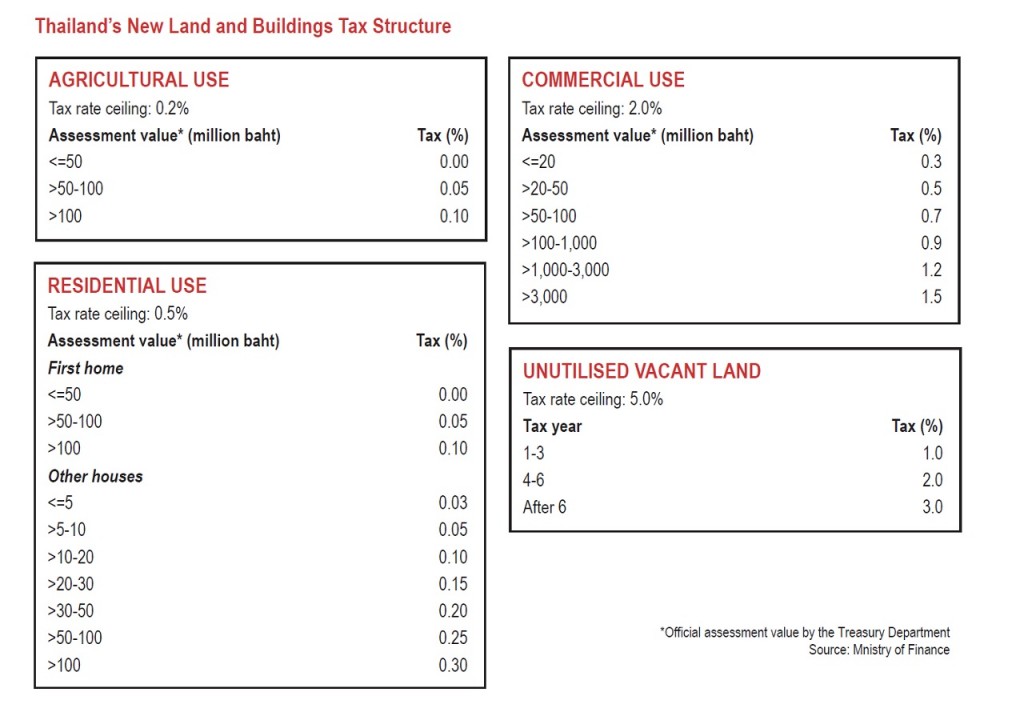

While property owners continue to familiarise themselves with the new land and buildings tax passed by the Thai cabinet, some feel these will have a short-term negative impact when they take effect next year. However, Suphin Mechuchep, managing director of JLL, pointed out that the new taxes should promote a more efficient use of land and will actually benefit Thailand’s property sector.

For example, some landowners will be forced to make better use of property currently vacant if they wish to avoid paying taxes at a higher rate. Others will likely sell off surplus property in order to avoid additional taxes.

JLL added that property owners who are forced to sell their land because of the new taxes are likely to adopt a flexible pricing strategy in order to speed up the sales process. This includes possibly reducing asking prices. On the other hand, owners backed by significant capital are unlikely to lower their price expectations, especially if the property is in a prime location.

Another benefit of the new land and buildings tax is that it should help curb speculative property purchasing. “The land and buildings tax will increase risk exposure to speculators who acquire a property asset with the hope to hold it until it becomes more valuable and then resell it for profit,” Suphin explained. “With the new tax, holding a property can be costly, particularly when the property is left unutilised or does not generate any income.”

It was also noted by JLL that there remains no clear answer as to whether the existing rental tax (12.5 percent of the annual rental value or the annual assessed rental value) will remain or be replaced by the new land and buildings tax. This could increase rental rates across the board.

“Whatever the case may be, landlords would be undoubtedly pass on any additional cost resulting from the new tax to tenants,” Suphin added. “This would eventually push up gross rents in all property sectors. Nonetheless, the amount of tax that owners would pass on to tenants may vary from sector to sector.”