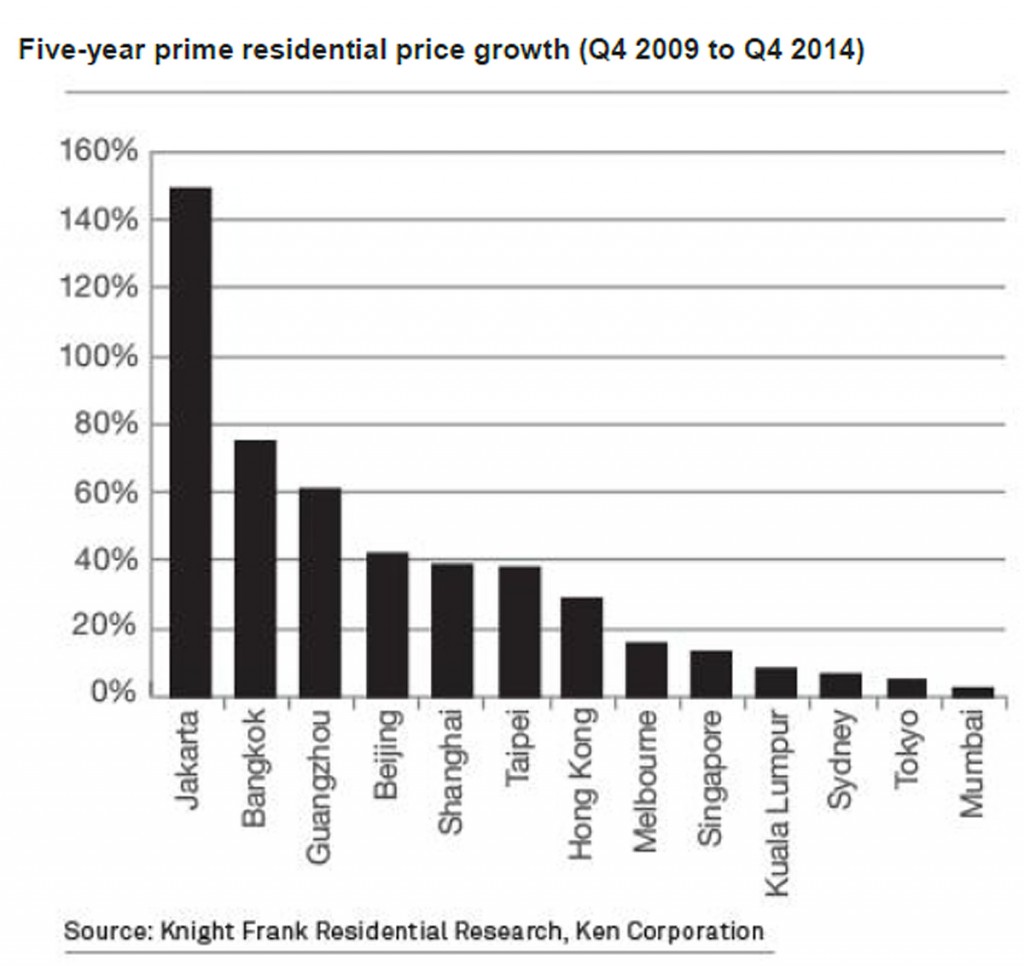

Bangkok’s prime residential property market has grown almost 80 percent in the five years ending Q4 2014 – with only the Indonesian capital of Jakarta eclipsing its performance.

The stunning performance is highlighting in Knight Frank’s latest research, The Wealth Report 2015, which reported how Asia saw the highest growth rate in super-rich populations in 2014;

Asia’s UHNWI (ultra-high-net-worth-individuals) population to overtake that of North America in the next 10 years, with the concentration of wealth remaining in Singapore, Hong Kong, New York, London and Mumbai over the next decade.

The ninth edition of The Wealth Report 2015, published today, tracks the growing super-rich population in 108 cities across 97 countries.

In 2014, around 15 people a day joined the ranks of the ultra-wealthy, or those with a net worth of over US$30 million. This growth is set to continue in the coming decade, with the global population of UHNWIs forecast to climb by 34 percent to almost 231,000.

Most notably on a regional level in 2014, Asia overtook North America as the region with the second-largest increase in UHNWIs – some 1,419 people moved past the US$30 million+ mark in Asia in 2014, after an increase of fewer than 1,000 in 2013. Standing strong, Europe held onto the top spot with the most new entrants of 1,834 people joining the UHNWI bracket over 2014.

The ultra-wealthy in Asia now also hold more in total wealth with net assets of US$5.9 trillion – 7 percent more than those in North America with $5.5 trillion. However, with a $6.4 tillion treasure chest, European UHNWIs still control the most wealth. Come 2024, Asia will overtake North America in UHNWI population by 11 percent, according to Knight Frank.

Liam Bailey, Global Head of Research at Knight Frank, said: “The most rapid growth in wealth will be seen in the likes of Ho Chi Minh City, Jakarta, Mumbai, and Delhi. One fifth of the 100 global cities assessed in The Wealth Report are expected to see greater than 100 percent growth over the next decade, all of which are in Asia or Africa.

“The geographic concentration of wealth remains a key trend – with 10 percent of all additional growth in UHNWIs taking place in just five cities – Singapore, Hong Kong, New York, London and Mumbai over the next decade.”

Nicholas Holt, Head of Research for Asia Pacific, added, “The rise of Asia and its subsequent impact on prime property within the region and beyond has been one of the key narratives highlighted in The Wealth Report. This growth in wealth is certainly impacting prime residential markets across Asia and Australasia, with the region’s key cities and second home destinations seeing strong price growth over the last five years. This is despite interventions by policy makers in a number of markets, designed to slow price growth and curb foreign ownership.

“Over the past nine years, the hunger for knowledge has only increased, especially from our clients here in Asia Pacific, where UHNW property investors are becoming increasingly confident and are looking to diversify their property portfolios by exploring new asset classes and locations.”

Andrew Batt, International Group Editor of PropertyGuru Group, wrote this story. To contact him about this or other stories email andrew@propertyguru.com.sg