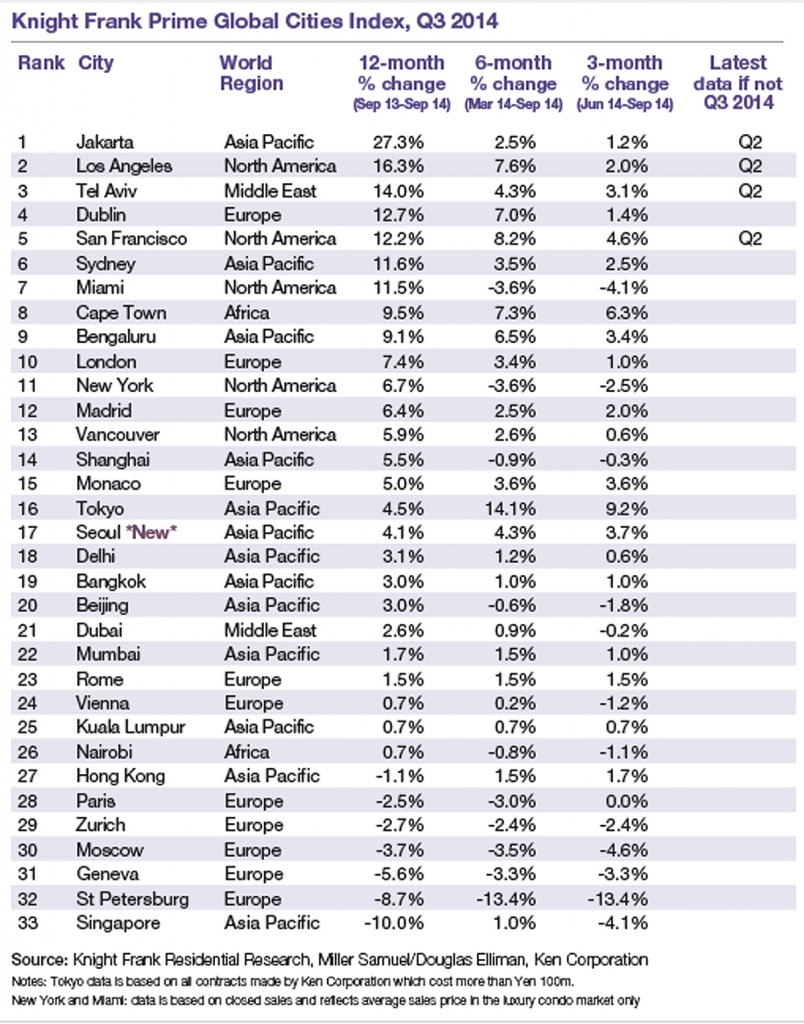

Prime property prices in Bangkok rise by 3 percent in the 12-months ending September 2014, and recorded a 1 percent month-on-month increase between Q2 and Q3, according to research published today by Knight Frank.

Prices for prime residential property in the world’s leading city markets rose by only 0.2 percent in the three months to the end of September, and by 4 percent over a 12-month period.

According to Knight Frank in its Prime Global Cities residential research for Q3 2014, this moderate level of price growth is partly attributable to the fact that the third quarter, for much of the world, is dominated by the summer holiday season which often sees slower sales activity reducing the pressure on prices.

Key events on the political and economic stage are also likely to have been contributory factors; the prospect of tightening monetary policy in the U.S., the approaching General Election in the U.K. (including ongoing discussions of a Mansion Tax), the persistence of cooling measures in key Asian cities and perhaps most pivotal, a new set of negative economic indicators emanating from Europe.

Despite the prime index’s muted performance in the third quarter, luxury prices continue to outperform their mainstream counterparts. The average price of a luxury home on the index is 36 percent higher than at the index’s lowest point in the second quarter of 2009, whilst the average price of a mainstream property has risen by 14 percent over the same period.

Although Jakarta tops the rankings, with prices rising 27 percent in the year to June , the city has seen a sharp deceleration in prices with prices rising by only 2.5 percent in the first half of the year.

In Dubai, the rate of luxury price growth has declined. This is in part due to temporary factors such as Ramadan which led to weaker buyer activity but also due to the UAE Central Bank’s mortgage cap which is stricter for those purchasing properties above AED 5 million.

Analysing the data on a quarterly basis, Tokyo and Cape Town were the strongest performers with prices ending the three month period 9.2 percent and 6.3 percent higher respectively.

The Knight Frank Prime Global Cities Index enables investors and developers to monitor and compare the performance of prime residential prices across key global cities. Prime property corresponds to the top 5 percent of the wider housing market in each city. The index is compiled on a quarterly basis using data from Knight Frank’s network of global offices and research teams.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.