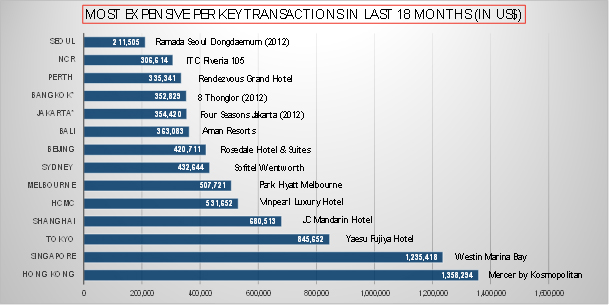

One Bangkok hotel transaction made it high on the list of most expensive deals to happen in the last 18 months, according to global real estate consultancy Cushman & Wakefield in their latest report on the hotel markets across 17 gateway cities and prime destinations in Asia and Australia.

The firm reported that hospitality investment market in the Asia-Pacific region reached a record high transaction volume of US$12.83billion in 2013, the highest in the last five years and over 30 percent higher than 2012.

The Bangkok transaction for 8 Thonglor translated to US$352,859 per key, placing the deal 11th most-expensive in the ranking by the firm.

There had been a substantial weight of capital invested in the core markets with China accounting for US$2.636 billion, or 20.5 percent of the total investment volume, Singapore the second largest market at US$2.634 billion, followed by Japan at US$2.610 billion and Australia at US$2.271 billion. Hotel investments were also more widespread across the region in 2013, where emerging and non-core markets like Cambodia, Macau, Maldives saw some assets changing hands.

Akshay Kulkarni, Regional Director of Cushman & Wakefield’s Hospitality Services for South Asia and Southeast Asia, said: “Hospitality investment volume in 2013 more than doubled since 2008 and can be attributed to the excess liquidity, the low borrowing costs and the region’s favourable tourism growth and outlook.”

The cities included in the report are Singapore, Hong Kong, Tokyo, Bali, Seoul, Mumbai, National Capital Region (India), Bangkok, Shanghai, Jakarta, Kuala Lumpur, Beijing, Ho Chi Minh City, Sydney, Melbourne, Perth and Brisbane.

In the first half of 2014, total investment volume of hospitality assets reached US$5.20billion, which is 9.5 percent higher compared to the same period last year.

While the core markets of Japan, Singapore, China and Australia are still the most traded ones and constitute about 68.8 percent of the investment volume, other emerging markets such as Philippines, Malaysia, Sri Lanka and Indonesia have experienced higher investment quantum compared to the same period last year.

For 2014, Cushman & Wakefield expects the hospitality investment market to moderate, and likely to close at US$9.0 to US$10.5billion.

Kulkarni added: “We expect the balance of 2014 to equal or come close last year’s level in terms of transactional activity. Japan has already seen significant investment volume and will undoubtedly improve further and lead the pack, due to strong corporate demand and greater investor optimism arising from Abe’s economic reforms.

“Lower hotel transaction volume is expected for Singapore this year compared to last year, at least in the organized institutional side. However with the change in norms on the shop houses those that have approved hotel licenses will see high guest demand.

“Thailand, Indonesia, and to some extent, Philippines, Sri Lanka could see more exciting times ahead with some major transactions to be closed. Emerging countries such as Myanmar and Cambodia have seen some renewed interest and could become viable investment destinations.”

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg

Most-read stories from last week on DDproperty.com’s English news

Probe launched into prominent Pattaya condo

Confidence in back for Bangkok property buyers

Expats living further out from Bangkok’s CBD to rent

Bangkok offive rentals are at an all-time high

If you have a news story, press release or comment for publication about Thailand property or real estate email: andrew@propertyguru.com.sg