DDproperty reveals that Thai consumer confidence towards real estate climate slightly drops to 62% in 2017 from 68% a year earlier due to stagnant economy and restrictions of home loans. Consumer sentiment in Indonesia, Singapore and Malaysia, however, has increased at 5%, 8% and 10% respectively from 2016.

The online questionnaires conducted amongst 3,255 first-time home buyers and upgraders in four countries where PropertyGuru operates in Thailand, Singapore, Malaysia, and Indonesia shows that Indonesian are most satisfied with their country’s real estate climate with a 5% rise to 66% from 61% the previous year as they foresee good long term prospects for capital appreciation. Malaysia consumer confidence also rises to 38% from 28% and Singapore confidence at 36% from 28% in the previous year as Singaporeans perceive their country’s economy is in excellent condition.

Thai respondents said their top 5 reasons for dissatisfaction are sluggish economy (55%), expensive property price (52%), property price increasing too quickly (46%), bank’s restricted loan application approval (30%) and unpredictable real estate climate (25%). (Figure1: Top 5 Reasons for Dissatisfaction with Real Estate Climate)

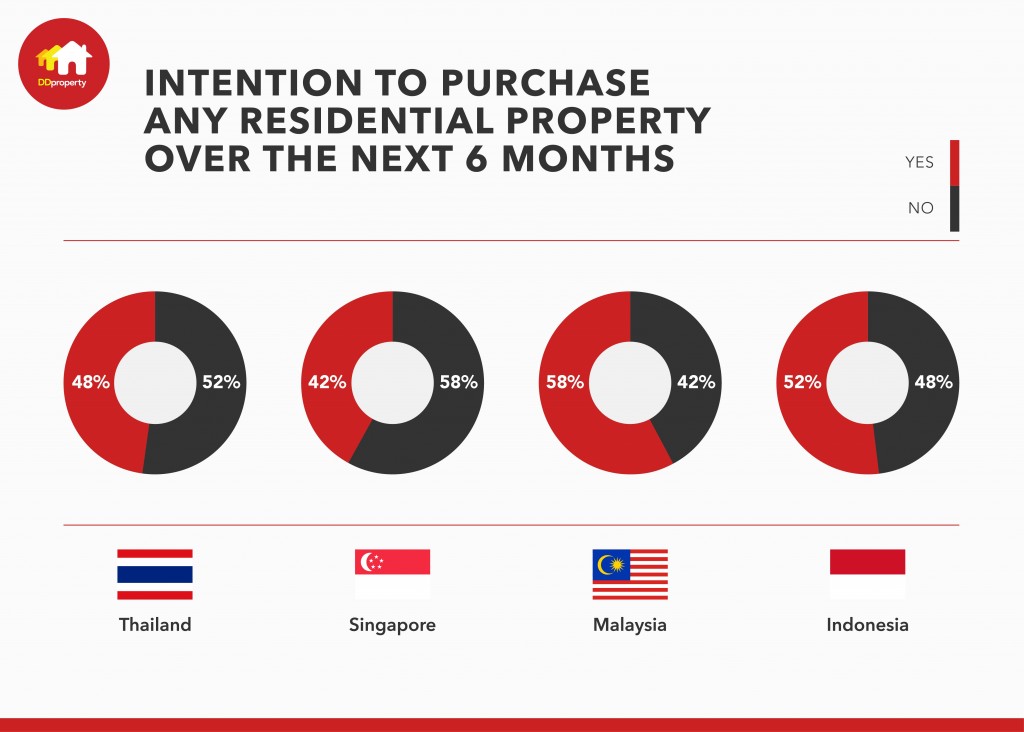

When asked for consumer intention to purchase property in the next 6 months, however, almost 50% of Thai respondents were optimistic and said they intend to buy a residential property in the next 6 months. Malaysia has the highest number of people intending to buy property over the next 6 months, Indonesia stands at 52%. Singapore home seekers has the lowest intention to purchase property at 42% while majority of Singaporeans feel the property prices will decline in the next 6 months as developers tend to cut prices to avoid paying extension charges and penalties resulting from unsold units. Buyers shall gain advantage of these discounts. Singapore also has lowest number of residential property ownership among the four countries at only 60%, compared with 82% in Indonesia, 66% in Malaysia and 65% in Thailand.

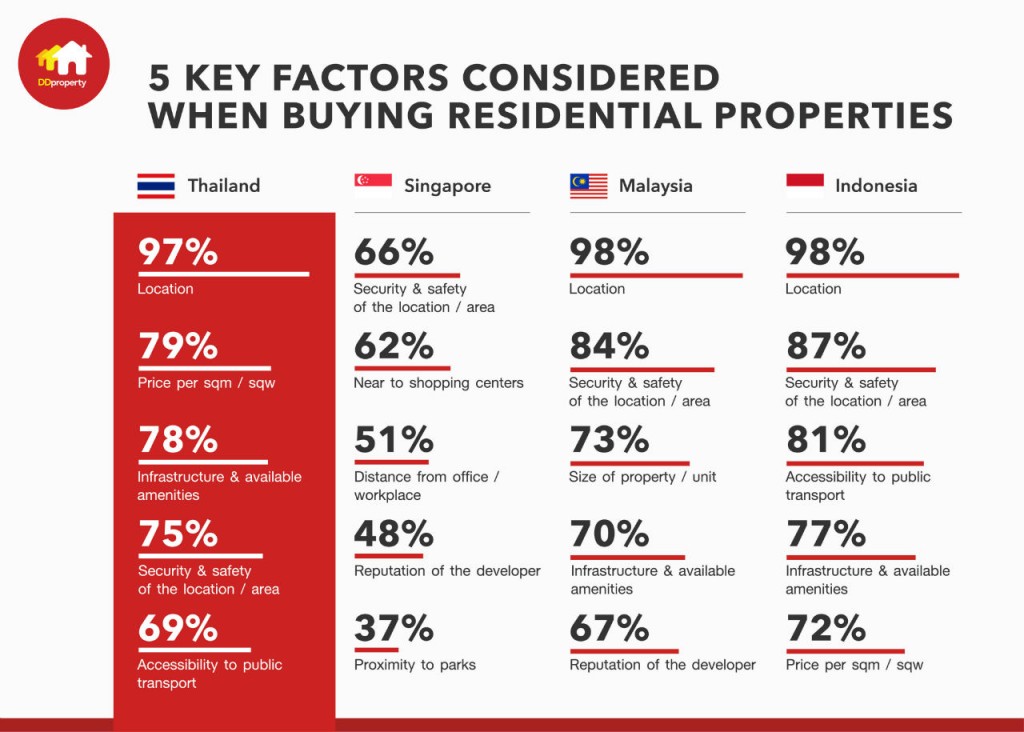

For Thai, Indonesia and Malaysia home buyers, property location emerges as their most important factor considered for purchase, while Singaporeans ranked security & safety of the property area as their number one reason considered for purchase decision. (Figure 2: 5 Key Factors Considered when Buying Residential Properties)

Majority of respondents across the four countries preferred both residential property types; new launch and resale when asked for the type of property they are looking to purchase over the next 6 months. If compared between resale and new launch in Singapore; however, resale seems to be more favourable as new launch is less affordable.

Buyers are seen with various pocket sizes for purchasing residential properties over the next 6 months. Thai home buyers intending to spend 2-3 million baht at 34%, 3-4 million baht at 16%, and 5-8 million baht at 15%. Singapore buyers at 25% intend to buy residential property at 250,000-500,000 SGD (6.25-12.5 million baht) and Malaysia home seekers at 38% intend to spend around 300,000-500,000 MYR (2-3.5 million baht). While majority of Indonesia home seekers or at 50% look to spend less than 500 million IDR or less than 1 million baht. (Figure 3: Budget for Property Purchase in Next 6 Months)

The questionnaires also revealed that Thais are likely to stay in purchased residential property at an average of 12 years followed by Singapore and Indonesia at an average length of stay of 11 years. Malaysia respondents, on the opposite, has the lowest average length of stay or 9 years after one bought residential property.

“Consumer confidence or sentiment towards real estate market is mainly driven by various catalysts to name a few; economic growth, continued infrastructure investments and developments, rising household or personal income, low interest rate and household debt. Majority of consumers then foresee that property prices likely to pick up in coming 3-5 years despite the challenging market condition recent year. Residential property is no longer consider as four basic needs but way of creating personal wealth.” said Mrs. Kamolpat Swaengkit, Country Manager, DDproperty as part of PropertyGuru Group.

Receive the latest property news on email from Thailand’s No.1 property website here, or read more project reviews