No one could have predicted the impact a virus could have on such a global scale and what role it would play in Thailand’s residential property market.

Recent data collected from DDproperty has gauged how COVID-19 has reduced property prices and forced developers to rethink their strategies.

As with any economic downturn, property prices have naturally taken a dip. An immediate reaction created due to economic uncertainty and individuals lacking job security and the ability to secure a home loan. However, before the outbreak, the property market already faced challenges due to high household debts and a subdued economy. The arrival of the virus has become another hurdle to overcome.

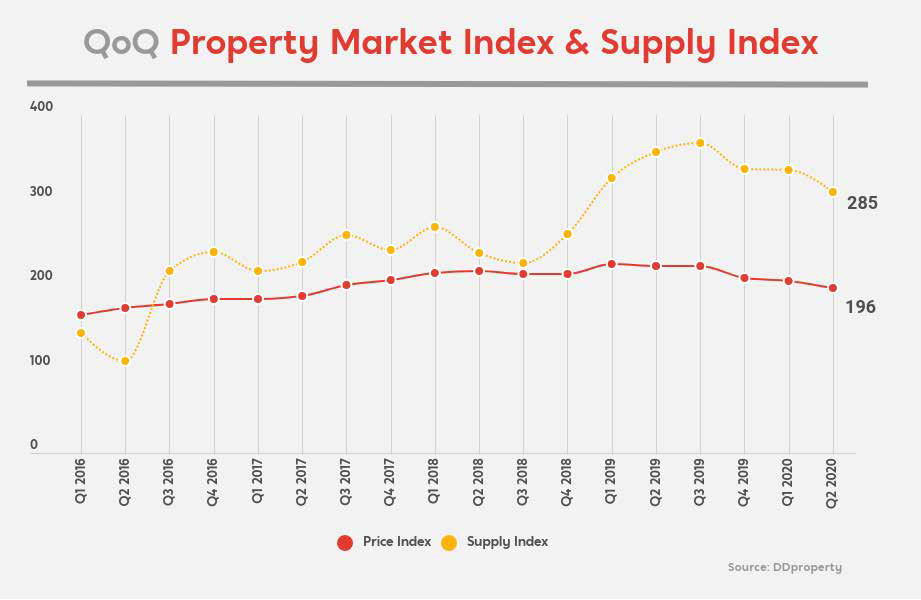

The DDproperty Thailand Property Market Index saw Bangkok’s price index reduce by 4% for the third quarter of 2020. Simultaneously, the supply index dropped 15% influencing individuals looking to invest in Thai property as well as developers who have become wary of market conditions.

Historically developer strategies in Bangkok have focused on condominium projects that were considered the most lucrative and safe form of investment. There has however been a shift over the last year driven by consumers who have seen the merit in Bangkok’s ever-increasing mass transit network and the realisation that a central bolthole is no longer.

Coincidentally developers started focusing their efforts on building landed residential properties in suburban areas and provinces to capitalise on real rather than speculative demand.

The arrival of COVID-19 led to employees abruptly working from home to adhere to social distancing. Living, working and playing all within one space amplified the need for homes with more space to accommodate this and weakened the demand further for condominiums.

Developers have concentrated efforts on shifting their backlog of unsold inventory before considering launching new projects and stock resulting in a market awash with promotions and offers in a bid to generate interest. Plus, as day-to-day life has become more virtual, there has been an increased use of online platforms to market and sell properties.

“Developers continue to concentrate on clearing inventory with attractive promotions to stimulate consumers, especially for condominiums. This has resulted in lower condominium prices, a trend we expect to see until the end of the year,” said Kamolpat Swaengkit, Country Manager of DDproperty.

As mentioned property prices are forecast to continue on a downwards trajectory until life returns to the new norm, and the economy shows signs of recovery. To top this off Thailand’s borders remain firmly closed restricting overseas investors who some state prop up the condominium market.

But this does create a window of opportunity for investors remaining in stable financial positions. The abundance of choice, price wars between developers and ongoing promotions lead to lower prices that astute investors are keen to capitalise on.

Stay abreast of the industry’s news and updates sending directly to your inbox, sign up here.