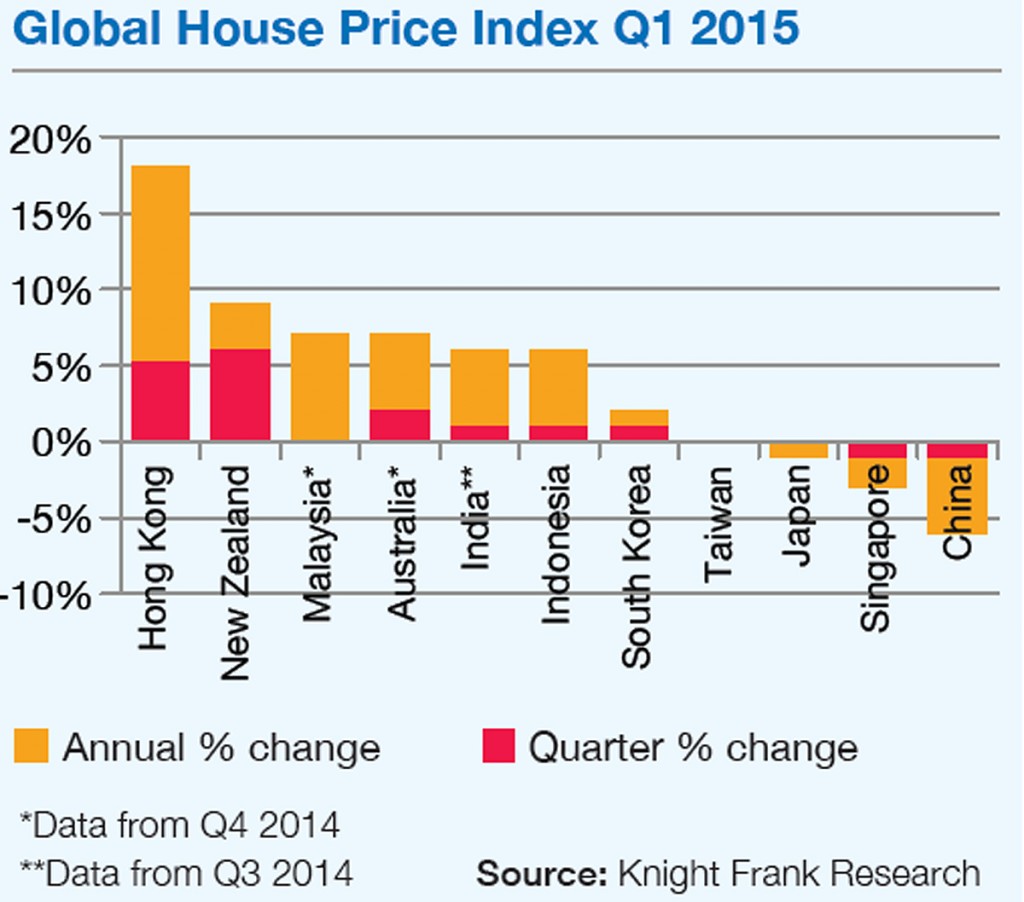

Real estate firm Knight Frank Asia-Pacific has launched the Asia-Pacific Residential Review for June 2015 that tracks the price movement of 11 major markets in Asia-Pacific. The first three months of 2015 saw house prices increase across six of these markets.

Nicholas Holt, Head of Research for Asia Pacific, said, “Despite facing many headwinds, the IMF is forecasting stronger growth in 2015 for six out of the 11 major countries we track. While this should be a positive sign for homeowners or investors, the reality is that in many cases there has been a divergence between short-term economic growth and market performance.

“Perhaps now more than ever, property market observers are looking to policy makers for clues about how markets will perform. Monetary policy, tax, regulations and underlying fundamental drivers such as growth demographics and urbanisation will have a significant impact on markets.”

Here are 10 things that will influence Asia-Pacific residential markets, and that property investors should monitor, according to Knight Frank.

Direct policy

Macro-trend: Easing of cooling measures

Countries impacted: China, Hong Kong, New Zealand, Singapore, Vietnam

The Singapore government could possibly start to review the cooling measures, specifically the Additional Buyer’s Stamp Duties (ABSD), as interest rates rise.

Macro-trend: Monetary easing

Countries impacted: Australia, China, India, Indonesia, Japan, New Zealand, South Korea, Thailand

China saw two interest rate cuts to-date in 2015.

Macro-trend: Tax

Countries impacted: Indonesia, Japan, Taiwan

The recent introduction of a revised super luxury tax and the potential extension of the luxury tax in Indonesia have already started to impact market behaviour.

Macro-trend: United States interest rates

Countries impacted: Hong Kong, Singapore, India, Indonesia, Malaysia, Thailand

The impending normalisation of global interest rates is likely to impact the markets with pegged exchange rates to the USD – ie. SGD, HKD. Some emerging Asian economies could also be vulnerable to capital outflows.

Policy related in some markets

Macro-trend: Household debt

Countries impacted: Australia, Singapore, South Korea, Malaysia, Taiwan, Thailand

Upward trend in consumer debt is a common characteristic of most Asia-Pacific markets, notably Malaysia.

Macro-trend: Land supply

Countries impacted: Hong Kong, Thailand (central Bangkok), India (Mumbai), Sydney, Beijing

The supply of land for development in Hong Kong has been one of the biggest bottle necks in one of the world’s costliest real estate markets.

Less directly policy related

Macro-trend: Birth rate

Countries impacted: China, Hong Kong, Japan, Singapore, South Korea, Taiwan

Japan population has shrunk since 2008 with little inward migration – demographics will continue to have an impact on both the economy and housing markets.

Macro-trend: Political uncertainty

Countries impacted: Singapore, South Korea, Taiwan, Thailand

Markets with upcoming elections tend to have a period of uncertainty until the new government has been set up. Political instability in Thailand undoubtedly impacted the attractiveness of Bangkok.

Macro-trend: Sentiment

Countries impacted: All markets

The waning optimism following Narendra Modi’s election victory in India.

Macro-trend: Urbanisation

Countries impacted: All markets

Continued population pressure, especially on Sydney and Melbourne – with nearly 90% of its population living in cities – is underpinning strong house price growth.

Knight Frank, in its research, noted the above groupings are very general to cover the entire region and mask differences between markets. The nature and structure of each country’s market varies significantly, and therefore reflects how influential policy makers can be in relation to housing markets.

For example, China is much more policy driven, hence both birth rate (one-child policy) and policy makers heavily influence urbanisation (such as the Hukou household registration system). This is not the case in most other markets.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg