There was a significant rush by developers to launch new condominiums in Bangkok in Q3 2014, despite the absence of a V-shaped economic recovery following last May’s coup.

In its latest Bangkok Residential MarketView Report, real estate firm CBRE Thailand reported the rush that focused mostly in the midtown and suburban markets of the Thai capital.

Although there was a decline in the number of launches in the downtown area during the quarter, CBRE expected to see an increasing number of new condominium developments appearing by the end of 2014 and going forward into this year.

Record-breaking prices were also witnessed in Q3 2014.

CBRE sold a unit at Raimon Land’s 185 Rajdamri development, a project which was completed in Q1 2014, for around THB330,000 per sqm. The firm also sold units at more than THB300,000 per sqm in four other projects.

“Prices of newly launched condominium projects in the downtown locations will continue to rise due to high land prices, as well as increasing construction costs. However, developers need to be careful about overpricing in downtown condominium projects,” the company noted in its research.

Again, CBRE noted that more than 90 percent of residential tenants in Bangkok with rents in excess of THB20,000 per month are expatriates.

Most expatriates who work in Thailand prefer to rent rather than purchase property because they are usually only here for a few years and it is very difficult for them to borrow money to finance property purchases in Thailand. This makes buying less attractive, according to the agency.

Most expatriates who work in Thailand prefer to rent rather than purchase property because they are usually only here for a few years and it is very difficult for them to borrow money to finance property purchases in Thailand. This makes buying less attractive, according to the agency.

As at the end of Q3 2014 there were some 74,000 holders of work permits in Bangkok, a rise of more than 7 percent in 12 months. The numbers exclude diplomats and expats with work permits outside Bangkok.

“Typically, expatriates prefer to live in a limited number of areas,” the report noted, with sukhumvit between Soi 1 and Soi 62, and Soi 2 to Soi 42, as well as Sathorn and central Lumpini being the most chosen locations for expatriate renters.

Perhaps surprisingly, CBRE predicted that between 30 percent and 40 percent of purchases made at new condominium units in Bangkok were made by buy-to-rent investors, with 70 percent of units under construction in downtown Bangkok being one-bedroom units or smaller.

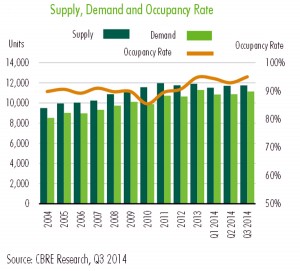

Highlighting a significant mismatch in supply and demand, CBRE noted it has seen strong demand for two- and three-bedroom units – with two-bed units are bigger making up a massive 75 percent of its leasing business.

“Demand for two- and three-bedroom units is starting to exceed supply, especially given the age and condition of older condominium buildings,” it reported.

It also noted, for the first time, the existence of waiting lists at some of the most popular developments.

“Demand for well-decorated two- and three-bedroom units is going to increase provided that expatriate numbers continue to grow.

“As demand will exceed supply, lump sum rents that have stayed at the same levels for almost 25 years will finally have to rise,” CBRE warned.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg