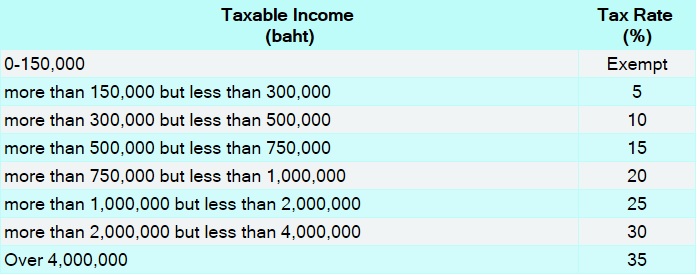

The first three months of every year is the tax return filing period among all income earners in Thailand, including Thai nationals and foreigners. According to the current tax rate in the table 1, each person is conformed to a specific rate regarding his/her income range. However, there are numerous ways to minimize this annual expense, mainly divided into Deductions and Allowances as follows:

Deductions

- Income from employment – 40% but not exceeding 60,000 Baht

- Income received from copy right – 40% but not exceeding 60,000 Baht

- Income from letting out of property on hire

- Building and wharves – 30%

- Agricultural land – 20%

- All other types of land – 15%

- Vehicles – 30%

- Any other type of property 10%

- Income from liberal professions – 30% for the medical profession where 60% is allowed

- Income derived from contract of work whereby the contractor provides essential materials besides tool – actual expense or 70%

- Income derived from business, commerce, agriculture, industry, transport, or any other activities not specified in 1 to 5 – actual expense or 65% – 85% depending on the type of income

Allowances

- Taxpayer self care allowance – 30,000 Baht

- Spouse care allowance – 30,000 Baht

- Child care allowance (age under 25) – 15,000 Baht for each child (limited to 3 children)

- Child education allowance (age under 25) – 2,000 Baht for each child (limited to 3 children)

- Parent care allowance (age over 60 with income below 30,000 Baht per year) – 30,000 Baht for each parent

- Disabled/incompetent persons care allowance – 60,000 Baht for each such person

- Health insurance for parents (age over 60 with income below 30,000 Baht per year) – Amount actually paid but not more than 15,000 Baht for each

- Life insurance – Amount actually paid but not more than 100,000 Baht for each

- Life insurance pension fund – 15% of assessable income, but not more than 200,000 Baht

- Provident fund – 15% of assessable income, but not more than 500,000 Baht

- RMF (Retirement mutual fund) – 15% of assessable income, but not more than 500,000 Baht

- NSF (National savings fund) – 15% of assessable income, but not more than 500,000 Baht

- LTF (Long term equity fund) – 15% of assessable income, but not more than 500,000 Baht

- SSF (Social security fund) – Amount actually paid

- Home loan interest – Amount actually paid, but not more than 100,000 Baht

- First home buyer during the period of 01 Jan 2016 to 31 Dec 2016 (below 3 million Baht) – 20% of the first home price, claimed in equal amounts over 5 consecutive tax year

- Domestic travel and hotel costs during 01 Jan 2016 to 31 Dec 2016 – Amount actually paid, but not more than 15,000 Baht

- Songkran dining and travel costs during the period of 09 to 17 April 2016 – Amount actually paid, but not more than 15,000 Baht

- OTOP products purchases during the period of 01 to 31 August 2016 – Amount actually paid, but not more than 15,000 Baht

- Year-end shopping during the period of 14 to 31 Dec 2016 – Amount actually paid, but not more than 15,000 Baht

All taxpayers must file the tax return and make a payment to The Revenue Department within the end of March for each tax year. You can also down load the tax return e-form at www.rd.go.th. For more information, please visit http://www.rd.go.th/publish/index_eng.html

Sources: http://www.rd.go.th/publish/6045.0.html

http://sherrings.com/personal-tax-deductions-allowances-thailand.html

Receive the latest property news on email from Thailand’s No.1 property website here, or read more project reviews