Thailand’s industry property market remained weak during the first three months of 2015, according to the latest research from CBRE.

“We had been hoping for a better year,” the real estate firm noted, “… with improved land sales on industrial estates and a reduction in vacancy rates for Ready Built Factories (RBFs) and Modern Logistics Properties (MLPs).

“Decisions were postponed last year by delays in getting Board of Investment (BOI) approvals as well as depressed local demand for cars and generally weak global demand for manufactured goods,” it noted.

The report noted that there have been some signs of improvement but no significant recovery in demand for industrial land and properties.

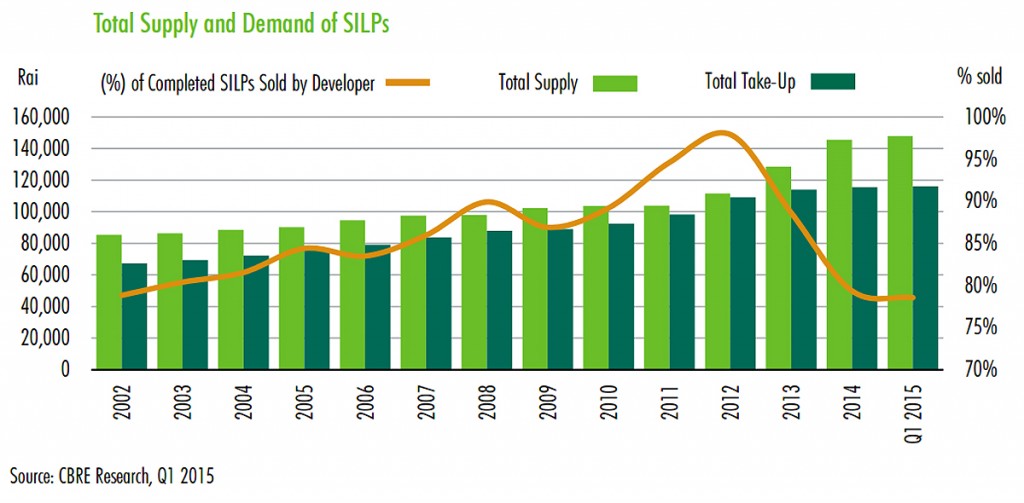

A total of 650 rai of serviced industrial land plots was sold in the estates and parks that CBRE surveyed in Q1 2015, 15 percent down quarter-on-quarter (Q-o-Q) but an increase of more than 300 percent year-on-year (Y-o-Y).

As of Q1 2015, the vacancy rate of Ready Built Factories (RBFs) in the CBRE survey basket was 36 percent, increasing 12 percentage points compared to Q1 2014. Total occupied space of RBFs in this quarter decreased by 3,000 sqm.

Discussions with developers show that rents for RBFs remained unchanged from Q4 2014 despite high vacancy rates. The vacancy rate for Modern Logistic Properties (MLPs) in CBRE’s survey basket stood at 25 percent during Q1 2015, the same compared with Q1 2014.

Industrial land prices and rental rates for RBFs remained the same as previous quarter however, rental rates for MLPs fell slightly from the previous quarter.

The increased vacancy rates for both RBFs and MLPs was a result of an increase in supply without a corresponding increase in demand, and developers are delaying or cutting back expansion plans and focusing on filling existing properties.

There was a 28 percent drop in the value of approved BOI investments Q-o-Q. The highest investment value was in the services and infrastructure sector at THB61 billion, followed by the electrical and electronics sector with an investment value of THB56 billion.

The Automotive sector, considered one of the key drivers of the Thai industrial property market, has not yet made a significant comeback. When comparing Q1 2015 to the low base performance in Q1 2014, production and exports showed increases of 1.4 percent and 12.6 percent respectively. However, domestic sales continued to fall by 11.8 percent Y-o-Y.

The government also announced a Special Economic Zone (SEZ) policy to help stimulate and expand cross-border trade with neighbour countries. SEZs have been announced for six border provinces. The government will offer investment privileges mostly to SMEs in term of tax reductions.

CBRE expects total industrial property demand this year to be better than 2014, but growth will be reliant on non-automotive sectors.

To read the full CBRE Industrial Market Research Report for Q1 2015 read here.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg