Residential property in Bangkok’s central business district (CBD) was fuelled by the launch of luxury condominium projects by Thailand’s Stock Exchange-listed developers during Q1 2015, according to the latest Bangkok Property Times research report from real estate firm DTZ.

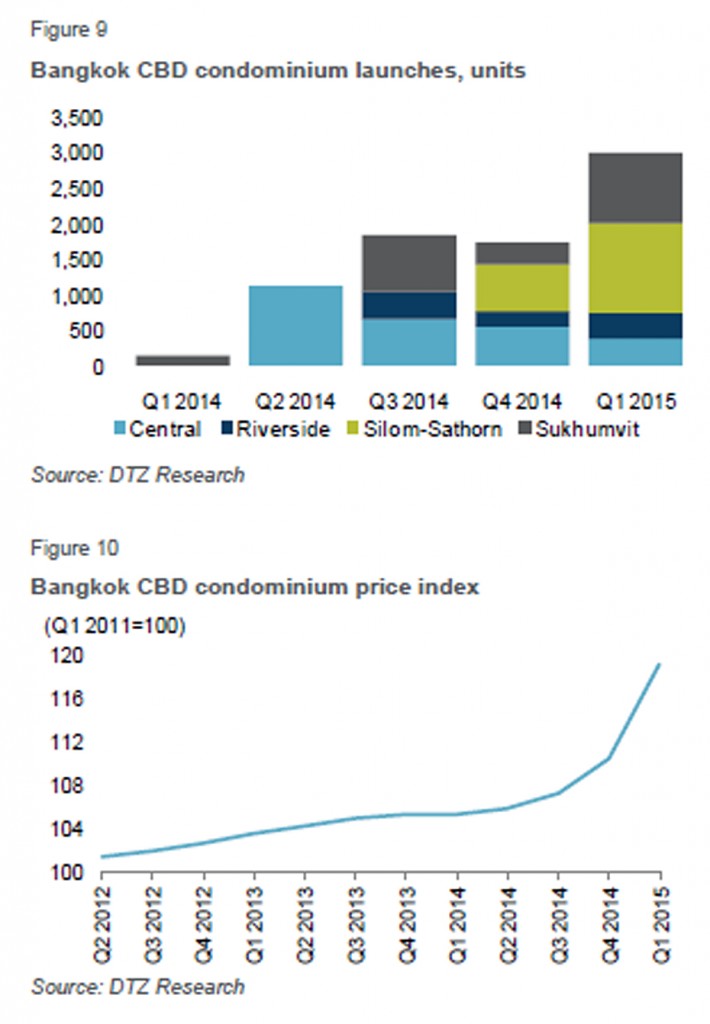

Nine condominium projects accounting for 2,291 units were launched in Q1 2015, a significant increase from the 1,733 units that made their debut in Q4 2014. Luxury condominium units accounted for 81 percent of the total new units launched in Q1 2015.

The majority (42.4 percent) of new condominium supply in the CBD was in the Silom-Sathorn area, followed by Sukhumvit (33 percent) and the Central area. (13 percent) (see figure 9 below)

Record breaking prices for luxury units

Luxury units in the Central area achieved record-breaking prices in Q1 2015 of THB320,000 per sqm. The average price increased by 60 percent q-o-q because of an influx of new super luxury condominiums, whereas there were no super luxury launches in Q4 2014.

The average price for luxury condominiums in all downtown locations is expected to continue to increase throughout 2015 as demand for high quality projects with superior specifications in prime settings continues to grow.

Similarly, capital values of condominiums in downtown areas are expected to increase further in the future, although generally at a slower pace in the medium- to long-term. This is mainly as a result of the increase in land values due to limited land supply, which in turn has pushed up the average unit selling price.

Newly launched high-end projects performed well

The newly launched high-end condominiums in downtown areas of Bangkok performed well in terms of number of sales. The average take up in Q1 2015 registered at approximately 80 percent.

Affluent Thai national buyers dominated the high-end market. Foreign buyers originating from Hong Kong and Singapore also showed strong interests in project launched in prime downtown areas, according to DTZ.

Medium and lower range condominium developments have not been as successful as the high-end projects. These sectors proved more challenging with slower growth in sales due to high household debts . Household debt is expected to continue to rise, and this will result in limited growth of consumer confidence in these markets.

Notwithstanding, it is anticipated that the condominium market will generally be resilient throughout 2015.

Condominium sector saw rise in resale value

Bangkok’s condominium sector experienced a significant increase in resale value in Q1 2015. Driven by increasing average selling prices of newly launched projects in prime areas, resale units with good specifications in well-maintained and managed buildings also became more attractive.

The average price of resale condominium units in CBD locations rose by 8 percent from Q4 2014, and was up by 13 percent year-on-year, to THB114,378 per sqm (see figure 10).

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg