Novice investors who look for capital gains through real estate investment should keep in mind that, besides a large amount of savings, other factors such as property type, facilities, safety, and most importantly “Location” are also needed to achieve considerable rental profits.

Locations with highest property growth

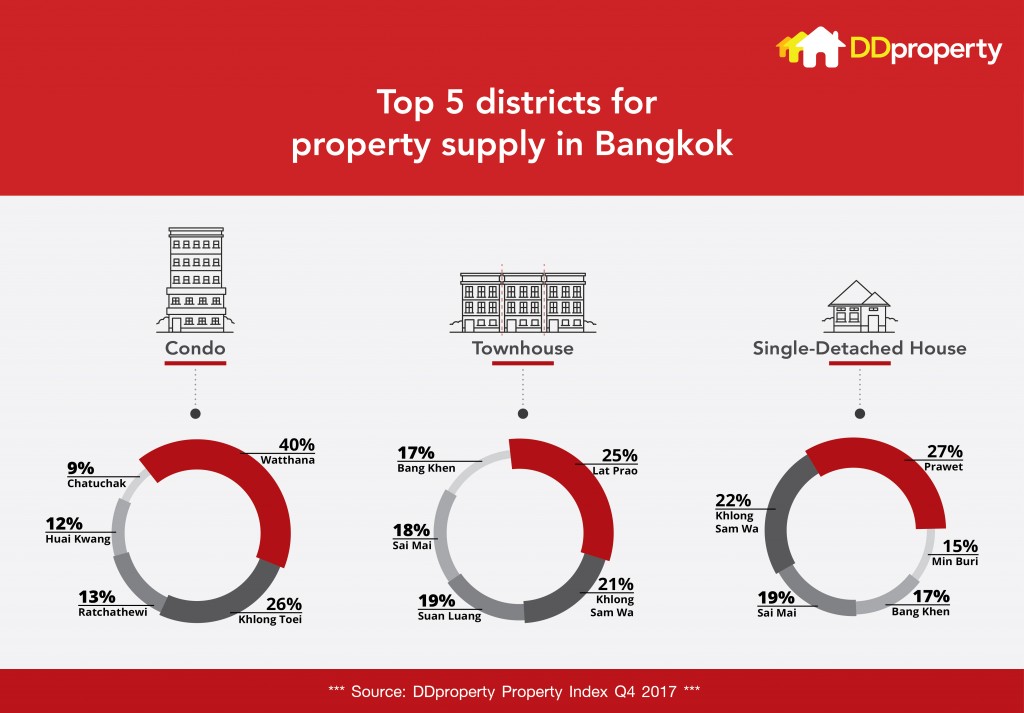

Prosperity – in terms of infrastructure, employment, or education – is the key factor triggering property seekers to inhabit in such locations, supplied by developers whose interests also lie in promising areas. Bangkok, the bustling capital city, is where developers compete relentlessly for a plot of vacant land, or an old building which can be refurbished into a brand-new residence, to build a condominium project or a housing estate depending on the location’s setting. According to DDproperty Property Index, Bangkok property market has been analysed and summarized as follows:

1. Watthana District remains the most sought-after location for condominium development

2. Lat Phrao District is found to have the most townhouse projects

3. Khlong Sam Wa District consists a large number of single-house housing estates

2. Lat Phrao District is found to have the most townhouse projects

3. Khlong Sam Wa District consists a large number of single-house housing estates

Though these three districts are among developers favourite locations to launch new project, which in rental market means a higher number of interested property seekers, be concerned that you have to compete with a great number of investors as well.

Revealed golden locations with high rental returns

After knowing top locations for condominium, townhouse, and single house supplies, investors need to observe the price growth of each property type which correlates to rent price. Statistically, condominium is found to have the highest price-per-square-metre growth, compared to townhouse and single house. And the two following locations reveal the highest price growth for property in the past few years.

After knowing top locations for condominium, townhouse, and single house supplies, investors need to observe the price growth of each property type which correlates to rent price. Statistically, condominium is found to have the highest price-per-square-metre growth, compared to townhouse and single house. And the two following locations reveal the highest price growth for property in the past few years.

1. Chatuchak District – 5% growth in residential property price compared to period at the end of 2016. Condominium prices on this location range from 120,000 – 180,000 baht per square metre. One-bedroom units have the highest rental demand and can fetch 520 baht per square metre monthly.

2. Bang Na District – 3% price growth in property, surpassed that of Phra Khanong District. The average condominium price on this area is 85,000 baht per square metre, with the average rent price rounded at 475 baht per square metre monthly. Bang Na Zone has seen mounting developments in recent years; being eyed by developers and investors, this maturing territory is a gateway to Eastern Economic Corridor (EEC) and found to have property growth at 75% within the past three years, according to DDproperty Property Index.

Techniques to quickly earn rental profits from houses and condominiums

As we have understood that “Location” helps contribute our long-term profits, next, we need to consider some technical aspects which strengthen our profitability in real estate rental market.

As we have understood that “Location” helps contribute our long-term profits, next, we need to consider some technical aspects which strengthen our profitability in real estate rental market.

1. Choose houses or a condos promising for increased value in the future. This can be a condominium near a mass transit line or major department stores, or in the form of mixed-use development where residence, office space, and retails merge in one project.

2. The property needs to look new and clean especially secondhand properties purchased for rents. Old buildings decay through time and it’s your job to check the electrical wiring, bathroom sanitary, or even the wallpaper condition – in order to fetch a satisfactory rent price. A little affordable decoration could be added to achieve increased profits.

3. Choose the property size concerning the needs of your prospective tenants. Thai citizens often look for a Studio or one-bedroom, while foreign expats normally prefer a two-bedroom, or in some case a single house, to accommodate their migrated family.

“Investment” is always risk-bound, but with thorough consideration on important aspects and some techniques adding values to the investment, the profits can be achieved without much difficulty.

Read more insights about Bangkok property market, check out DDproperty Property Index Report and DDproperty Property Market Outlook Report .

Receive the latest property news on email from Thailand’s No.1 property website here, or read more project reviews

Disclaimer: The information is provided for general information only. DDproperty by PropertyGuru c/o AllProperty Media Co., Ltd. makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.