Prospects for the condominium market in the Gulf of Thailand city of Pattaya are “not good” according to the latest research from real estate firm Knight Frank.

Risinee Sarikaputra, Director of Research and Consultancy for Knight Frank Thailand, explained the condominium market in the studied area has grown continuously since 2007, and 181 condominium projects with more than 63,000 units developed along the coastline of Pattaya City.

Jomtien remained the most popular choice of many developers due to its relatively long beachfront. The area also enjoys close proximity to Pattaya’s city centre, making it the next priority for potential development after Pattaya itself where beachfront land is becoming more limited.

The majority of condominium units in Pattaya were developed by non-branded developers, representing about 79 percent of the total. Many of the non-branded projects were developed by local developers owned by Thai and foreign entrepreneurs.

Global Top Group, Matrix Group and Riviera Pattaya Group are among the well-known developers that are owned or co-owned by foreigners. Noticeably, all condominiums developed by branded developers were high-rise buildings with the exception of The Trust Central Pattaya by Q House, which is a low-rise development.

Different buyer profiles discovered in different locations, and the main characteristics of the area are the key attractions for individual buyers.

The main buyers of condominium units are Russians and other Europeans who purchase condominiums for second vacation homes or as investment assets.

Wongamat and Pratumnak Hill, unlike Jomtien and Pattaya City, feature a more peaceful and private residential zone with many condominiums offering a beachfront and panoramic sea view of Pattaya Harbour.

Risinee added: “The main buyers of condos in the Pratumnak Hill area are continental Europeans, British and Americans, as well as Scandinavian travellers and retirees who usually buy homes for vacation or post-retirement permanent resident purposes.

“Wongamat is where many prestigious projects are located. It is known for being the most expensive residential area and is popular for wealthy Thais, Europeans, as well as Russians who bought a unit for their second home,” she said.

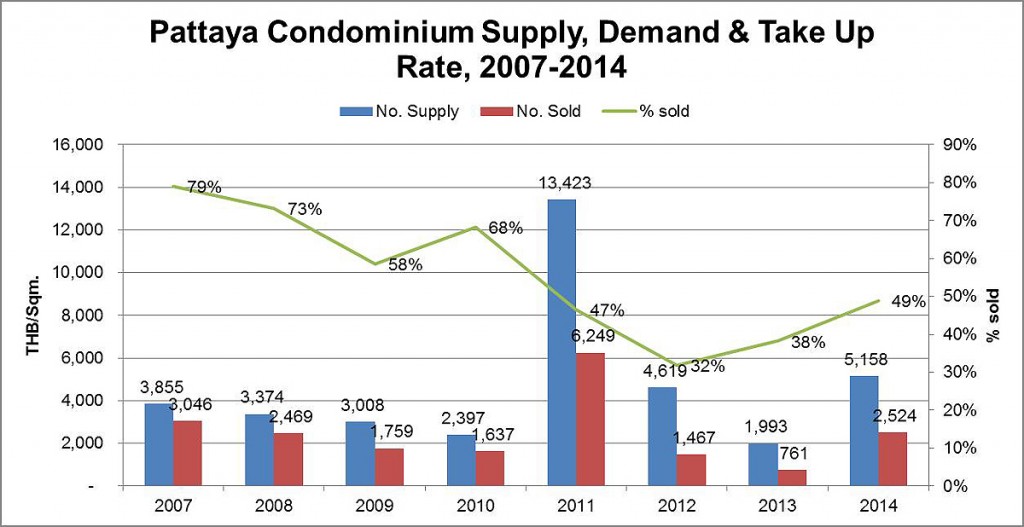

The average annual take-up unit for condominiums in Pattaya was approximately 2,200 units per year from 2007 through to 2010. While the average annual take-up rate increased from 2011 to 2014 to around 2,750 units, the overall take-up rate dropped dramatically due to a glut of condominium supply in the market after 2010.

The average number of condominium units flowing into the market from 2011 until 2014 was approximately 6,300 units per year, whilst there were only an average of 3,200 condominium units sold during the same time period.

The spot take-up rate of Pattaya’s condominium market, representing the selling rate, was constantly declining from 2007 until 2009. It bounced back a little in 2010. The take-up rate then dropped significantly in 2011, from 68 percent in 2010 to 47 percent in 2011. In 2012 it was only 32 percent.

The take-up rate is currently rebounding from the low of 2012 to 38 percent in 2013 and 49 percent in 2014. The average spot take-up rate from 2007 until 2014 was approximately 53 percent of the total supply during each year, according to Knight Frank

Source: Knight Frank Chartered (Thailand) Research and Consulting Department

Source: Knight Frank Chartered (Thailand) Research and Consulting Department

Remark: The historical demand and absorption rate data does not account for every project included in the overall supply data basket due to some limitations with the availability of historical data in the data set. The basket of data set used to create the chart includes only the projects that consist of the past data. Although the information does not necessary cover the specified areas completely, it is sufficient to represent each of the specified area as a sample.

During 2014 the average selling price of a sea view condominium was THB114,025 per sqm, with a CAGR of 4.7 percent. In 2007 it was just THB82,629 per sqm.

According to Knight Frank’s research, the average selling price of sea view condominiums was 71 percent higher than the average selling price of non-sea view condominiums last year. This was partly due to the scarcity of beach front land with close proximity to Pattaya’s city centre.

Moreover, significantly better views obtained by sea view condominiums add significant value to the unit, as the majority of the market is based on foreigners and retirees who buy condominiums for vacation and holiday purposes.

The unit selling price of studios in the study area was in the range of THB0.73 million to THB12.71 million, whereas one-bedroom units were in the range of THB 0.79 million to THB30.8 million, two-bedrooms were from THB1.39 million to THB54.6 million, and three-bedrooms and over were priced from THB4.69 million to THB129.9 million.

Risinee added, “It is to be noted that the minimum unit price of condominiums in Wongamat is the highest among every unit type.”

In conclusion and with words of caution, Knight Frank noted the prospects for Pattaya’s condominium market are not good due to the major buyers are Russian.

With the Russian rouble currency devaluation, this will limit the activity of Russian buyers in the market. Units signed-for by Russians but not transferred will be returned to the market since the transferred amount will be higher and there will be many Russians who cannot afford to

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg