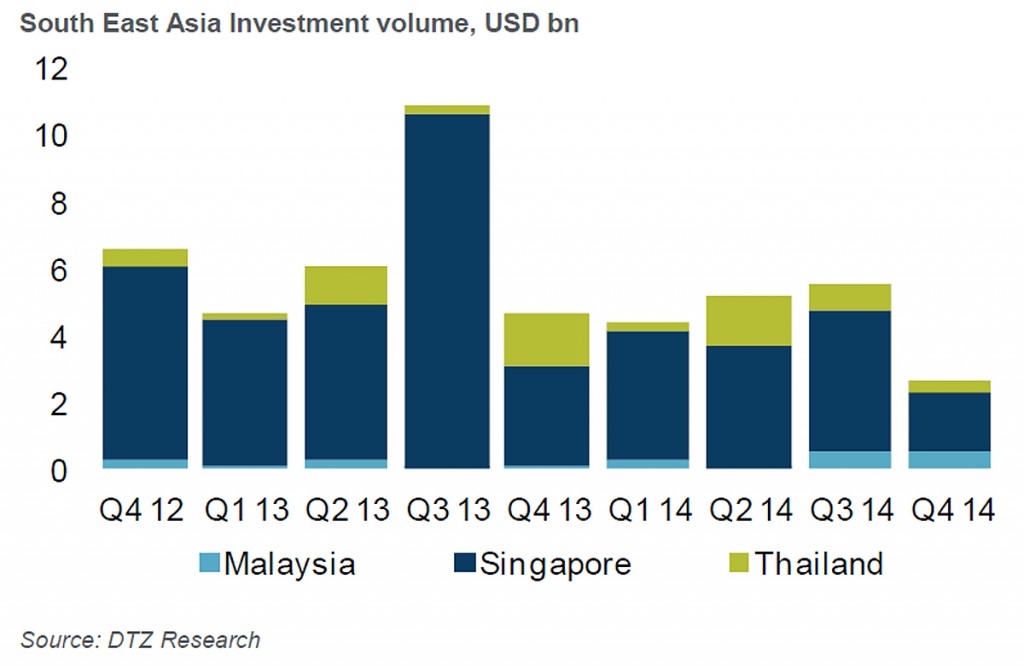

Combined real estate investments in Malaysia, Singapore and Thailand plunged by 52 percent quarter-on-quarter to US$2.7bn in Q4 2014 according to research from DTZ, bringing the full-year investment volume to US$17.9bn – 32.1 percent lower than what was invested during 2013.

According to the real estate firm in its latest Investment Market Update research report, investments were sustained by the establishment of REITs in Thailand.

Investments in industrial properties, at US$1.2bn, were the highest in Q4. For the whole of 2014, investment in the office sector was the highest (US$ 5.4bn), followed by the residential (U$ 4.6bn), industrial (US$ 3bn and retail (US$ 1.2bn) sectors.

Foreign investment increased by more than 1.7 times q-o-q in Q4 due to investments in Singapore. Notwithstanding, total foreign investment in Southeast Asia during 2014 contracted by 31 percent compared with 2013.

According to DTZ, real estate investment sentiment in Southeast Asia is expected to be relatively subdued in 2015, due to concerns over economic growth, falling oil prices and policy issues.

However, this will be mitigated by the growth of the nascent REITs market in Thailand and continued interest from mainland Chinese companies.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg