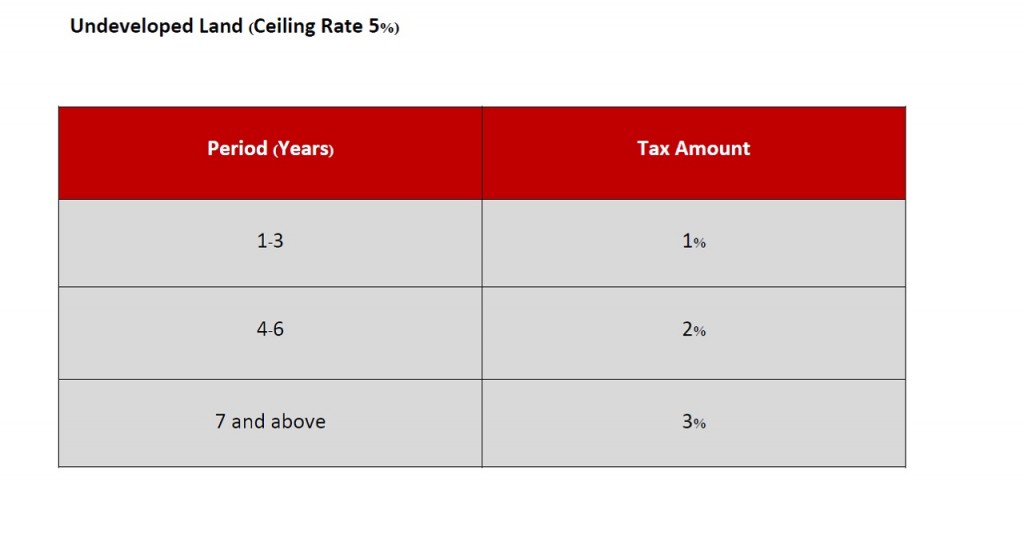

Undeveloped Land (Ceiling Rate 5%)

Lands utilised for the public, or belong to a housing estate or condominium project, are exempt

As a result, the new land and building tax law will urge many land owners to take action. Some may decide to sell their land, or join hands with a big-name developer to utilise in order to avoid the extreme rate, while others could seek tax gurus to find the best solution. On the other hand, the new law is a positive sign in the eyes of developers, as it translates to more land supplies, especially those in the prime locations where they want to launch projects.