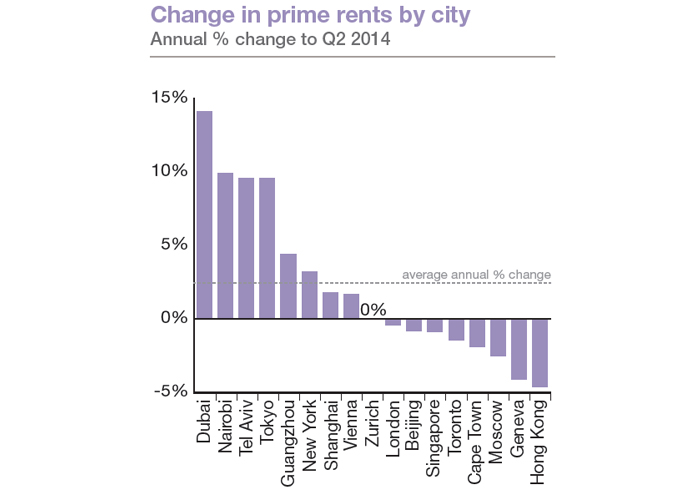

There was a 2.2 percent rise in Knight Frank’s Asia Pacific Prime Global Rental Index in the year ending June 2014 – down from 4.7 percent in the previous three months.

Despite occupying the top two rankings, Dubai and Nairobi saw the rate of prime rental growth soften in the second quarter. Although London, Singapore and Hong Kong saw prime rents decline in the year to June, the rate of decline is slowing.

Some of the key prime rental markets are expected to benefit from quieter activity in the world’s luxury sales markets during the remainder of 2014.

Kate Everett-Allen, Partner International Residential Research, said: “Although overall our index has weakened in the second quarter, the world’s key financial centres rose up the annual rankings. Of the 17 cities tracked, nine saw flat or rising prime rents in the year to June.”

The gap between the strongest and weakest performing cities over the last 12 months shrank from 32 percentage points in March to 19 points in June suggesting the performance of the world’s top luxury rental markets is converging.

As economic conditions in the world’s top financial centres improve, prime rental demand is likely to accelerate due in part to the upturn in corporate relocations. Prime rents in London began their recovery at the start of the year and recorded monthly growth of 0.9% in June, a three-year record. In Hong Kong, rental demand for luxury homes picked up towards the end of the second quarter as expatriate families sought homes prior to the start of the new school year.

With interest rates likely to rise in the U.S. and the U.K. during 2015, economic growth largely stagnant in Europe and stringent cooling measures still in place across much of Asia, prime rental markets are expected to benefit from quieter activity in the world’s luxury sales markets during the remainder of 2014.

Since the Lehman crisis in Q3 2008, prime rents in London have grown 22.9 percent while those in Singapore have decline 2.0 percent, and those in Hong Kong have nosedived by 14.4 percent.

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg