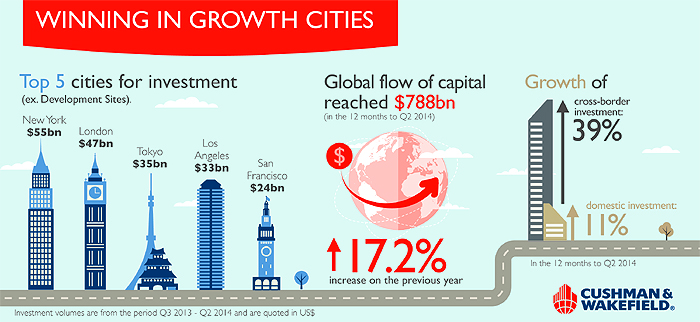

The American city of New York attracted the most commercial real estate investment during the last year as the global real estate investment market saw volumes increase by 17.2 percent to US$788 billion, according to Cushman & Wakefield’s annual ‘Winning in Growth Cities’ report.

While a number of cities still dominate, activity is spreading to an increased number of global markets as investors relax their risk tolerance.

New York saw US$55.4 billion invested in the year to Q2 2014 – which equates to 7 percent of global market share. London, which registered US$47.3 billion of investment, closed the gap on New York thanks to a 40.5 percent increase in activity; it is also the largest global market for cross-border investors. Tokyo (US$35.5 billion) reclaims third position from Los Angeles (US$33.1 billion) which drops into fourth, while San Francisco completes the top five ranked cities with US$23.8 billion invested.

Cushman & Wakefield’s International Chief Executive Officer Carlo Barel di Sant’Albano, said: “Competition, growth and change will bring forth more new global winners. While gateway cities remain a primary focus for investors, interest in a broader spread of locations is increasingly apparent due to improved confidence and finance availability as well as a lack of supply in core cities. Risk appetites have expanded in the U.S. and buyers in Europe and Asia are following suit, particularly where local partners can be found.”

The top 10 cities for global investment changed little from last year, with the exception of Dallas moving into 9th at the expense of Houston (11th). Shanghai, Beijing, Miami and Stockholm join the top 20, while Toronto, Singapore, Moscow and Seoul fall out. Dubai and Dublin saw significant change and leaped into the top 50 from 186th and 82nd position respectively.

Top cities continue to be popular across multiple sectors with New York top in retail, multifamily and hospitality, London top for offices, Los Angeles top for industrial and Tokyo a top five market in retail, office and industrial.

The fastest growing stream of international investment has been Asian capital flowing out of the region. Asian global investment rose 56 percent last year compared to a 54 percent increase by American investors, 26 percent by Europeans and 13 percent by Middle Eastern and African players.

Typically, Asian players cross borders easily but much in the past has been within their own region. That has changed dramatically in recent years as Asian businesses have diversified abroad, focusing initially on gateway cities in the US and the UK but now spreading their net more widely, says the report.

David Hutchings, Head of EMEA Investment Strategy, said: “Core markets still offer attractive returns for core investors but those seeking higher returns are having to take on risk, either in core markets or by targeting quality assets in second-tier locations. However, caution is needed as real estate usage is evolving as tenants adjust to new technology, new working practices and demographic change.”

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg