[Special Scoop] Condominiums in the city area have been in-demand for both residential usage and investment with those located close to public transit lines being the most popular. However, during the next 10 years, condos in the peripheral areas of Bangkok could potentially become popular as well since the public transit network will soon extend to the city’s outskirts with as many 10 lines to be completed.

How much property demand each area can create depends on the popularity of that region’s mass transit line. While the type of properties allowed for each area will need to conform to the government’s city plan restrictions. However, it is likely that both these rules and the government will change during this period, which means the most popular type of development launched during the coming years could also change.

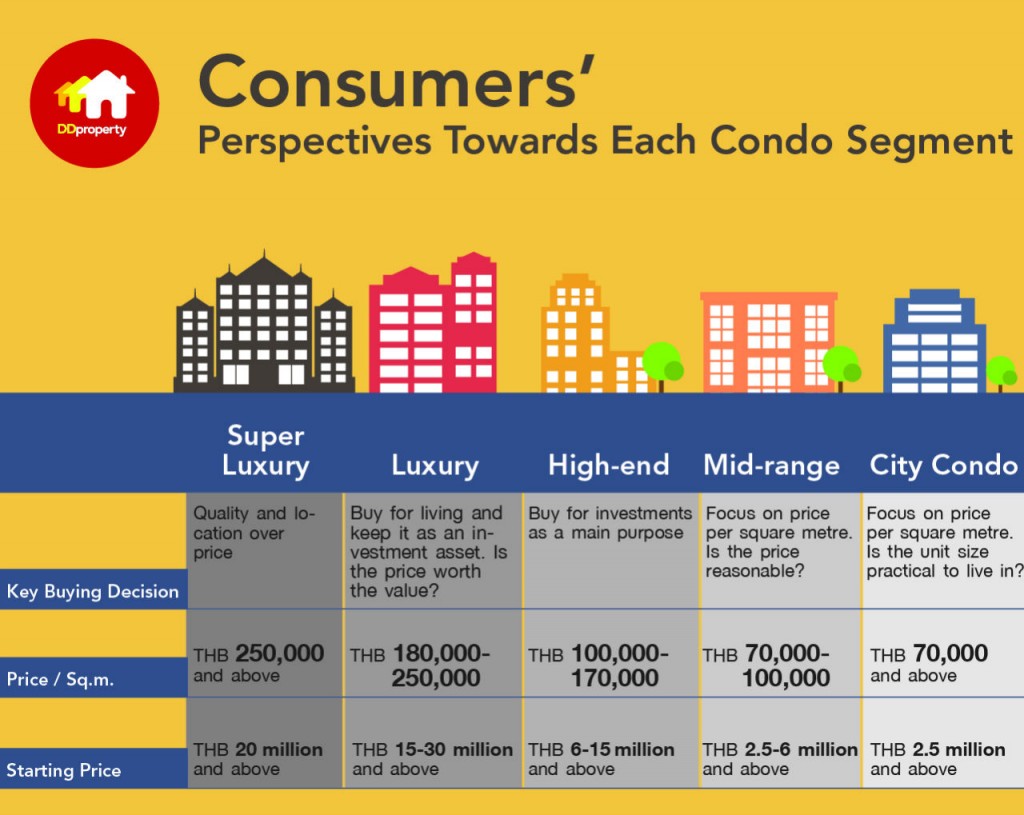

Regardless of the location, there are 5 segments in the market and consumers have different perspectives towards each condo segment. Buyers have distinctive motives to purchase condo units in each segment, which can be explained and summarized below.

Affluent consumers who are concerned about location and quality over the price demand super-luxury condos. Demand from this group of people isn’t affected by economic or political situations that are a key concern for the lower-income groups. Super-luxury condominiums can be purchased for both residential purpose and investment, but the rental investment in this segment is less than in the lower segments. 98 Wireless is an example of a super-luxury condo. It is located on Witthayu Road and has a record price over THB 700,000 per sq.m.

The luxury segment comprises of condos with a price between THB 180,000 – 250,000 per sq.m. Consumers in this segment have money, but don’t want to spend more than necessary. Mostly, they purchase a condo unit as a second property and keep it as an investment asset which can be used for either staying or leasing later. They place importance on the location and practicality of the unit.

The most penetrated segment for investment is high-end condos that have a price between THB 100,000 – 170,000 per sq.m since this level is closer to the consumer average income. High-end projects from leading developers last year recorded strong sales, partly due to a large portion of investors who purchased units during the presales, official launches, or the resale period. This segment needs to be watched carefully in 2017 to see if it can sustain the high demand seen last year or if levels will drop.

The 2 bottom segments, mid-range condos and city condos, refer to condos priced between THB 70,000 – 100,000 per sq.m. Consumers in this segment focus on price due to their limited budget. With a greater number of supply in these segments when compared to the luxury segments, consumers in this group are looking for a unit which has both a reasonable price and practicality. In other words, the unit shouldn’t be too small despite an attractive price. Moreover, the price of units in these segments are not likely to surge as high as the other segments and this makes them less appealing to investors.

Another segment which could be drawing demand from consumers soon is the resale condo market in the CBD and city fringe. Compared to newly launched projects, these resale condos have a lower price by approximately 20-30 per cent. Consumers could be more interested in a well-maintained condo than a unit at a new launch in the city due to its lower price and larger unit size.

Receive the latest property news on email from Thailand’s No.1 property website here, or read more project reviews