Investing other people’s money must seem like a dream job, but there are significant risks and responsibilities involved. Get it right and you are a hero but get it wrong and someone’s life-long savings could disappear overnight.

For serious property investors it often pays to look at where these institutional investors are putting their cash. While the goals for these fund managers and individual property investors are quite different, you can gain some useful information regarding trends when you look at where millions of baht are being moved on a monthly basis. A snapshot of one month is good but a trend of movements into or away from specific companies is much more valuable to an investor.

Let us start by looking at the Franklin Templeton Investments Templeton Thailand Fund, with a value of US$182 million and close to a 20-year record. Although property companies have featured previously in their public list of top ten share holdings, Land and Houses was, at the end of May 2015, the largest property stock holding, and the largest overall, in the fund at 8.88 percent at that time. That was up slightly on the previous month.

Managed by emerging markets guru Dr. Mark Mobius the find aims to achieve long-term capital appreciation by investing primarily in equity securities of companies with their main business in the Kingdom.

Land and Houses was the only pure property developer to appear in the public list of 10 companies held by the fund at the end of April, with Kasikornbank and Siam Commercial Bank the second and third largest holdings.

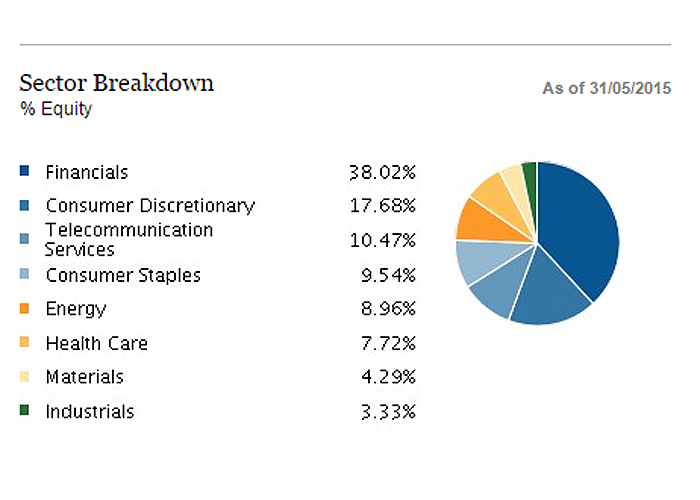

In contrast the Aberdeen Thai Equity Dividend Fund, valued at the end of May 2015 at THB529 million and established since 2003, had no property companies listed within its top ten publically listed portfolio holdings. Instead, the focus of this find was on Siam Cement, Bangkok Insurance and PT Exploration and production as its top three equity holdings.

Finally, the Allianz Thailand Equity Fund that looks for capital growth over the long-term, and at the end of April had US$220 million invested in Thailand companies, had 7.13 percent of its portfolio in Minor International and 6.6 percent in Amata Corporation – the only two remotely property-related companies in its public top 10 list of holdings.

All of this fund portfolio information is available to members of the public, but use it with caution where investment decisions are made. Consider it part of your due diligence for your next property investment.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg