DDproperty, a leading online property portal as part of PropertyGuru, the leading real estate group in Asia reveals that 47 per cent of consumers felt that the government is not putting enough effort to make housing affordable and to stimulate the real estate industry in 2016 compared to 24 per cent which was a 23 per cent increase from the same period in the previous year.

The online sentiment survey, which posed questions to 661 consumers who were considering buying or have bought properties between October 1-31, 2016, also showed that about 36 per cent of property seekers or buyers said that the price is the biggest obstacle for their property purchase with interest rates and the banks’ restriction on loan approvals also a concern. Meanwhile, 52 per cent of those surveyed felt that property in Thailand is overpriced. (Figure 1: Top 5 Perceptions on Thailand Real Estate Climate)

Reasons for the price hike were the reassessment of land price for the period between 2016-2019 and industry’s stiff competition which has resulted in developers looking for modern materials and technologies, such as automated parking or collaboration with globally renowned architects, to help improve the appeal of their projects despite the price of construction materials remaining similar as in years past.

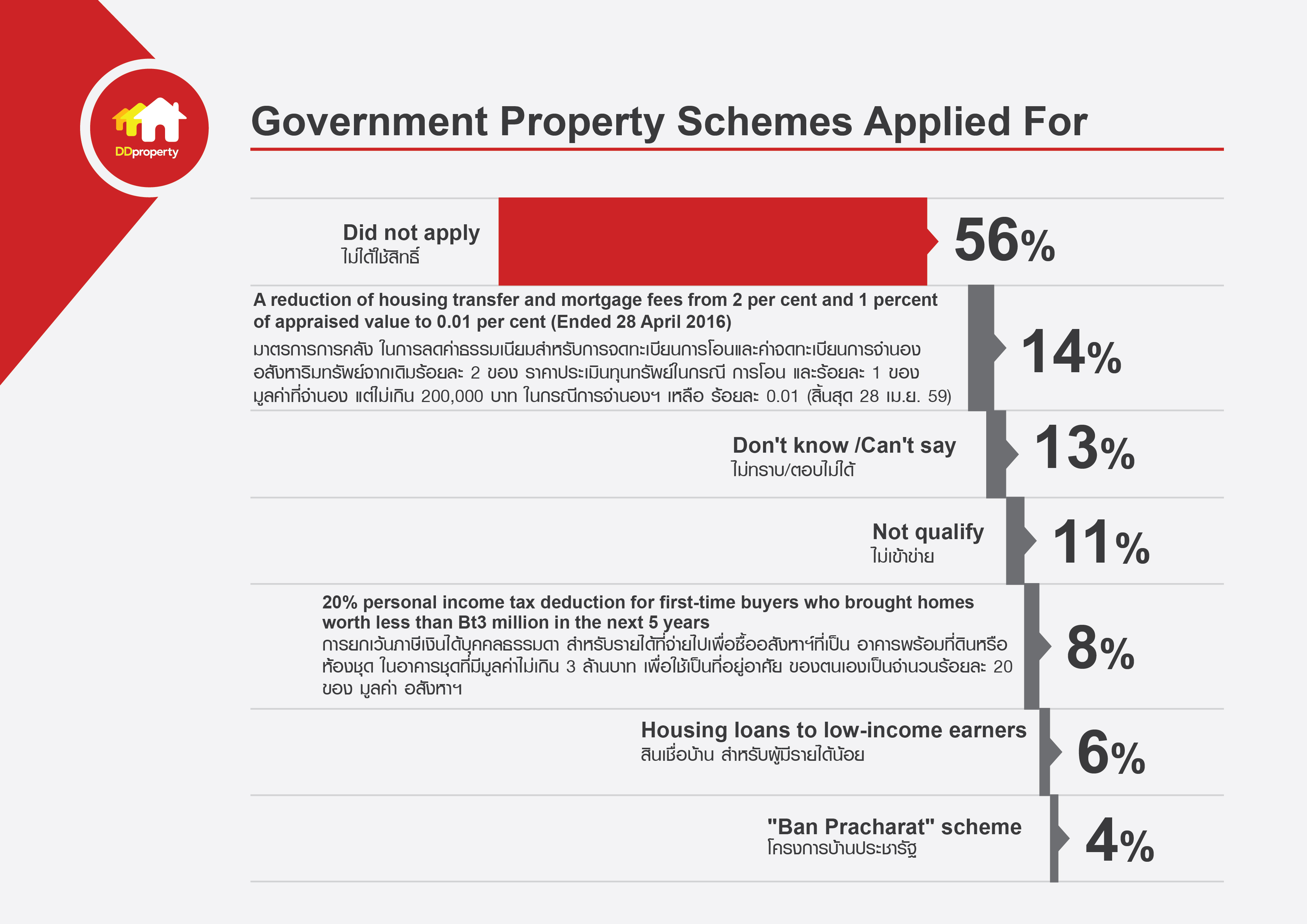

Surprisingly, one out of two or 56 per cent of those surveyed said that the government’s efforts to stimulate and boost the real estate industry did not apply to them, while 11% said they did not qualify for the perks. Only 14% responded to the reduction of housing transfer and mortgage fee from 2% and 1% of appraised value to 0.01% (ended on April 28, 2016) for properties under 200,000 baht, while 8% responded to the 20% personal income tax deduction for first-time buyers who bought homes worth less than 3 million baht for residential purpose. About 6% responded to the housing loans to low-income earners, and 4% responded to the Baan Pracharat scheme (Figure 2: Government Property Schemes Applied For).

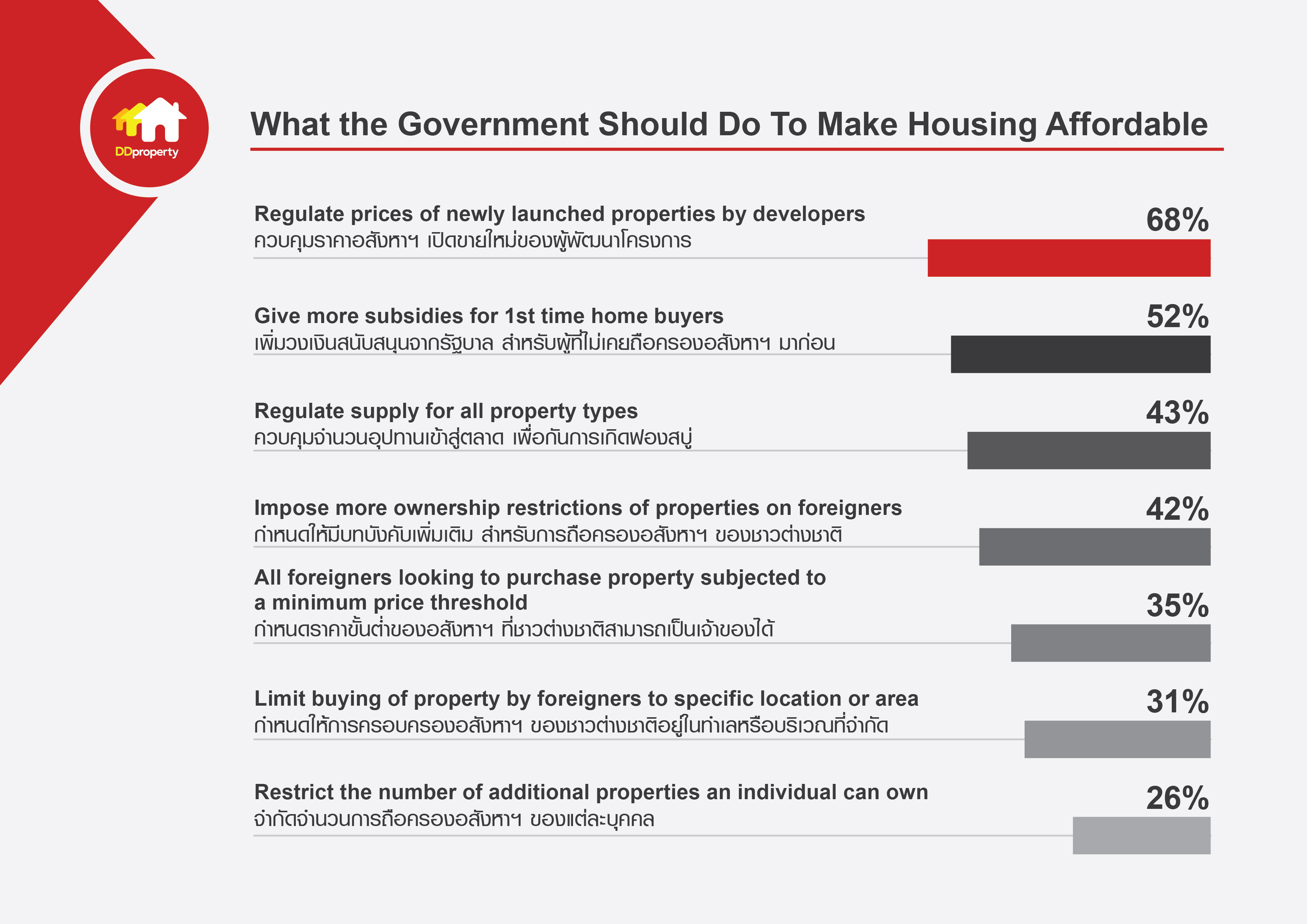

Meanwhile, 68% of those surveyed felt that the government should regulate prices of newly launched projects by developers and give more subsidies to first-time buyers (Figure 3: What the Government Should Do To Make Housing Affordable).

“The domestic and international economy is also another important factor that empowers consumers’ spending, in addition to the government’s real estate policy. However, many organizations are keeping an eye on their spending, because buying an expensive property requires long-term planning. DDProperty focuses on providing useful information for buyers, such as new projects review and tips, to ensure that the consumers can make an informed choice. We always introduce new technology to support the changing needs of the consumers,” said Mrs. Kamolpat Swaengkit, Thailand Country Manager.

Receive free latest property news on email from Thailand’s No.1 property website here, or read more project reviews