Gross residential yields for individual condominium investments in Bangkok remained stable during Q1 2015, according to the latest research from CBRE released late last week.

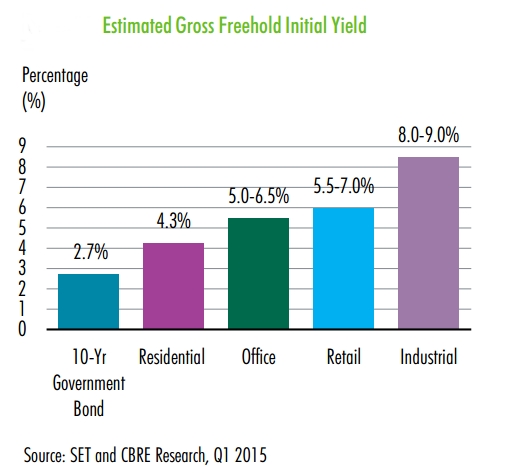

In its Marketview Report covering the first three months of this year, the real estate firm noted the Bank of Thailand cut its policy rate to 1.75 percent – down from 2 percent – during Q1. The 10-year government bond yield dropped by 15 basis points quarter-on-quarter to 2.72 percent during the same period.

CBRE reported that yields for publically listed property funds and REITs (Real Estate Investment Trusts) increased by 15 basis points quarter-on-quarter to 5.70% in the first three months of the year.

It also noted how the lack of transactions makes analysis of yields difficult. Its yield information and estimates and based on its market knowledge, it said.

Most yields for property investments remained quite stable in the first quarter of Q1, is said. Average gross residential property yields for individual condominium investments remained at 4.3 percent at the end of March 2015, CBRE reported.

“We based residential yields each quarter on the leasing transactions completed by our own leasing team during the previous three months, so yields can vary from quarter to quarter where transactions have been concluded,” it reported.

CBRE believes that developers are still searching for additional land plots, especially in the heart of Bangkok’s central business district, however it noted there have been no public announcements of any significant transactions to date.

This, it said, was because there is more demand than supply.