The number of serviced apartments in Bangkok has continued to decline in recent years, with many owners focusing their attentions on daily rentals to achieve higher income.

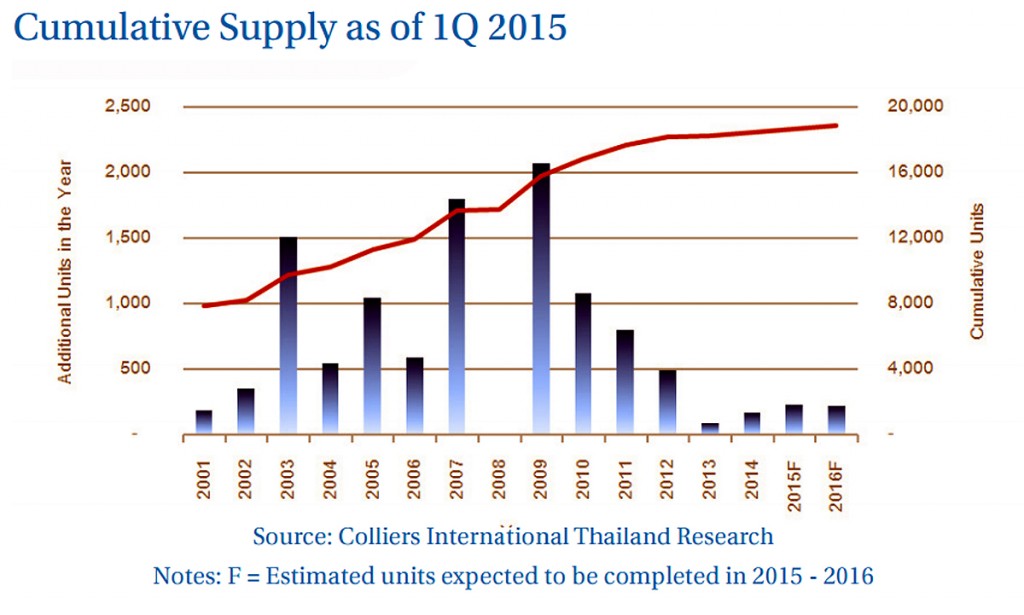

High land prices in the Thai capital means that conditions are not ideal for developing serviced apartments, and between now and the end of 2016 just 240 units are expected to be completed, according to the latest research on the sector from Colliers International Thailand.

Just 210 serviced apartment units were completed during the first quarter of 2015, according to Colliers, underlining the decline in supply with started more than five years ago.

There were approximately 18,640 total serviced apartments in Bangkok as of Q1 2015, Colliers revealed.

Serviced apartments are intensely competitive with condominiums and luxury apartments during the past few years, and many foreigners and expatriates have moved from serviced apartments to condominiums due to lower rents and similar facilities. Therefore, not many new serviced apartments were added to the market in the past few years – or will be in the future according to the real estate firm.

More than 50 percent of the total serviced apartments, or approximately 9,790 units, are located in the area along Sukhumvit Road due to its convenient transport links and the many supporting facilities.

The main target group of serviced apartments in Bangkok is expatriates who work in Bangkok. Approximately 78,820 applied for work permits in Bangkok as of Q1 2015, and the total number of expats in Bangkok has continuously increased over the past few years.

Occupancy rates in all locations have steadily increased, and most are higher than 80 percent.

Colliers said that it expects that the average occupancy rate of serviced apartments in Bangkok during 2015 may be similar to Q1 2015.

It also noted that most serviced apartment projects that are under construction in Bangkok are developed by small developers and not related to international or local brands. This is due to lower profits n offer compared with other sectors.

In its forecast for the sector, Colliers said land prices and many competing condominium units in Bangkok are the major factors affecting serviced apartment development, due to lower profits and extreme competitiveness. Average rents and occupancy rates in 2015 will continue to increase, however the increase may be only a few percentage points as most clients for serviced apartment projects are on long contracts.

To read the full Colliers Q1 Bangkok Serviced Apartment research report see here.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg