Limited supply and increasing demand in pushing Bangkok office vacancy rates down, according to JLL in its Asia Pacific Property Digest Q3 research report.

According to the real estate company, net absorption totalled 7,900 sqm in 3Q 14 as business sentiment continues to improve with a relatively stable and calm environment following the May 22 military coup.

Leasing demand remained active and consisted mostly of lease renewals in existing prime grade office buildings. All large renewals were in Central East, with the largest being Lazada renewal of its lease at One Pacific Place Building.

As a result of leasing demand and no new supply in the quarter, the overall vacancy rate declined slightly from 8.2 percent in 2Q 14 to 7.8 percent in 3Q14.

In Central Bangkok vacancy decreased to 9.1 percent, while in Central East it increased to 4.3 percent.

Grade ‘A’ office stock remained unchanged in 3Q 14 at 1,738,000 sqm with no new supply in the Central Bangkok and Central East submarkets.

Bhiraj Tower (47,442 sqm), which was previously expected to complete in 4Q 2014 has been delayed until 1Q 2015. The mixed-used building is located near Phrom Pong BTS station in Central East.

The mixed-used Magnolia Ratchadamri Boulevard on Ratchadamri Road, which comprises 6,000 sqm of office space as well as luxury residences and the Waldorf- Astoria Hotel is scheduled for completion in 1Q 2015.

AIA Sathorn Tower (38,500 sqm) on Sathorn Road is expected to come online in 2Q 2015 and the Noble Ploenchit development, which comprises 3,000 sqm of office space and high-quality residences, is under construction with completion expected in 1Q 2017.

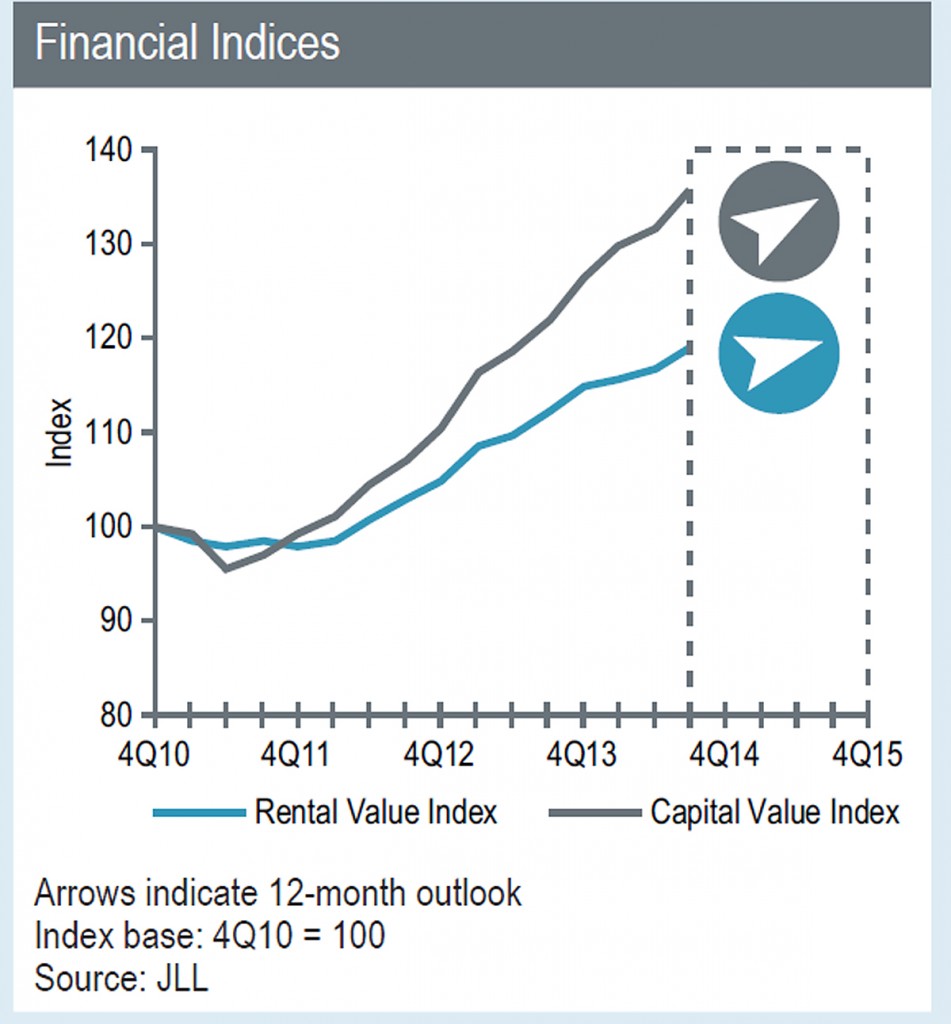

Average gross rents increased 1.9 percent quarter-on-quarter to THB746 per sqm per month in the three months ending September 2014.

Capital values increased at a higher rate than average gross rents, up 3.1 percent q-o-q to THB98,069 per sqm in 3Q 2014, while market yields compressed by 10 basis points to 7 percent, said JLL.

One freehold office building sales transaction was completed at end-June 2014 when Major Development sold Equinox Office Tower to WHA Plc for THB2.05 billion. The building name was changed to SJ Infinite 1.

In its 12-month outlook, JLL noted The Bank of Thailand maintained its policy rate at 2 percent in September in order to stimulate the economy, which is expected to improve by end-2014.

With an improvement in the political climate and economic direction, a continued recovery in investment and business sentiment is expected to lead to GDP growth of 4.5 percent in 2015. These positive fundamentals should support a continued growth of the Bangkok office market.

Vacancy is expected to fall gradually through end-2014 as new supply has been delayed into 2015, and should support a rise in rents. While new projects such as Bhiraj Tower and AIA Sathorn have some pre-commitments, JLL does not expect them to be fully let upon completion, likely causing an uptick in the vacancy rate in early 2015.

Image: Bangkok skyline by Diliff. Reproduced under WikiCommons license.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.