According to research from Knight Frank Thailand, there are some positive signs for Thailand’s industrial real estate market and the consultancy is expecting to see a slow recovery in industrial land sales and demand in factory space despite the country’s sluggish economy. Thailand remains a prime destination for foreign investors due in part to its solid infrastructure and links to Cambodia, Laos, Myanmar and Malaysia.

There are some risks Knight Frank Thailand believes investors need to take into a consideration including political instability which had a huge impact on the market during 2014. However, sentiment in the country is still positive with the BOI’s new incentives expected to yield encouraging results, as the government aims to facilitate industrial growth even further.

“We expect to see continued growth in 2016 specifically from new investment in the electronics, auto parts, food and renewable energy sectors, and while Japanese investment remains subdued, we are starting to see increased activity from European and increasingly, Chinese firms,” Marcus Burtenshaw, executive director and head of commercial agency, Knight Frank Thailand, noted.

Thee total supply of Serviced Industrial Land Plots (SILPs) increased 2.7 percent y-o-y and during the past five years this figure has risen two to eight percent annually. This number includes both new industrial estates and the expansion of existing ones. Knight Frank Thailand reported that industrial land sales increased more than 55 percent in 2015 as the market recovered from 2014 when sales drop sharply due to political unrest.

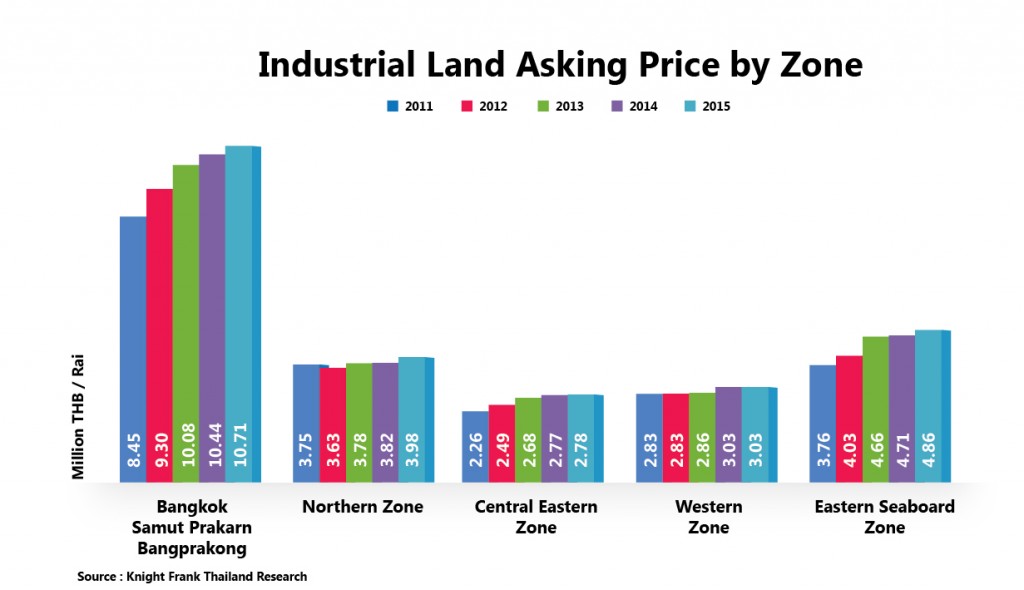

Industrial estates in Bangkok – Samut Prakarn – Bangprakong recorded the highest average selling price last year followed by those in the Eastern Seaboard Zone which includes Chonburi, Si Racha and Rayong. The total supply of ready-built factories also increased by 6.4 percent y-o-y with Chonburi having the largest share of these. The occupancy rate for this segment came in at 73 percent, which decreased slightly from 2014.