It has been a good year for the Bangkok office market, according to new research from CBRE Thailand’s research team. The entire market performed well over the course of 2016 as limited new supply and healthy take up saw rental rates grow and low vacancy rates shrink even further.

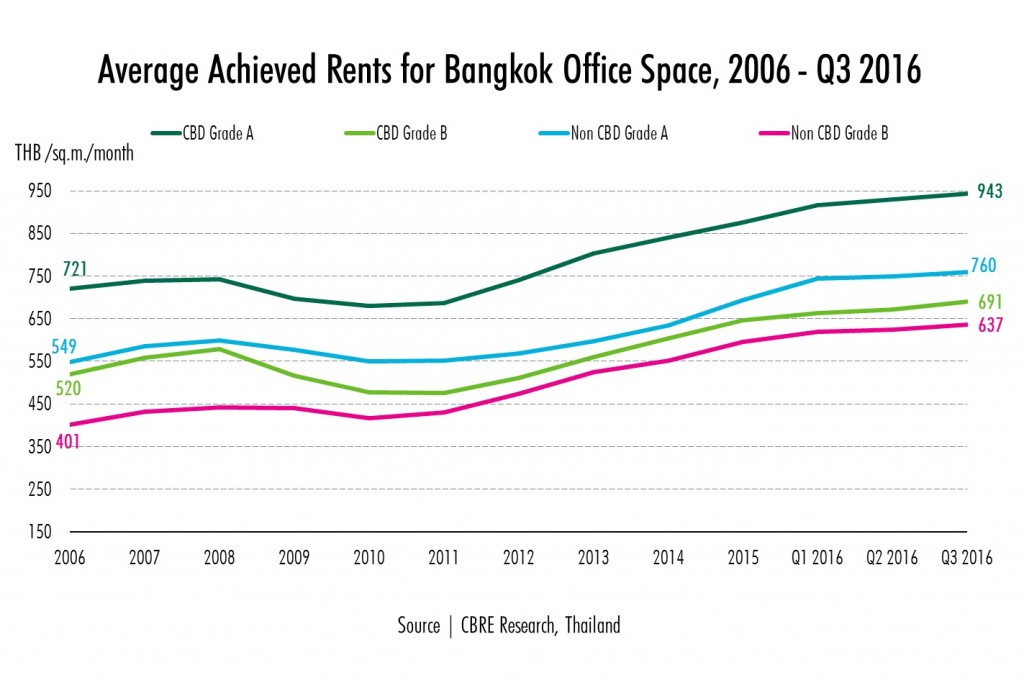

It is being reported that Bangkok office rents are set to increase by an average of 6.5 per cent this year with Grade A rents rising by around 8 per cent and Grade B rents jumping 5 per cent. Bhiraj Tower at EmQuartier joined Park Ventures Ecoplex as office buildings in the city able to achieve a rental rate of THB 1,000 per square metre per month for a small, standard specification unit.

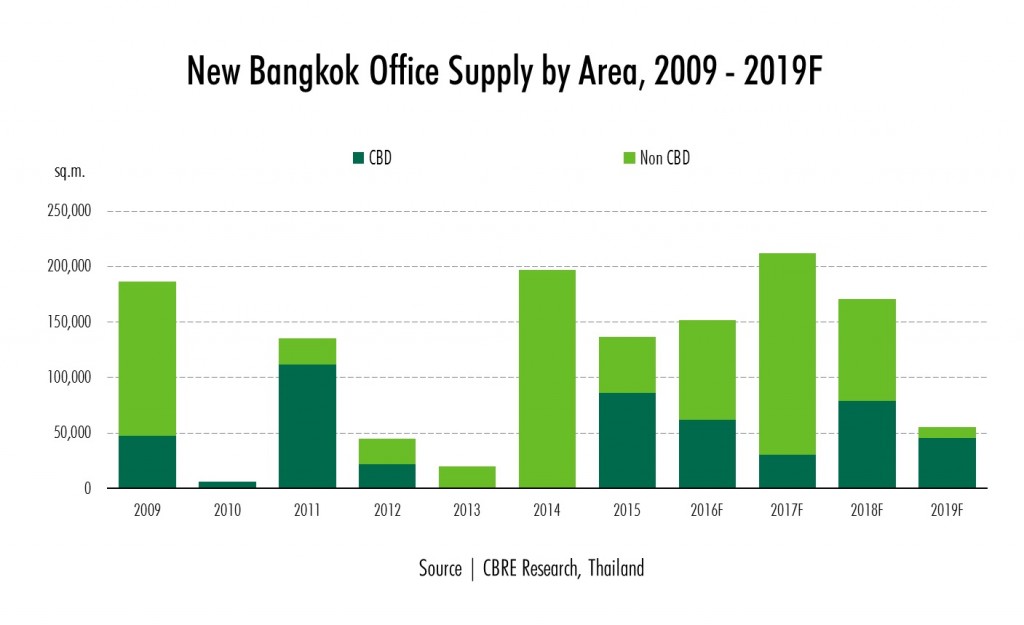

Nithipat Tongpun, Head of Office Services, CBRE Thailand estimates that a total of 151,000 square metres of new office space will be finished this year. That figure including two new buildings, Thairath and Osotspa, that will be owner-occupied.

However, as some buildings are going up, others are coming down. Two office complexes in Bangkok, Kian Gwan One and Vanissa Building, were demolished removing 28,000 square metres from the city’s leasable office stock in the process. Nithipat says this trend could continue as owners of dated buildings consider options with central land prices and rents increasing.

Even as supply increased, the overall occupancy rate kept raising, landing at 91.8 per cent so far in 2016. Pre-leasing demand in Bangkok was also strong in 2016, with Gaysorn Tower and M Tower leading the way. Both projects are slated for completion next year. Additionally, the FYI Centre was able to secure significant commitments from tenants over 6 months before it was completed this year.

Despite developers looking to build more office projects, only 463,000 square metres are set to be finished between now and 2019. CBRE concludes that the overall occupancy rate is likely to continue growing with office rents further rising over the next 12 months because of this.