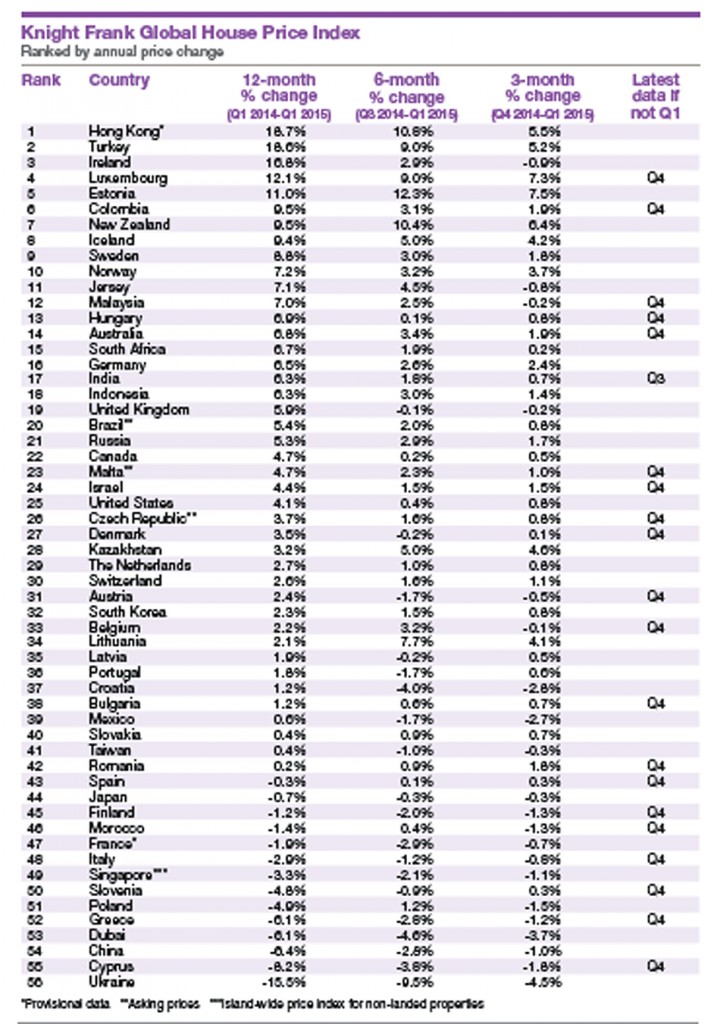

Global mainstream residential house prices increased by just 0.3 percent in the 12 months ending March 2015, according to the newly released Knight Frank Global House Price Index.

Despite cooling measures, Hong Kong leads the rankings (up 19 percent year-on-year), due to tight supply pushing up mainstream prices.

The weakest-performing world region is now Russia & CIS with prices down 2.3 percent on average year-on-year. Seven of the top ten countries ranked by annual house price growth are now in Europe

Ukraine, Cyprus and China occupy the bottom rankings for annual price growth, falling 15.5 percent, 8.2 percent and 6.4 percent respectively.

Kate Everett-Allen, Head of International Residential Research for Knight Frank, said: “Around 75 percent of countries tracked by the index recorded flat or positive annual price growth in Q1 2015; three years earlier this figure was closer to 47 percent.”

Th is was the weakest performance of the Global House Price index for three years. Weighted by a country’s GDP, the index ensures countries such as China and the U.S. have a greater influence than much smaller economies such as Jersey and Malta.

With some of the larger economies such as Japan, France and crucially China all experiencing housing market slowdowns, this is masking the fact that overall we are seeing more sustainable growth amongst a larger number of countries, according to Knight Frank.

The Knight Frank Global House Price Index, established in 2006, allows investors and developers to monitor and compare the performance of mainstream residential markets across the world.

The Index is published on a quarterly basis using official government statistics or central bank data where available. The index’s overall performance is weighted by GDP, and the latest quarter’s data is provisional pending the release of all the countries’ results.

Bangkok is not included in the survey due to the lack of verifiable and independent data.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg